Content

After announcing that the 2014 tax season would open on January 31, 2014, for individual taxpayers, the IRS has now announced that they will begin accepting 2013 business tax returns on Monday, January 13, 2014. This start date applies to both electronically-filed and paper-filed returns. The IRS reminds taxpayers that filing electronically is the most accurate way to file a tax return and the fastest way to get a refund. There is no advantage to people filing tax returns on paper in early January instead of waiting for e-file to begin.

In summary, employers with more than 50 employees will be required to offer coverage to their employees starting in 2014 and the uninsured will have to begin the process of purchasing coverage. Depending on defined income requirements, some individuals may qualify for exemptions or subsidies. The ACA also caps pre-tax health flexible-spending accounts at $2,500 per person. For the 2014 year, the IRS announced new tax brackets that will impact tax rates across the board. For married taxpayers filing jointly, the taxable income levels are higher (for example the lowest bracket was raised from $0-$17,850 to $0-$18,150 and the highest bracket starts at $457,600 instead of $450,001). For taxpayers filing as head of household, the bracket starts higher than last year ($12,950 is the lowest compared to $12,750).

Irs Delays 2014 Tax Season

Tax season 2014 is underway, which means you should be gathering your documentation and getting ready to file your tax return for 2013. The year 2013 brought a few changes, which means your taxes are likely to look a little different this year. The tax brackets for 2014 tax season don’t vary much from last year’s tax table, except for “high income” earners. That means if you haven’t had any significant changes to your income, your W-4 form, etc., then you’ll probably receive the same tax refund as before. Taxpayers have until Tuesday, April 15, 2014 to file their 2013 tax returns and pay any tax due. The IRS expects to receive more than 148 million individual tax returns this year, and more than four out of five returns are now filed electronically. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

If you are unmarried and pay for more than half of the costs for keeping up a home. If you are unmarried, divorced, or legally separated you will file under the single status. Been using this site for several years now, very professional and great customer service. Take a few seconds to fill out our simple form, and a specialist will reach out shortly.

So, if you or a family member were in the hospital last year, you will have a harder time writing those costs off. I’ll have more on tax season deadlines and announcements as tax season nears. Corporate returns are generally due on March 15 but since March 15 falls on a Saturday in 2014, the due date for forms 1120 and forms 1120S will be March 17, 2014.

Be aware that you might not get the same exemption you received in years past. When taxpayers are ready to fill out and file their returns, another online option, available exclusively on IRS.gov, enables anyone to e-file their returns for free. If you need a copy of your past year tax return, W-2 or 1099-R transcript, we can assist. We have the expertise to retrieve important aged tax documents online for all your needs. It only takes a few minutes of your time to supply us the required information and we will go to work for you with our amazing state of the art retrieving technology.

Your Information Is Safe With Us!

The IRS has a great breakdown of many of the changes for 2014 here. The Federal Insurance Contribution Act tax rates have increased. A federal government website managed and paid for by the U.S. If you can’t find your Form 1095-A online, you should call the Call Center at .

At IRS, I participated in the review and audit of federal estate tax returns. At one such audit, opposing counsel read my report, looked at his file and said, “Gentlemen, she’s exactly right.” I nearly fainted. It was a short jump from there to practicing, teaching, writing and breathing tax. The January 13, 2014, start date does not apply to businesses that report their income on a federal form 1040. The start date for those filers – as well as all other 1040 filers – is January 31, 2014. Have a dedicated expert do your taxes for you start to finish—They can prepare, sign, and file your return for an additional fee. Getting ready for the upcoming tax season can mean a lot of things for tax preparers and tax business owners.

Provisions in the ACA contribute to some of the biggest changes in the tax law for 2014. We covered many of these in our blog post on the ACA, which you can read here.

Whats My Filing Status And Tax Rates For 2014 Tax Season?

