Content

It took appealing three times just to be able to claim the kids. So despite the fact that I am his dependent we will never do that again. Unfortunately your girlfriend could not make more than $4,050 for 2016 in order to claim her. You may be able to claim your daughter as long as she didn’t provide over half of her own support, must live with you more than half the year, and no one else can claim her.

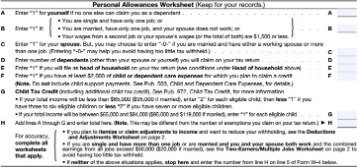

The child must actually live with you in order for you to qualify for this status. You can file Form 2120, the Multiple Support Declaration, with the IRS if multiple people support a single person, such as because you and your siblings are collectively supporting your parent. You can’t claim anyone as your dependent if you’re someone else’s dependent. Likewise, no one else can claim you as a dependent if you claim a dependent. For example, if you live with your parents and have a child, you can’t claim your child as a dependent if your parents claim you. If your child is a full-time college student, you can claim them as a dependent until they are 24. If they are working while in school, you must still provide more than half of their financial support to claim them.

If your parents claim you as a dependent on their taxes, they claim certain tax benefits associated with having a dependent. As a dependent, you do not qualify to claim those tax benefits.

Biden Agrees To Lower Income Cap For Stimulus Checks

Your relative must live at your residence all year or be on the list of “relatives who do not live with you” in Publication 501. About 30 types of relatives are on this list.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. You must provide more than half of the support for that person during the year. The person must be related to you in one of these listed ways as a relative who does not live with you, or live with you all year as member of your household. The child must have lived with you for more than half the year. Refer to Publication 504, Divorced or Separated Individualsfor more information on the special rule for children of divorced or separated parents .

The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service.

Information Menu

Available only at participating H&R Block offices. CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

The taxpayer with the highest adjusted gross income gets to claim the child If neither taxpayer is the child’s parent. You can indicate the year or years for which you’re agreeing to release your claim. You can also revoke the release if you later change your mind. Some credits also increase with the number of dependents you claim, such as the itemized medical expense deduction and the tuition and fees deduction. Claiming dependents can save you a good bit of money at tax time. It can qualify you for the head of household filing status, plus various tax deductions, and even a few tax credits.

Can I Claim My Girlfriend Or Boyfriend As A Dependent?

A qualifying relative is a much broader category that can include a wide variety of different people in your life who you’re supporting financially. So, a live-in boyfriend or girlfriend with no income to speak and for whom you’re paying the bills can score you some tax benefits. Your relative’s income can’t exceed the amount of the personal exemption for the tax year. The income limit is $4,300 for the 2020 tax year, the return you’ll file in 2021.

Description of benefits and details at hrblock.com/guarantees. Terms and conditions apply; seeAccurate Calculations Guaranteefor details.

- It took appealing three times just to be able to claim the kids.

- He previously worked for the IRS and holds an enrolled agent certification.

- About 30 types of relatives are on this list.

- Find out if you need to file here.

- If you wish to claim a non-relative as a dependent, such as a friend, they must have lived with you for the entire year to count as a qualifying relative in the eyes of the IRS.

Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations.

It’s worth up to $14,300 per child. It’s not refundable, but any credit beyond your tax liability can be pushed forward for as many as five years.

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns.

The Tcja Changed Things, But A Lot Of Dependent Tax Breaks Remain

TurboTax will ask you simple questions and give you the tax deductions and credits you’re eligible for based on your answers. Southern New Hampshire University is a registered trademark in the United State and/or other countries.

I have been a stay at home mom to our youngest son since he was born three years ago. The first year I didn’t have income to claim we tried claiming me as a dependent since we have been living together for years and at that point he was supporting me.