While the tax season was much longer than planned due to Coronavirus/COVID related impacts, we can expect it to return somewhat to normal in 2021. This is 2 to 3 weeks later than when they normally start processing in late January as originally estimated. Tax payers can still submit and file their return with their preferred provider but the IRS won’t begin processing and paying returns until after February 12th, 2021. The estimated refund processing schedule table below has been updated to reflect this. The IRS is required to hold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax credit until at least Feb. 15, 2017. Keep in mind it can still take a week to receive the refund after the IRS releases it. So some people who file early may experience delays while awaiting their refund.

I will continue to update this article and encourage you to check back regularly. If the information here was useful please consider sharing this page viaFacebook, Twitter or your other social media channels. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you’ll be logged-in to this account. Remember, this is not an official chart published by the IRS, but a guideline we created based on the timing we’ve seen helping tax payers every year.

Turbotax Guarantees

Well…that’s because the site has changed for the year 2020 returns. Anyone have a phone number someone will answer? This question comes up a lot and I have seen a few comments on this suggesting that that if you can order your transcript then your refund is on the way. Yes there is a correlation because to get a transcript the IRS generally has to have processed your tax return . But the IRS is very clear that being able to request a transcript does not mean you will imminently be getting a refund and is among the common myths and misconceptions repeated in social media. The IRS’ official line is that checking the WMR tool is the best and official way to check your refund status. Many readers have reported this and while it is very frustrating, there is not much that can be done given the economic fallout from the virus and soaringunemployment claims.

This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. The IRS has replaced the refund cycle chart with taxpayer instructions for using the IRS2Go phone app or “Where’s My Refund” online at IRS.Gov. When looking at tax refund cycle dates, keep in mind that the dates on the chart are not set in stone. These dates are composed of the previous year’s trends.

At one point in the past, the IRS used to issue an IRS refund cycle chart so taxpayers could be aware of when their refunds would arrive. However, in 2012, the IRS stopped issuing this chart. The good news is helpful tools are available, which replace the chart while helping you understand the refund cycle for 2020, 2021. The latest is that the IRS made a massive screw up and thousands of refunds were incorrectly labeled as “balance due”. They blame the computer, it’s never the programmer. A purge file is to be run the week of 6/29/20 to correct their mistake, then 2 to 3 weeks for the money to show up. Did you know that identity theft, especially around tax season, is running rampant?

To day October system said ” you tax refund is still been processing a refund date will be provided when available” no tax topic showing. So yes struggling, with kids and no money and haven’t been able to get in touch with irs. While the IRS promises to have regular return refunds processed within 21 days for nine out of ten tax payers, it does take quite a bit longer to receive a refund if you amended your tax return.

See the various reader comments below on timing and their experience after getting this and other WMR messages. Also note that it could take much longer to get your refund if the IRS deems your tax return submission needs further reviews or your identity needs to be verified. This would add two to nine weeks to the date range of your refund delivery date.

Follow the provided instructions and return any additional information ASAP to get your potential refund and reduce any further delays. Talk to your accountant, tax advocate or tax professional if you are not clear on what the IRS is asking for or you don’t get an update after 21 days. So hang in there if you are dealing with extended delays for getting for your federal tax refund. Returns are potentially delayed due to Covid-19. If you eFiled and have no issues with your tax return, you shouldn’t have any delays. However, if you file by mail, expect significant delays.

Should You Call The Irs?

