Content

I pre-registered for 2020 TaxChat services — Where will I find my 10% discount? The 10% pre-registration discount will automatically be applied when you enroll in 2021. Yes, you can still file a 2019 tax return. You generally have up to three years to claim a federal income tax refund. After three years the IRS simply won’t pay you the refund. If you are owed a refund, you will not be charged a late filing penalty.

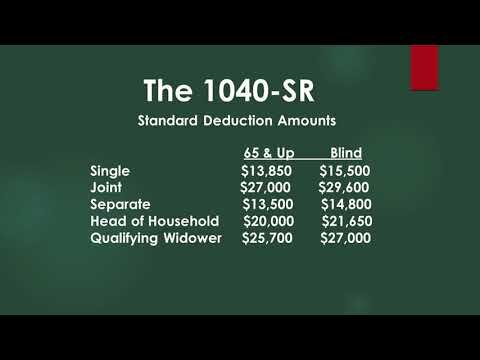

breaks down the tax due by taxable income and filing status. Simply, find the amount of your taxable income in the table and match it to your filing status to see how much tax you owe. or be considered legally married as of the last day of the tax year, and the taxpayer’s spouse died before the return was filed. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

Deluxe Online

Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95).

State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

Website was user friendly and return was processed fast compared to other sites. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

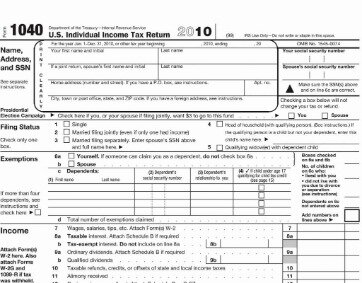

More About The Federal Form 1040

It only takes a few minutes of your time to supply us the required information and we will go to work for you with our amazing state of the art retrieving technology. While this may seem like a lot to digest, our EY tax professionals remain up to date on tax developments and apply that knowledge when preparing your tax returns. Unemployment benefits may be a new and unfamiliar tax topic for many. We handle the reporting on your tax returns and provide guidance on tax withholdings and estimated tax payments. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations. ©2020 HRB Tax Group, Inc.

Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Available at participating U.S. locations. EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021. To get started, create an account either at or by using the mobile app, which is available for download from the Apple App or Google Play stores.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

How To File Taxes In 3 Easy Steps With Turbotax Online

Store all of your tax info and docs for up to six years.

- Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.

- Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

- These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

- Fees apply for approved Money in Minutes transactions funded to your card or account.

Additional personal state programs extra. One state program can be downloaded at no additional cost from within the program.

EY TaxChat is an on-demand mobile service that connects you with knowledgeable tax professionals who can prepare and file your return in a secure, online environment. What are the advantages of using EY TaxChat? EY TaxChat makes filing personal taxes simpler, faster and more reliable.

Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax® offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities.

Terms and conditions apply. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details. Make sure you have the forms you need to file your taxes. Learn about 2020 tax forms, instructions, and publications. Find out what to do if you don’t get your W2 on time, and learn how to request copies of your previous tax transcripts.

The IRS also provides a Form 1040A which is a hybrid between the Form 1040EZ and Form 1040. Luckily, there are a few different ways to fill out and file your Individual Income Tax Return. It’s important to remember that you may still need to file state and local income taxes in addition to the federal return. Read your state and local individual income tax laws to be sure you comply. As a US taxpayer, you are required to file an annual US Individual Income Tax return to comply and report your earnings and tax liability with the Internal Revenue Service . Most taxpayers find tax forms confusing and frustrating, but the IRS has a “simplified” version of the tax return, which can be filed if you meet certain criteria. Questions Answers What is EY TaxChat™?

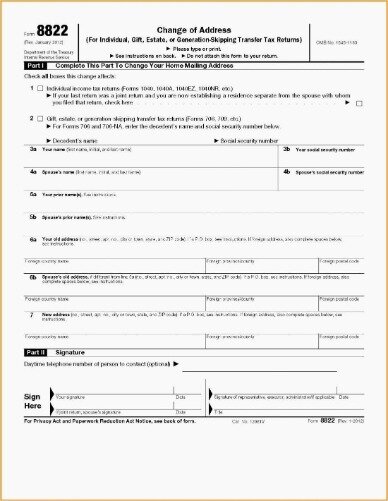

If you want to file for 2018, 2019, or 2020, then you should use 1040 form versions that have the appropriate year on them. Never use forms with years that don’t match the year you want to report. Using 1040ez-form-gov.com, you can apply all our form-filling instruments to file the form as fast as possible. Our website lets you print the complete or a blank form, or send it via e-mail directly to the IRS.

About Form 1040

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Businesses and government agencies use 1099 forms to report various types of income other than wages, salaries, and tips to the Internal Revenue Service . Learn about the types of Form 1099, what to do if you notice any errors, and how to get a copy if you didn’t receive one. Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work.

It’s one of the simplest ways to report your income if it’s lower than $100,000, you’re filing jointly or separately, and you don’t claim to have any dependents. The IRS Form 1040EZ includes only 4 short boxes on a single page, so it’s very fast to fill. Any US resident taxpayer can file Form 1040 for tax year 2019. The short Form 1040A and easy Form 1040EZ have been discontinued by the IRS. Nonresident taxpayers will file the 2019 Form 1040-NR. Commonwealth residents will file either Form 1040-SS or Form 1040-PR. First time user and I’m very satisfied!