Content

The IRS processes a small percentage of tax returns from major software providers to test the tax return submission process and allow for fixing bugs before opening the doors to all taxpayers. All “your tax return was accepted” means that it passed a basic test of having a valid social security number and other data. It doesn’t mean anything except that it’s in the IRS queue for processing. Your 21 day average starts from this point in time. If you filed before the IRS started accepting eFile submissions, your 21 day processing time starts from the IRS start date. The IRS typically provides updates with direct deposit dates, assuming there are no other problems with the tax returns. We expect the actual direct deposits to arrive the last week of February, similar to previous years.

Unfortunately, if you enter your bank account information incorrectly, the payment method defaults to a check. Filing a tax return early is a good start to getting on track to receive your refund. The only problem is that there’s no way to know how many other returns are filed in the same time period as yours. As with anything done by the IRS, the answer is subject to change based on the tax laws that year. Different tax returns mean different rules that affect how quickly they can offer you an update.

If you’ve got a significant refund coming your way, you might consider talking to a financial advisor about how to invest the extra cash. You can useSmartAsset’s advisor matching tool to find an advisor in your area today. BFS will contact you directly with the amount of the offset, who is receiving the offset payment and the original amount of your refund. The IRS receives notice of the amount taken from your refund once the refund date passes. Expect delays on your refund when a TOP investigation begins. This information won’t be available with your Where’s My Refund status updates. The answer to this question comes down to whether your stimulus check increases your “provisional income.”

For paper filed returns, taxpayers should allow 8 weeks from the date filed before contacting ADOR’s Customer Care Center to check on the status of a return. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. When it comes to Arizona income tax refunds, processing times vary and depend on how taxpayers file (e-file or paper) and the date the return was filed. Individuals waiting for refunds can check their status by visiting Where’s My Refund on AZTaxes.gov.

When Will I Get My 2020 Tax Refund? Likely Dates And Irs Tracking Tools

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. Check Where’s My Refund for your personalized refund date. Direct deposit—the electronic transfer of funds directly into your bank account—is the safest way to get your refund. You won’t have to worry about a paper check getting lost in the mail, stolen, or misplaced once you have it in hand. But keep in mind that IRS doesn’t allow more than three direct deposits into the same bank account per tax year. This is a general processing status. While your return is in this stage, our Call Center representatives have no further information available to assist you.

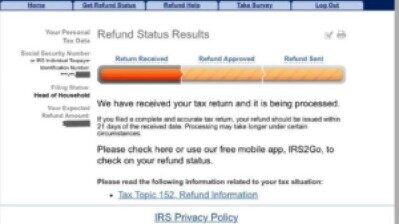

If your return has errors, is incomplete, or you’re the victim of identity theft you should expect delays. The status updater lists which option you selected. Expect to receive an estimated date of deposit or mailing during this phase. Use this date to track whether a refund is lost or stolen.

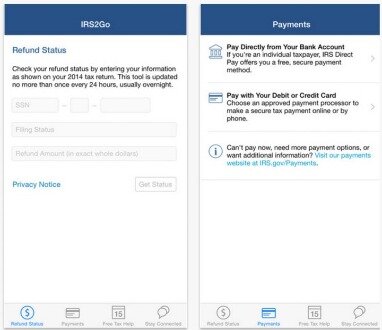

on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15. Many different factors can affect the timing of your refund after we receive your return.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail. If you want a more accurate look at when you might get your tax return in 2021, check this table, based on past years and our best estimates. More than 90 percent of tax refunds are issued by the IRS in less than 21 days, according to the IRS. However, the exact timing depends on a range of factors, and in some cases, the process may take longer. What we’ve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund. Processing times can take more than four to six weeks in the best of times since the IRS has to manually input data.

Most tax refunds are still being issued within 21 days.” More info. Keep in mind it may take a few days for your financial institution to make your deposit available to you, or it may take several days for the check to arrive in the mail. Keep this in mind when planning to use your tax refund. The IRS states to allow for 5 additional days for the funds to become available to you. In almost all cases a direct deposit will get you your tax refund more quickly than 5 days, and in some cases will be available immediately. The first day to officially file your tax return is February 12, 2021.

What Is Happening When Wheres My Refund? Shows My Tax Return Status As Received?

110 allows you to access the money quicker than by mail. H&R Block’s bank (MetaBank®, N.A.) will add your money to your card as soon as the IRS approves your refund. Your status messages might include refund received, refund approved, and refund sent.

- Refunds should be processed normally after this date.

- The IRS allows up to 3 deposits into the same account before cutting you off.

- It provides real-time updates on the status of your refund.

- Timing is based on an e-filed return with direct deposit to your Card Account.

- As you track the status of your return, you’ll see some or all of the steps highlighted below.

- Married couples who filed jointly must use the form.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

The IRS strongly discourages filing paper tax returns, particularly during the early days of 2021, due to agency closures and staffing shortages stemming from the coronavirus pandemic. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details. When you’re filing your taxes, a tax filing service can make things easier.

How To Track The Status Of Your Tax Refund With These Two Irs Tools

Here’s how to track it when you file, along with your missing stimulus money. A tax transcript will not help you find out when you’ll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation. You should see an estimated date for deposit into your bank account if your refund has been approved.

Amended returns can take around 3 months to process. Don’t expect any updates on your refund until this time period passes.

Here’s what you need to know to predict how long you’ll wait for your refund. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Refunds can take six to eight weeks if you file a paper return. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc.

Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. Western Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

If you want a bigger tax refund next year, then there are a few ways you can increase the amount of money the government will give you as a tax refund. You can open an IRA in a variety of locations, including banks, brokerage firms, independent advisors, and more. You can also call the IRS at , or , or and inquire about your tax return status with an IRS a customer service representative. Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 am. They do not update the status more than once a day, so checking throughout the day will not give you a different result. Of the three refund options available to you, direct deposit is the fastest and safest option. You can receive your refund via an ACH bank transaction in as little as a few days.

When Does Irs Update Refund Status?

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then.

The refund schedule should be the same if you filed for a tax extension, however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take 8-12 weeks to process. If you do not receive an amended tax return refund within 8 weeks after you file it, then you should contact the IRS to check on the status.

Calling The Irs

Married couples who filed jointly must use the form. on the IRS website to check the status of your refund. The tool is updated every 24 hours, usually overnight. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting for companies such as Forbes and Credit Karma. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

You can also apply a refund to any future taxes owed. This is a popular choice among some small business owners who are required to pay estimated taxes. If you have the Earned Income Tax Credit or Additional Child Tax Credit, your refund does not start processing until February 15. Your 21 day average starts from this point – so you can usually expect your tax refund the last week of February or first week of March. First, it starts with your tax software, tax preparer, or your paper refund. Once you submit it, the IRS receives it.