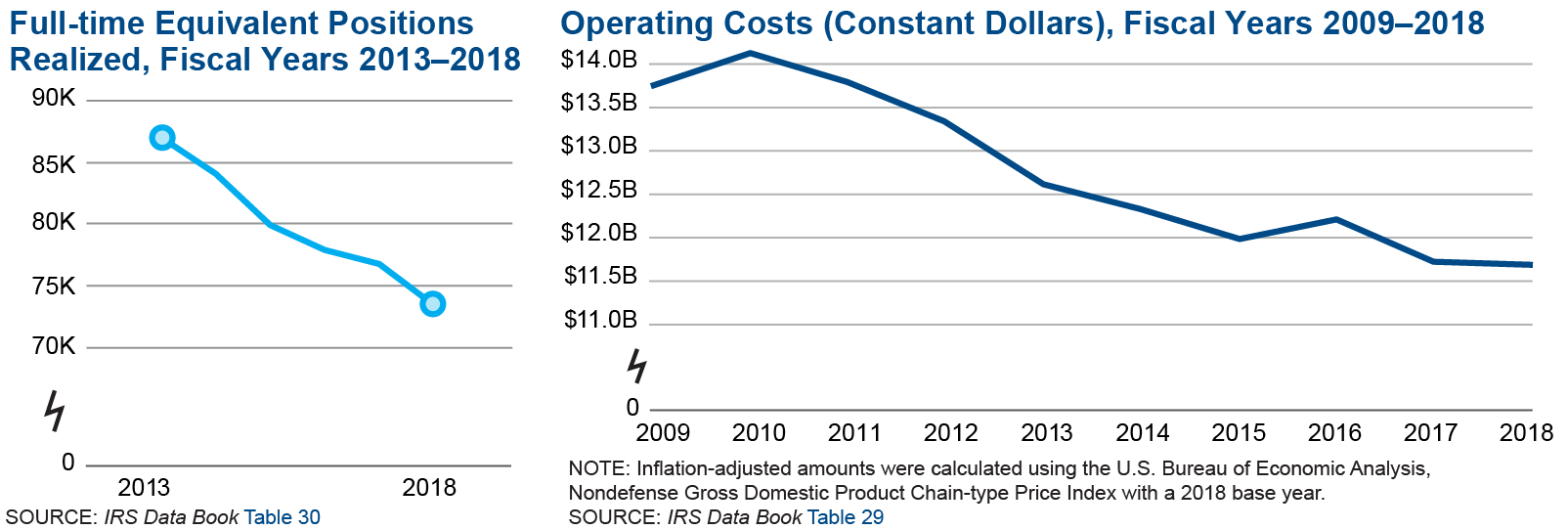

If your return is under review or other information is needed, you may experience significant delays due to staffing. The IRS does not release a calendar, but continues to issue guidance that most filers should receive their refund within 21 days. They also remind filers that many tax software programs allow you to submit your taxes before the start of tax season. However, these software programs don’t eFile until the IRS opens the system . The first day to officially file your 2017 tax return is not set yet. However, many tax software programs will allow you to complete your return and “file” it before that date. They will then hold the returns until the IRS begins accepting them.

In the very least, the same interest accrual we would be required to pay is what we should auto-collect from them. I’m confused as to why there isn’t more information about e-filing being SO delayed too. My return got accepted the exact same date and still only shows as accepted. IRS has flagged your refund for further processing and will provide an update when done. Some or all of your refund is being garnished. At the 21 day mark, you should either see a message that says approved or take action.

If purge was run in June, why have none of them heard anything yet? Seems this has happened to lots and lots of folks but nobody has any answers. I filed paper return on March 30th, now it’s July 15th. The WMR tool doesn’t even give me a status which would mean they haven’t even opened my return? I can’t even get a confirmation that they received my return. After using one of the electronic options for both Fed and State and being told I would have to pay for state I sent the printed fed tax return in by snail mail on April 15.

I sent it from the Post Office but I decided not to ask for delivery confirmation. In July I talked to a very polite trying-to-be helpful IRS representative that told be that she could not confirm they had received it but I should call back in August. I can wait for any refund but I did express some concern that if they had not received our return by July 15th we would be open to penalties. I am still worrying and now the irs.gov site says not to call. I get that they have been closed because of Covid19, and short-staffed because of a bad administration . I guess all I can do is wait and worry some more.

Can I Get A Loan Against My Tax Refund?

