Look into alternatives to showing up at the same appointment or sitting at a table to fill out the forms together. Under certain circumstances, you might be able to file as Head of Household as a single person or even if you are technically still legally married. If you lived apart from your spouse for the last half of the year, and if you keep up a home for a dependent child, you might qualify for Head of Household. There are five different choices of filing status, but you can only qualify for one or two in any given year, depending on your circumstances.

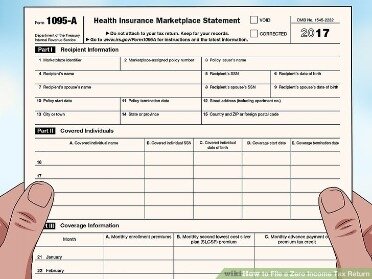

If you can’t claim the child tax credit for a child who is an eligible dependent, you may be able to claim the credit for other dependents instead. See the Instructions for Forms 1040 and 1040-SR for details. If your qualifying person is your father or mother, you may be eligible to file as head of household even if your father or mother doesn’t live with you. However, you must be able to claim your father or mother as a dependent. Also, you must pay more than half the cost of keeping up a home that was the main home for the entire year for your father or mother. 1 A person can’t qualify more than one taxpayer to use the head of household filing status for the year.2 See Table 3 for the tests that must be met to be a qualifying child. You may be able to claim certain credits you can’t claim if your filing status is married filing separately.

You’ll file as either married filing jointly or married filing separately. After divorce, you and your ex can’t both file as head of household based on shared support and care for the same child or children.

The written separation agreement set forth that it expires upon the execution of a divorce decree dissolving the couple’s marriage. On May 27, 2020, a court executed the divorce decree awarding alimony under the same terms as described in the couple’s separation agreement. The alimony payments made in January 2020 through May 2020 under the written separation agreement are includible in the recipient’s income and deductible from the payer’s income. A payment that is specifically designated as child support or treated as specifically designated as child support under your divorce or separation instrument isn’t alimony.

For sales after a divorce, if those two-year ownership-and-use tests are met, you and your ex-spouse can each exclude up to $250,000 of gain on your individual returns. And sales after a divorce can qualify for a reduced exclusion if the two-year tests haven’t been met.

However, you can add it to the basis of the property you receive. For example, you can add the cost of preparing and filing a deed to put title to your house in your name alone to the basis of the house. Within 60 days after you receive a final decree of divorce, send a certified copy of the decree to the IRS office where you filed Form 709.

If you’re legally divorced, you must file as single or head of household. But, if you are still legally married, the IRS always allows you to file either jointly or separately. For many, that choice can be a double-edged sword. Those payments are not deductible or considered taxable income. As an alternative, they may simply want to claim their own tax refund. Both are good reasons to consider filing a separate return. couples in the midst of a divorce might not want to file jointly regardless of the tax consequences.

Reporting Alimony And Child Support

In other words, you and the other person can’t agree to divide these tax benefits between you. The cover page (write the other parent’s SSN on this page).

If you will file taxes jointly and one spouse is responsible for preparing the returns, you should consider entering a stipulation regarding tax indemnification. An indemnification agreement says that one spouse will be liable for any amounts due on previously filed joint returns and protects the spouse who didn’t prepare the return. However, if you have doubts about your spouse’s ability to prepare accurate tax returns, you’re better off filing separately. So, if you’re calling it quits on your marriage, add filing taxes after divorce to the long list of headaches you need to deal with. For starters, if you haven’t already done so, you need to file a new W-4 form with your employer to adjust the amount withheld from your paycheck.

In addition, your spouse must report $2,000 as alimony received. When the marital community ends as a result of divorce or separation, the community assets are divided between the spouses. Each spouse is taxed on half the community income for the part of the year before the community ends. However, see Spouses living apart all year, earlier. Income received after the community ended is separate income, taxable only to the spouse to whom it belongs. In some states, spouses may enter into an agreement that affects the status of property or income as community or separate property. Check your state law to determine how it affects you.

When two parents divorce, only one of them can claim their children as dependents on their tax return. Generally, it is the custodial parent – the person the children live with for most of the year – who gets to claim them. If custody of the children is shared equally, then the dependents can be claimed by the parent with the highest Adjusted Gross Income. It can get a bit more complicated if you are single and have qualifying dependents e.g. a child or relatives. Here you don’t have to read a lot of Tax Mumbo Jumbo to find out what your correct filing status is. Simple use this STATucator below and click on Get Your Filing Status and you get the answer. If you are not sure if one your your dependents or relatives might indeed qualify to be a dependent on your tax return use the DEPENDucator or the RELucator and get the answer.

You may be wondering why the claim matters, since the Tax Cuts and Jobs Act signed into law in 2017 suspended the dependency exemption. Before the Tax Cuts and Jobs Act, taxpayers could deduct up to $4,050 from taxable income for each dependent. That deduction will not be available again until Jan. 1, 2026. The noncustodial parent can’t use the child to claim head-of-household status. Even if the custodial parent releases the right to claim the child by signing IRS Form 8332 , there’s no exception for head-of-household status.

