Content

The house is completely furnished with furniture belonging to your parents. Utilities aren’t usually included in rent for houses in the area where your parents live. If you don’t provide the total lodging, the total fair rental value must be divided depending on how much of the total lodging you provide. If you provide only a part and the person supplies the rest, the fair rental value must be divided between both of you according to the amount each provides. To figure if you provided more than half of a person’s support, you must first determine the total support provided for that person. Total support includes amounts spent to provide food, lodging, clothing, education, medical and dental care, recreation, transportation, and similar necessities.

- except your girlfriend’s 10-year-old son also lived with you all year.

- You and your siblings can’t all claim your parent.

- H&R Block Audit Representation constitutes tax advice only.

- He isn’t your qualifying child and, because he is your girlfriend’s qualifying child, he isn’t your qualifying relative .

- You are required to meet government requirements to receive your ITIN.

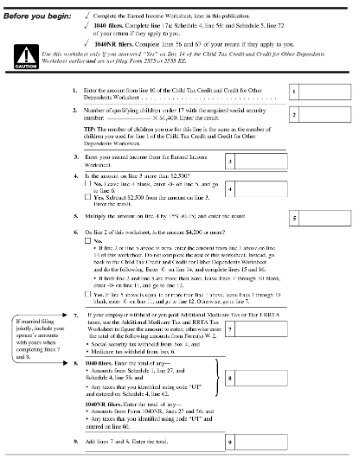

Use our FREE “HOHucator” head of household tax tool to find out whether or not you qualify as Head of Household as a single person. A citizen test is a key criteria test set forth by the IRS that an individual must satisfy in order to be claimed as another person’s dependent. “Child tax credit by the numbers.” Accessed Dec. 18, 2020. A child may not have provided more than half of his or her own support during the tax year. The child’s age also factors in by the end of the tax year. The child must be younger than 19, or as old as 24 if he or she is a full-time student for at least five months during the year. Children that are permanently disabled are exempt from the age rule.

Table 5 Overview Of The Rules For Claiming A Dependent

Your father receives a nontaxable pension of $4,200, which he spends equally between your mother and himself for items of support such as clothing, transportation, and recreation. Your total food expense for the household is $6,000. Your heat and utility bills amount to $1,200.

To claim a child as a dependent, you must list the child’s Social Security number on your tax return. This rule is intended to prevent people from claiming tax credits and other benefits for children who don’t really exist. You may obtain a Social Security number for your child by filling out and filing Social Security Form SS-5. See the Social Security Administration website at for details. It takes about two weeks to get a Social Security number. If you do not have a required SSN by the filing due date, you can file IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. If you or your spouse is expecting a child, apply for a Social Security number at the hospital when you apply for your baby’s birth certificate.

Student Loan Interest Tax Deduction

Joint return test, Joint Return Test, Joint Return Test Joint returns, Married Filing Jointly, Nonresident alien or dual-status alien.Dependents on, Joint return. LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes.

For tax years prior to 2018, every qualified dependent you claim, you reduce your taxable income by the exemption amount, equal to $4,050 in 2017. This add up to substantial savings on your tax bill. Unlike the dependency exemption, which only reduces your taxable income, a tax credit reduces the amount of tax you must pay—for example, if you qualify for a $2,000 credit, you’ll pay $2,000 less tax. The more dependents you have, the less income tax you’ll have to pay. Although changing your W-4 now won’t affect your 2019 taxes, it’s still worth taking a look for next year. A W-4 is a common form that you typically fill out when you start a new job. It allows you to select how much to withhold from your paycheck for taxes.

Dependents Credit & Deduction Finder

970 for more information on what qualifies as a scholarship or fellowship grant. You can’t claim the higher standard deduction for an individual other than yourself and your spouse. If your spouse died in 2020 before reaching age 65, you can’t take a higher standard deduction because of your spouse. Even if your spouse was born before January 2, 1956, he or she isn’t considered 65 or older at the end of 2020 unless he or she was 65 or older at the time of death. If you are age 65 or older on the last day of the year and don’t itemize deductions, you are entitled to a higher standard deduction. You are considered 65 on the day before your 65th birthday.