Find out if the IRS received your tax return and check the status of your refund. Learn why your tax refund could be lower than you expected. At the end of July 2020 the irs accepted my taxes.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours. Still getting the TT 152 and still processing. The IRS employees are sitting at home getting paid.

- Im just worried if it ever made it to the processing center.

- Several letters later from the IRS stating they need to review the information provided, I re-submitted a 1040x with my accountant in June 2020.

- However, this will likely not be as much of an issue this year due to the late start.

- We don’t expect the tax deadline to move this year, but if anything changes, we will report it.

- The Where’s My Refund app may show “Return Received,” even if we’ve already issued your refund.

The chart above provides a general estimate of when taxpayers can expect their refund, based on date filed and type of refund payment. Satisfaction Guaranteed — or you don’t pay.

They now issue refunds every day, Monday through Friday . The following tax refund table is based on previous refund tables released by the IRS to help tax payers know when they should receive their tax refund. You must file your taxes by April 17, 2018. (April 15 is the tax deadline for most years, unless it falls on a weekend or an observed holiday. April 15, 2018 is the observed holiday for Emancipation Day, for Washington DC). You canfile a tax extensionif you are not ready to file your taxes by the deadline.

Also, if there are any issues with your return, expect delays as well. If you have the Earned Income Tax Credit or Additional Child Tax Credit, your refund does not start processing until February 15. Your 21 day average starts from this point – so you can usually expect your tax refund the last week of February or first week of March. The IRS typically provides updates with direct deposit dates, assuming there are no other problems with the tax returns. We expect the actual direct deposits to arrive the last week of February, similar to previous years. If you’ve already filed your return, our assumption is there will be continued delays in processing times.

Everything else, the say, is just details. How quickly a taxpayer receives a refund also depends on when they file and whether they have requested a direct deposit of their refund, or a paper check. This is because during some time frames there is increased traffic, with more filers getting their forms in. The busiest time, and which can experience longer waits on refunds, is usually for those who file in the last week before the April 15 deadline. You can call the IRS to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time.

All of the information that is on the tax return is correct that was resubmitted. On the rejected tax code it has a completely different refund amount listed and under additional info it has the last 4 numbers of a social security number that is not familiar. It’s never taken 2 weeks for my status to change from accepted to approve. It is likely to be a very busy tax season with many people filing and claiming their missing stimulus check payments (especially dependent stimulus’) via recovery rebate credits. This should ensure that your refund is also processed as soon as possible.

For refund dates specific to your tax filing go to the Where is my Refund page or use the IRS2Go mobile application. Second, now is a great time to check your credit report and make sure that there are no issues. You should be checking your credit at least once per year, and tax time is a great time to do it. We recommend using Credit Karmabecause it’s free! Plus, Credit Karma has a lot of great tools to help you improve your credit if you need to, and they can help you monitor your credit over time.

Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system.

Called and spoke to an IRS representative and was informed they received my 1040x but processing and refunding will not happen until December 2020. As of today, 12/9/2020, I’m still waiting for the processing and refund. Checking their website states your refund is still being processed. Beyond frustrated as like many others, this refund will help with the many bills that piling up.

The federal IRSrefund schedule table below is only for electronically filed returns (e-file) done thorough online tax software providers and assumes your tax return was in order. I.e accepted by the IRS via the WMR tool and status is equal to “Return Received”. Paper filed returns can take considerably longer and would add 1 to 2 weeks to the time frames below. Again, use the the tax refund chart below as a guideline and refer to the IRS WMR tool for specific time frames related to your return. If you have filed your federal income taxes and expect to receive a refund, you can track its status. Have your Social Security number, filing status, and the exact whole dollar amount of your refund ready. You can also check the status of your one-time coronavirus stimulus check.

We are in no relation to the federal government. We are a private entity owned by an individual. We estimate our 2017 Tax Chart using actual user data, see our chart of information. Refund checks are mailed to your last known address.