Turbotax Guarantees

You don’t recognize gain or loss on the first transfer. Instead, your spouse or former spouse may have to recognize gain or loss on the second transfer. If you transfer property to a third party on behalf of your spouse , the transfer is treated as two transfers. The transfer is made under your original or modified divorce or separation instrument. A property transfer is related to the end of your marriage if both of the following conditions apply. If you deducted alimony paid, report this amount as income on Schedule 1 , line 2a. Payments that decrease because of the death of either spouse or the remarriage of the spouse receiving the payments before the end of the third year.

You can only choose one filing status on your tax return, but your filing status may change from year to year. Visit the Alimony Payment and Taxes page for a detailed overview. Please check your divorce or separation agreement for further details. People sometimes mistakenly believe that claiming a child as a dependent entitles them to file as head of household. Even if you allow your ex-spouse to claim your child as a dependent, you can still file as head of household, provided you meet the requirements above. Typically only the custodial parent may claim the earned income credit because the child must meet the residency test, which means the child must have lived with the parent for more than six months of the year.

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. You must be able to claim an exemption for the child. However, if the noncustodial parent is claiming an exemption for the child since you signed Form 8332 , you still meet this last requirement. Child support isn’t deductible by the payer, and it’s not income to the recipient. There’s no liability to make any payment — in cash or property — after the death of either spouse.

For any questions about divorce legal fees, it is best to talk to a tax expert to ensure that you handle everything properly. You lived with a qualifying dependent for more then six months of the year. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Whatever major life changes you’ve experienced, TurboTax has you covered. We’ll ask you up front what’s changed, fill out all the right forms, and make sure you get every tax break you deserve. The time your spouse owned the place is added to your period of ownership for purposes of the two-year test.

Transfer Of Retirement Assets

In order to do this, you’ll need a decree of separate maintenance by the end of the tax year. This will come from the court and may issue separate maintenance, which is a form of alimony that applies pre-divorce. During marital separation, you’ll need to file a married status tax return unless your divorce was granted before Dec. 31.

That type of expense was subject to the 2% floor, meaning you could only deduct it if the total of your itemized expenses exceeded 2% of your adjusted gross income. Whether you can deduct alimony you pay, or must include alimony payments you receive as gross income, depends on when your divorce was finalized. You’re not considered married as of Dec. 31 of the year for which you’re filing the tax return. You can now file Form 1040-X electronically with tax filing software to amend 2019 Forms 1040 and 1040-SR. To do so, you must have e-filed your original 2019 return. Amended returns for all prior years must be mailed. See Tips for taxpayers who need to file an amended tax return and go to IRS.gov/Form1040X for information and updates.

You can learn more about child tax credits and their requirements by reading our guide to child tax credits. You should also keep in mind that the Trump tax planeliminated exemptions for dependents in favor of a higher standard deduction. This means that if in 2017 you were able to claim an exemption of $4,050 for each dependent or child, you could no longer do so after the 2018 tax year. The noncustodial parent can claim a child as a dependent if the custodial parent signs Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. In that case, the noncustodial parent is eligible to claim the Child Tax Credit and the Additional Child Tax Credit. The way to avoid this tax-trap is to have the transfer accomplished under a Qualified Domestic Relations Order , which gives your ex-spouse the right to the funds and relieves you of the tax burden.

As a general rule, a child can only be claimed on one of the divorced/separated parents’ tax return (use the Dependucator Toolto find out if it’s you or not). You claim your child as a dependent on your tax return if the divorce decree or legal separation agreement names you as the custodial parent.

But because they meet the four conditions listed earlier under Spouses living apart all year, they must disregard community property law in reporting all their income from community property. They each report on their returns only their own earnings and other income, and their share of the interest income from community property. George reports $26,500 and Sharon reports $34,500. You and your spouse haven’t transferred, directly or indirectly, any of the earned income in between yourselves before the end of the year. Don’t take into account transfers satisfying child support obligations or transfers of very small amounts or value.

- It is best to avoid owing back taxes with your ex-spouse after the divorce is final.

- Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit.

- An absolute decree of divorce or annulment ends the marital community in all community property states.

- To qualify as deductible alimony, the cash-only payments must be spelled out in your divorce agreement.

- The 2017 Trump tax plan also eliminated the deduction of legal expenses that were associated with generating income (e.g. seeking to receive property or alimony payments).

General alimony requirements and specific requirements that apply to post-1984 instruments (and, in certain cases, some pre-1985 instruments) are discussed in this publication. See Instruments Executed Before 1985, later, if you are looking for information on where to find the specific requirements that apply to pre-1985 instruments.

You will lose the option to file a joint return when your divorce decree becomes final. Starting with Tax Year 2018 and ending with Tax Year 2025 , the dependency exemption for dependent children has been abolished. As of now, the dependency tax exemption will be reintroduced for Tax Year 2026.

Changing Your Name? Heres What It Means For Your Taxes

and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service.