It doesn’t disappear like the dependent exemption phase out does. Personal and dependent exemptions can help reduce your income, and thus reduce how much you owe in taxes. Starting with the 2014 tax season , there are phase outs that can affect you. Phase outs start at $250,000 , $300,000 , $150,000 , $275,000 . Once you reach a certain point, though, the deduction disappears completely.

Before sharing sensitive information, make sure you’re on a federal government site. Every effort has been taken to provide the most accurate and honest analysis of the tax information provided in this blog. Please use your discretion before making any decisions based on the information provided. This blog is not intended to be a substitute for seeking professional tax advice based on your individual needs. Or speak to us live through the chat button on the bottom of your screen or by calling us directly at . The home needs to be the main home for both you the filer and one relative who qualify.

For married filing separately, the bracket for taxable income levels are higher (the lowest bracket was raised from $0-$8,925 to $0-$9,075). The new start date is one day later than the 2013 filing season opening, which started on January 30, 2013. That start date contributed to one of the shortest tax seasons in recently memory. For most Americans, April 15 marked the end of this year’s tax season.

expert Help Was Amazing They Were Able To Help Me Get An Extra $500 On My Refund.

For others, including those who have yet to file because they requested an extension, tax season is not yet complete. At CMS we work throughout the year to reach out to consumers and help them understand the ways in which their taxes and health care intersect. Programming, testing, and deployment of more than 50 IRS systems is needed to handle processing of nearly 150 million tax returns. Updating these core systems is a complex, year-round process with the majority of the work beginning in the fall of each year. The 2014 filing season is likely to be delayed one to two weeks to allow adequate time to program and test tax processing systems following the 16-day federal government closure. Looking at the tax tables above, you must first know your 2014 tax filing status.

- It only takes a few minutes of your time to supply us the required information and we will go to work for you with our amazing state of the art retrieving technology.

- Plus, unlimited tax advice all year—Our tax experts are available on demand to answer your tax questions, year-round.

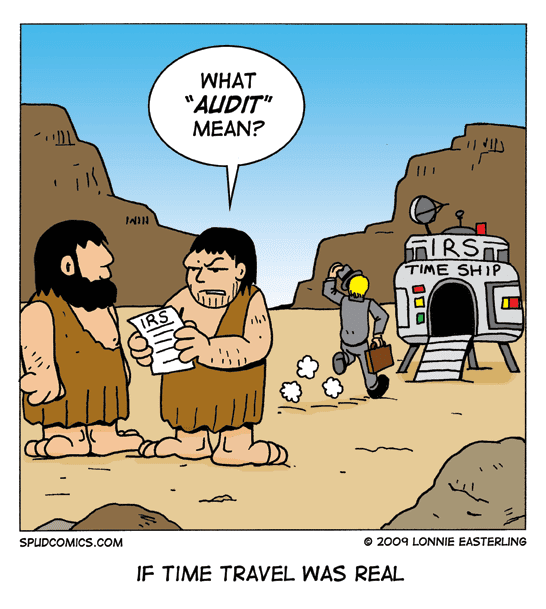

- We know that many business owners spend very little time with their tax accountant and in so doing bring on more risk of an audit.

- At CMS we work throughout the year to reach out to consumers and help them understand the ways in which their taxes and health care intersect.

- For others, including those who have yet to file because they requested an extension, tax season is not yet complete.

You are able to file a joint return since you are still married. However, so that you are not responsible for owing based on his income, I suggest choosing married filing separately. Before filing your taxes in 2014, you should refresh your memory on the 2013 tax rates. Your tax rate will be dependent on what filing status category you fall into and help you get an idea of what your tax refund or tax liability will look like whenfiling your taxes.

To attain the enrolled agent designation, candidates must demonstrate expertise in taxation, fulfill continuing education credits and adhere to a stringent code of ethics. The government closure came during the peak period for preparing IRS systems for the 2014 filing season. Many high earners choose high deductible health care plans, pay some of their costs out of pocket, and then claim medical expense deductions. Prior to tax year 2013, the threshold was 7.5 percent of AGI. Now, though, you have to spend 10 percent of AGI on medical costs in order to deduct.