Content

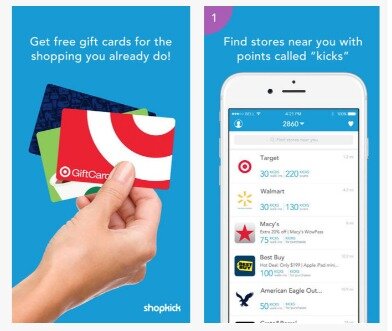

Here is a list of 1099 types you may be eligible for as an Acorns investor. This at-a-glance information may help you or your tax professional in preparing your tax return. Acorns provides three different types of 1099 forms, depending on your situation—A combined 1099-DIV/B, 1099-R, and 1099-MISC—which we break down briefly below. If you want to make the most of your spare change and get the occasional retailer kickback, there’s really no better place to do that — especially since Acorns offers IRA accounts.

Limited time offer at participating locations. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Available only at participating H&R Block offices. CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

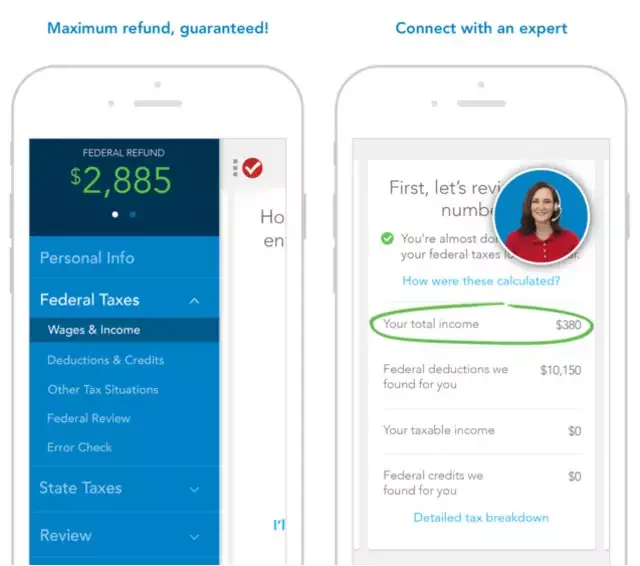

Based on your answers to these questions, EY TaxChat gives you a fixed-fee quote for preparing your taxes. Please note that this quote may change if we learn that your returns involve additional complexity or filings. I pre-registered for 2020 TaxChat services — Where will I find my 10% discount? The 10% pre-registration discount will automatically be applied when you enroll in 2021. TurboTax®offers limited Audit Support services at no additional charge. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current.

Over 10 Million Federal And State Returns Filed This Year

You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. If you get a larger refund or smaller tax amount due from another tax preparation engine with the same data, we will refund the applicable purchase price you paid to TaxSlayer.com. Our Simply Free Edition is excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer. Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund.

It’s worth noting that custodial accounts are not the same as 529 savings accounts. 529 accounts are less flexible, as they’re designed for education expenses, but they also offer more tax advantages and are generally considered a better way to save for college. Be sure to do your research or consult a financial advisor to determine the best account for you. Acorns has partnered with more than 350 companies — including Airbnb, Warby Parker, Walmart, Nike and Sephora — to give you cash back when you use a linked payment method at one of the partners. In most cases, you get the cash back automatically, without an additional step. You simply use a card linked to an active Acorns account to make the purchase, and the Found Money rewards will usually land in your account in 60 to 120 days. Acorns sweeps excess change from every purchase using a linked account into an investment portfolio.

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return .

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Only available for returns not prepared by H&R Block.

Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. You can check to see what dividends you received by visiting the Recent Activity section of your Acorns Investment accounts.

Invest spare change automatically, set aside money from each paycheck, earn more, and get money tips on the go. To see the latest dates by which you can expect to receive your tax forms, please review our tax schedule here. The 1099-R form lists any money you took out of your Acorns Later account last year.

Is Tax

Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. Questions Answers What is EY TaxChat™? EY TaxChat is an on-demand mobile service that connects you with knowledgeable tax professionals who can prepare and file your return in a secure, online environment. What are the advantages of using EY TaxChat?

The good news is our EY tax professionals are here to address the complexities of your tax filings. Travels can add complexity to your tax filings. EY TaxChat™ can help you navigate through these complexities of state filing requirements. With EY TaxChat, you’ll have access to a dedicated and experienced tax professional.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

Simple Tax Returns Only See Offer Details.

Additional state programs extra. The audit risk assessment is not a guarantee you will not be audited. Emerald Cash Rewards™ are credited on a monthly basis. Our 60,000 tax pros have an average of 10 years’ experience. We’re here for you when you need us. We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years.

You can file confidently with our always up-to-date calculations and 100% accuracy guarantee. Do you own, sell or mine virtual currencies? EY TaxChat™ can help with the new tax reporting requirements on your annual tax returns. There’s no doubt that taxes can be quite complex, especially with the frequency of recent tax law changes and personal circumstances during these times.

- In this event, you can often use these investment losses — but not losses from the sale of personal property — to offset capital gains.

- Once activated, you can view your card balance on the login screen with a tap of your finger.

- This form will be delivered to you by May 31.

- If H&R Block makes an error on your return, we’ll pay resulting penalties and interest.

- Must be a resident of the U.S., in a participating U.S. office.

See Cardholder Agreement for details. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities.

Additional fees may apply from WGU. Year-round access may require an Emerald Savings®account.

Experienced Tax Pros

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Each year, nearly 28 million returns out of more than 150 million returns filed don’t match information statements.

Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records.

EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021. To get started, create an account either at or by using the mobile app, which is available for download from the Apple App or Google Play stores. How will I know the cost to prepare my return? During the registration process, you will be prompted to answer some questions about your 2020 tax year. For example, did you have a mortgage or dependents, or did you have investment income?

You can also enter key words to search additional articles. You want to safeguard your tax return, just in case. In the event of an IRS audit, TaxSlayer will help you resolve the matter as quickly as possible. are subject to change without notice.

If capital losses exceed capital gains, you can usually use up to $3,000 of the excess loss to offset other income for the year. Any unused amount carries forward to future years to offset future capital gains or income.

Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. OBTP# B13696 ©2020 HRB Tax Group, Inc. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

If you recently became a US citizen, are a citizen of multiple countries or work in the US under a visa, our team will analyze your scenario to assist and file the appropriate US returns. As your income rises, you may be surprised to see how your tax filings change. Growth is a theme we often see with our clients at EY TaxChat™. If paying taxes makes you cringe, tax credits and deductions should make you smile.