Fees apply if you have us file a corrected or amended return. The Child Tax Credit is worth up to $2,000 per child dependent under the age of 17. Individual taxpayers earning up to $200,000 and married taxpayers filing jointly who earn up to $400,000 are eligible for the full credit.

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts .

The one who claims your mother as a dependent must attach Form 2120, or a similar declaration, to his or her return and must keep the statement signed by the other for his or her records. Because neither brother provides more than 10% of the support, neither can claim your mother as a dependent and neither has to sign a statement. Sometimes no one provides more than half of the support of a person. Instead, two or more persons, each of whom would be able to claim the person as a dependent but for the support test, together provide more than half of the person’s support. If you pay someone to provide child or dependent care, you can include these payments in the amount you provided for the support of your child or disabled dependent, even if you claim a credit for the payments. Your niece takes out a student loan of $2,500 and uses it to pay her college tuition. She is personally responsible for the loan.

In other words, you don’t have to figure out whether to itemize deductions or use standardized deductions. Choosing to itemize versus a standard deduction on your return or not is done by the eFile app based on the information you enter. Even if the itemized deduction is more beneficial to you, you can still select and claim one of the federal standard deduction amounts below based on your tax return for the given tax year. The Child Tax Credit is a $2,000-per-child tax credit given to a taxpaying parent with a dependent child under the age of 17. A qualified dependent for tax purposes can be either a qualifying child or another qualifying relative .

In August and September, your son lived with you. For the rest of the year, your son lived with your husband, the boy’s father. At the end of the year, you and your husband still weren’t divorced, legally separated, or separated under a written separation agreement, so the rule for children of divorced or separated parents doesn’t apply. You can claim a person as a dependent who files a joint return if that person and his or her spouse file the joint return only to claim a refund of income tax withheld or estimated tax paid. You can’t claim a married person who files a joint return as a dependent unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid. You can generally change to a joint return any time within 3 years from the due date of the separate return or returns.

If you provide a person with lodging, you are considered to provide support equal to the fair rental value of the room, apartment, house, or other shelter in which the person lives. Fair rental value includes a reasonable allowance for the use of furniture and appliances, and for heat and other utilities that are provided. You must apply the support test separately to each parent. You provide $2,000 ($1,000 lodging + $1,000 food) of your father’s total support of $4,100—less than half.

You don’t need to itemize in order to take advantage of the child tax credit or the child and dependent care tax credit. “You can claim the standard deduction and still get the Dependent Care Credits,” says Pon. Families can deduct up to $2,000 from their federal income taxes for each qualifying child under 17. These are credits, so if your tax bill is $10,000 and you qualify for the maximum credit, your bill goes down to $8,000. Even if you don’t owe any money to the IRS, you can get that money back as a refund as long as you’ve earned at least $2,500 to qualify. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

Standard Deduction For Dependents

This means you can’t claim the same person twice, once as a qualifying relative and again as a qualifying child. It also means you can’t claim a relative—say a cousin—if someone else, such as his parents, also claim him. Are you the only person claiming them as a dependent? You can’t claim someone who takes a personal exemption for himself or claims another dependent on his own tax form. Having trouble deciding if your Uncle Jack, Grandma Betty or daughter Joan qualifies as a dependent? Here’s a cheat sheet to quickly assess which of your family members you can claim on your tax return.

If these people work for you, you can’t claim them as dependents. The person either must be related to you in one of the ways listed under Relatives who don’t have to live with you, or must live with you all year as a member of your household2 . The terms qualifying child and qualifying relative are defined later. You are eligible to file your 2020 return as a qualifying widow if you meet all the following tests. In the year of the child’s return, the child lived with you for more than half the part of the year following the date of the child’s return. Generally, the qualifying person must live with you for more than half of the year. Include in the cost of keeping up a home expenses such as rent, mortgage interest, real estate taxes, insurance on the home, repairs, utilities, and food eaten in the home.