Content

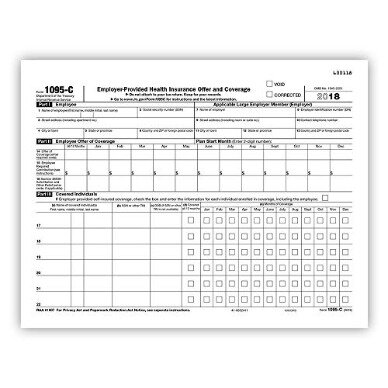

Employers who offer an employer-sponsored self-insured plan also use Form 1095-C to report information to the IRS and to employees about individuals who have minimum essential coverage under the employer plan. Thus, if, for a month, an individual is enrolled in an employer’s self-insured major medical group health plan and also has an HRA from the same ALE Member, the ALE Member is not required to report enrollment in coverage under the HRA (Form 1095-C, Part III or Form 1095-B, as applicable) for the individual. Note, however, that an ALE Member that provides post-employment coverage through a self-insured health plan must report that coverage for any former employee or family member who enrolls in that coverage in Part III of the Form 1095-C for the calendar year in which the employee terminated employment.

It is important to note that these are final revisions of Form 1094-C and 1095-C which clearly defined the mandate of ICHRA Reporting. However, these final instructions are a helpful guide for mandatory ACA reporters and service providers who will need to accommodate these changes in 2021 ACA reporting. If a DGE is designated to file returns on behalf of more than one ALE Member, the DGE must file a separate Form 1094-C for each ALE Member for which the DGE is reporting. On lines 9-14 of Form 1094-C, Part I, the DGE would report its name, address and EIN, and on lines 1-6 it would report the name, address, and EIN of the ALE Member for which it is reporting. Contact names and telephone numbers must be provided for both the ALE Member and the DGE.

For purposes of these Q&As, minimum essential coverage refers to health coverage under an eligible employer-sponsored plan. For more details on minimum essential coverage, see Publication 974, Premium Tax Credit . For more information on when coverage provides minimum value see, Employer Shared Responsibility Q&As. Even though employers that have a certain level of common or related ownership are treated as a single employer for purposes of determining status as an applicable large employer, the requirement to file Forms 1094-C and to file and furnish Forms 1095-C applies separately to each ALE Member in the Aggregated ALE Group.

Form 1095-C is also used by the IRS and the employee in determining the eligibility of the employee (and the employee’s family members) for the premium tax credit under section 36B. For employers that are subject to section 4980H and that sponsor self-insured health plans, Form 1095-C is also used by the IRS and individuals to verify employees’ and family members’ enrollment in minimum essential coverage under the self-insured health plan for purposes of the individual shared responsibility provisions of section 5000A. Therefore, enrollment in an HRA must be reported under section 6055 in the same manner as enrollment in other minimum essential coverage, unless an exception applies. Under one exception, if an individual is covered by two or more plans or programs that are minimum essential coverage and that are provided by the same reporting entity, reporting is required for only one of them for that month. For information on how to identify the section 6055 reporting entity for employer-sponsored coverage, see the Section 6055 Q&As. ALEs must report information that the IRS uses to administer employer shared responsibility under Code § 4980H and premium tax credits for individuals. Generally, the IRS needs to know whether the ALE offered minimum essential coverage to at least 95% of its full-time employees and whether the offered coverage provided minimum value and was affordable for purposes of Code § 4980H.

A County with 20,000+ Employees See how a county in midwest continues to benefit from an end-to-end ACA reporting solution. An HCM Provider with 100+ Clients Check how ACAwise has made the reporting process smoother for an HCM provider having 100+ clients. A person may be designated to file the return and furnish the statements under section 6056 on behalf of the ALE Member if the person is part of or related to the same governmental unit as the ALE Member. A government entity that is appropriately designated to file for another governmental unit is referred to as a Designated Government Entity .

Is An Ale Member Required To Enter A Code On Line 16, Section 4980h Safe Harbor And Other Relief, Of Form 1095

With this guide, you can easily stay on top of frequent changes to health care legislation and get expert advice and reference materials. The IRS also released a draft of 2020 Form 1094-C, the transmittal form that accompanies Form 1095-C when filed with the IRS. Members may download one copy of our sample forms and templates for your personal use within your organization. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices.

This is because only the individuals who received an offer of COBRA continuation coverage are potentially ineligible for the premium tax credit for coverage through the Marketplace due to the offer of COBRA continuation coverage . An ALE Member that sponsors a self-insured health plan should complete Part III of Form 1095-C for employees and family members who enroll in the self-insured coverage. An ALE Member that sponsors a health plan that includes self-insured options and insured options should complete Part III of Form 1095-C only for employees and family members who enroll in a self-insured option. An employer who participates in a multiple employer welfare arrangement is considered to offer that coverage to its employees, so if the employer participates in a self-insured MEWA, that employer would be required to complete Part III for its employees and family members who enroll in the MEWA. For information on how to complete Form 1095-C for an employee who is enrolled in self-insured coverage but who is not a full-time employee, see the Instructions for Forms 1094-C and 1095-C.

Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission. To request permission for specific items, click on the “reuse permissions” button on the page where you find the item. Now that you have these ten kernels of wisdom by your side, completing your and 1095-Cs will be a snap. And once you finish each one, you’ll start to see why health insurance is such a sweet part of the entire benefits universe. Or in other words, it has to offer “minimum essential value.” If you don’t stick to this golden rule, you’ll have to pay a fine to the IRS. Basically, the two health insurance documents go together like peanut butter and jelly. And sandwiched inside, there’s a whole lot of important information you should know about.

The line 17 reports the applicable ZIP code your employer used for determining affordability if you were offered an individual coverage HRA. With an ICHRA , an employer provides a class of employees with a monthly allowance that can be used to purchase individual health coverage from the marketplace. , except that for November and December, code 1E, Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent and spouse, should be entered on line 14. The following examples illustrate how employers should report offers of COBRA continuation coverage for active employees on Form 1095-C. However, the ALE Member is required to file Forms 1095-C on behalf of all its full-time employees who were full-time employees for one or more months of the calendar year. It is important to note that there is no exception from a potential assessable payment under section 4980H for cases where the employee waived, declined or did not enroll in coverage.

Reporting For Governmental Units

An ALE Member must furnish a completed Form 1095-C to each employee who was a full-time employee of the ALE Member for any month of the calendar year (that is, the same group of employees for whom the ALE Member is required to file a Form 1095-C with the IRS). The parts of the form that relate to section must be completed and furnished regardless of whether the ALE Member offers coverage, the employee enrolls in any coverage offered, or the employee waived any coverage offered. Also, an ALE Member that sponsors a self-insured health plan must furnish Form 1095-C with Part III completed for each employee and family member who enrolls in the self-insured health coverage, regardless of whether the employee is a full-time employee for any month of the calendar year. The information reported on Form 1094-C and Form 1095-C is used in determining whether an employer is potentially liable for a payment under the employer shared responsibility provisions of section 4980H, and the amount of the payment, if any.

For example, assume a full-time employee who has been offered spouse and dependent minimum value coverage elects self-only coverage as the original (non-COBRA) coverage. Further assume the employee becomes part-time and receives an offer of COBRA continuation coverage that provides minimum value, but neither the employee’s spouse nor dependents are offered COBRA continuation or other coverage at that time. In that case, the ALE Member should enter code 1B, Minimum essential coverage providing minimum value offered to employee only, on line 14 for each month for which the COBRA continuation coverage offer applies. If a DGE is designated to report on behalf of an ALE Member, all of the reporting rules for Forms 1094-C and 1095-C provided in these Questions and Answers apply to the DGE, including reporting coverage information for employees and family members in Part III of Form 1095-C for an ALE Member that sponsors a self-insured health plan. Also, if the coverage or offer of coverage would have continued if the employee had not terminated employment during the month, the ALE Member will be treated as having offered coverage to that employee for purposes of section 4980H for that employee’s last month of employment.

Find the answers to all your clients’ questions about Social Security and Medicare in this essential Quickfinder handbook by Thomson Reuters Checkpoint. Moulder expects the IRS will release draft instructions in the coming weeks that will provide additional details—and perhaps greater clarity—about completing the revised Form 1095-C. “Even though we don’t know too many ALEs that went with the ICHRA option, we’re going out on a limb and predicting that those who did are going to find the new codes a bit baffling,” MZQ’s consultants wrote. Subscribe today to stay up-to-date on the latest healthcare reform news, tools and resources. As a reminder, Forms 1094-C and 1095-C are used in combination with the IRS automated Affordable Care Act Compliance Validation system to determine whether an ALE owes a payment under the Employer Shared Responsibility Provisions under IRC Section 4980H. Stay tuned for the release of the final Forms 1084-C and 1095-C as they should be released soon. For the 1095-C, you only need to check the “Corrected” box on the form with the error, but you need to send it in with the 1094-C — just don’t check “Corrected” on that document. If the number hovers somewhere between 50 and 99, then it means you’re officially a member of the Applicable Large Employer club.

The IRS Form 1094-C can be a little confusing because of rules pertaining to aggregate employees. If you’ve read our coverage of the Affordable Care Act, you know the concept of a full-time employee and the fact that the magic number is between . If you have 50 or more full-time employees , you are an applicable large employer, which means these rules apply. Further, if you have part-time employees, you combine the total hours that they worked, divide that by 30, and that number is how many additional full-time equivalent employees you have.

1099-NEC State Reporting – For Tax Year 2020, the 1099-NEC is not part of the IRS Combined Federal State/Filing Program and businesses are required to report the tax form directly to the states! Prepare your ACA software solution today for 1094 & 1095 Affordable Care Act form management & IRS reporting!

Forms & Instructions

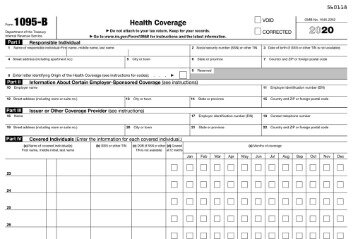

For details about additional reporting requirements applicable to sponsors of self-insured health plans under section 6055, see Questions and Answers on Information Reporting by Health Coverage Providers . Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. The IRS has published new filing forms for the 2020 tax year that employers will need to familiarize themselves with. Employer contributions help spread out the cost of health insurance between employees and employers so it’s easier for both sides to handle. Learn more about how employer health insurance works and what percentage employers have to pay. Individual coverage health reimbursement arrangement offered to an employee with the affordability determined using the employee’s primary residence location ZIP Code. Form 1095-C is filed and furnished to any employee of an Applicable Large Employers member who is a full-time employee for one or more months of the calendar.

Therefore, each ALE Member in the Aggregated ALE Group must file its own Authoritative Transmittal and file and furnish Forms 1095-C for its own full-time employees. Each ALE Member in the Aggregated ALE Group must have its own Employer Identification Number and no Authoritative Transmittal should be filed for an Aggregated ALE Group. Although an ALE Member may file multiple Forms 1094-C to transmit Forms 1095-C to the IRS, each ALE Member must file one Authoritative Transmittal with the IRS reporting summary information about that ALE Member and its employees.

Turbotax Guarantees

We’ve covered the Form 1095-C, which is meant to lay out the offered insurance to each individual employee. The 1094-C must be filed with the Form 1095-C, but it acts as a sort of cover sheet that sums up all the 1095-Cs. With the Affordable Care Act comes the necessary paperwork that the IRS has to collect. Doing so ensures that employers are providing a sufficient option of healthcare for its employees. Meanwhile, the health care law also requires most people to have health insurance, and it provides financial assistance to some people who do not have an opportunity to get coverage through an employer.

The IRS requires employers to report the ICHRA coverage information on Form 1095-C. In the month of November, the IRS released final instructions of Form 1094-C and 1095-C. These Forms which are integral to the ACA reporting process have undergone changes and updates, primarily the Form 1095-C. On the Form 1094-C, line 22, Certifications of Eligibility, the ALE Member should check box A, Qualifying Offer Method. On Form 1095-C, line 14, the ALE Member should enter code 1A, Qualifying Offer, for each employee receiving a Qualifying Offer for all 12 months of the year. When an employee receives a Qualifying Offer, no entry is required in line 15, Employee Required Contribution, and no entry is required in line 16, Section 4980H Safe Harbor and Other Relief. All family members of an individual who are covered individuals due to that individual’s enrollment should be included on the same Form 1095-C as the individual who enrolls in the coverage.

- Keri’s enrollment information will be included on her Form 1095-C; ABC Corporation may report for Gerald on a separate Form 1095-C or 1095-B.

- As discussed in questions above in Reporting Offers of Coverage and other Enrollment Information, if a full-time employee has an offer of coverage, the ALE Member enters the applicable indicator code on line 14 to report what type of coverage the employee was offered.

- The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

- If you have any legal or tax questions regarding this content or related issues, then you should consult with your professional legal or tax advisor.

- Individual coverage HRA offered to an employee only using the employee’s primary employment site ZIP Code affordability safe harbor.

- For the first month of employment, in Part II of Form 1095-C, the ALE Member should report that the employee was not offered coverage for that month by entering code 1H, No offer of coverage, on line 14 .

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

In that case, the ALE Member should enter code 2B, Employee not a full-time employee, on line 16 for that month. In addition, the ALE Member can treat the employee as having been offered coverage for the month for purposes of Form 1094-C, Part III, column . For information about reporting offers of coverage in months after the date of termination, see Reporting Offers of COBRA Continuation of Coverage and Post-Employment Coverage below. The rules are different for Part III of Form 1095-C. In Part III of Form 1095-C, an ALE Member that sponsors a self-insured health plan should report an individual as having coverage under the plan for the month if the individual was covered for any day of the month. Accordingly, if an employee who terminates employment with an ALE Member had coverage for any day during the month of termination, the employee (and any family members who had coverage through the employee’s enrollment) should be reported as having coverage for that month in Part III of Form 1095-C. Accordingly, if the employee enrolls in the plan and obtains coverage for any day during the month of hire, the employee (and any family members who obtained coverage through the employee’s enrollment) should be reported as having coverage for that month in Part III of Form 1095-C.

How Should An Ale Member Report Enrollment Information For Self

Form 1094-C is used to report to the IRS summary information for each employer and to transmit Forms 1095-C to the IRS. ALEs must file the 2019 Form 1094-C transmittal (and copies of related Forms 1095-C) with the IRS by February 28, 2020, if they are filing on paper. ALEs filing electronically must file the Form 1094-C transmittal (and copies of related Forms 1095-C) with the IRS by March 31, 2020. Electronic filing is mandatory for ALEs filing 250 or more Forms 1095-C for the 2019 calendar year; otherwise, electronic filing is encouraged, but not required.