Content

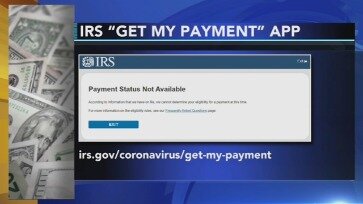

Check it out so you know what to expect before entering the portal. The Internal Revenue Services on Tuesday night encouraged people waiting on a $600 stimulus check to “check back later” online as anger mounted among those who have not received their payments. There are millions of low-income people who are not normally required to file tax returns that will have to take some action before receiving their stimulus money.

There are tens of millions of people who don’t fall into those categories. Taxpayers who haven’t authorized a direct deposit could be waiting weeks for a check in the mail — though they can update their bank information using Treasury’s new web portal, which went live Wednesday. If Get My Payment does not provide a payment date, a payment will not be issued and you may claim the Recovery Rebate Credit, if you’re eligible.

You can check the status of your stimulus payment through the I.R.S.’s Get My Payment tool. If it says your payment was sent to an account you do not recognize, it’s not necessarily an indication of fraud, the I.R.S. said. It might just mean you were linked to a temporary account, and you should continue to watch your bank account for a deposit. If you don’t get a second stimulus check (or didn’t get a first one), you can claim the amount you’re owed – assuming you’re eligible – as a “recovery rebate” credit on your 2020 federal income tax return. The IRS started accepting 2020 returns on February 12, 2021. If you receive this message, you were either not eligible, or eligible but the IRS was unable to issue you a second stimulus check.

How Can I Get My Money Faster?

It also won’t work for some residential buildings where the postal service hasn’t yet identified each unit. Maybe there’s a cryptic message that suggests the IRS doesn’t have enough information about you. You can find much more information about your privacy choices in our privacy policy.

Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice.

The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. If the information entered does not match the IRS records, you will receive an error message. Check your most recent tax return or consider a different way to enter your street address and use the help tips provided when entering your personal information. If you enter incorrect information multiple times you will be locked out of Get My Payment for 24 hours. According to the IRS, your Get My Payment status may have inaccurately said that your payment was being sent to the same account for the second time.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours. You can call the IRS to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. But you can avoid the wait by using the automated phone system. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services.

How To Set Up Informed Delivery To Track Your Stimulus Payment Directly To Your Mailbox

Informed Delivery has free apps forAndroidandiPhoneyou can also use. When the USPS runs mailed letters through its automated mail sorting equipment, it automatically creates a digital image of the front of all letter-size mail. Anyone who signs up for Informed Delivery can access the information by asking the USPS to notify you when each piece of mail with your name on it is on the way.

Those without that information will have to wait for paper checks in the mail. Most people will receive their stimulus check by Direct Deposit – in other words, the IRS will deposit the money directly into your bank account. If you do not have your bank information on file with the IRS, then you will get a paper check in the mail. If you want to provide your bank information to the IRS for Direct Deposit and your stimulus check hasn’t been mailed yet, you can do that in the “Get My Payment” portal as well.

“The ‘please wait’ message is a normal part of the site’s operation,” the IRS said. TapVerify identity online if you want to receive a verification code on your phone or tap Request invitation code by mail if you want USPS to mail you a code. You may also have the option to visit a post office to verify your identity in person.

You get an additional $500 for each dependent child, which is also subject to the same 5% reduction rule. The recently signed stimulus package includes Economic Impact Payments for most Americans as well, however, the amount will be $600 this time around. For more information about the most recent legislation, please see $600 Stimulus Checks for 2nd Round of Payments. Please continue to monitor this page as the “Get My Payment” tool is updated and becomes available again. IRS.com is a privately owned website that is not affiliated with any government agencies.

TurboTax said affected customers can expect to receive direct deposits starting on Friday. You receive Social Security payments or other federal benefits, and the IRS doesn’t have enough information from the appropriate federal agency to process your payment. Lastly, dependents with an Individual Taxpayer Identification Number instead of a valid Social Security Number are ineligible forboththe entire stimulus check amount and the additional $500 per dependent. Senior citizens aged 65 and older and claimed as dependents are ineligible forboththe entire stimulus check amount and the additional $500 per dependent. As are adult children with disabilities who are claimed as dependents. Receiving Money for DependentsParents who have eligible dependents can receive an additional $500 per child. The agency warned those residing abroad that their checks could take longer to arrive due to disruptions to air travel and delivery caused by the worsening coronavirus pandemic in some parts of the world.

If they haven’t sent your stimulus payment yet, you can update your direct deposit information. If they already sent your payment, there’s nothing you can do to change your payment method. The IRS is using information from your last filed tax return to send your stimulus payment. Get My Payments tool to help people track the status of their Stimulus payment, confirm their payment method and provide direct deposit information. If you didn’t get any payments or got less than the full amounts, you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you don’t normally file. By law, the I.R.S. said, it must issue the stimulus payments by Jan. 15. After that, those who are entitled to a payment but haven’t received one must instead claim a credit on their 2020 returns.

What Does The need More Information Status Mean On The Get My Payment App?

Even if you choose not to have your activity tracked by third parties for advertising services, you will still see non-personalized ads on our site. collects data to deliver the best content, services, and personalized digital ads.

If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance. If you owe money to a federal or state agency, the federal government may use part or all your federal tax refund to repay the debt.

- But you can avoid the wait by using the automated phone system.

- If you believe that a deduction was an error, contact the agency that said you owed money.

- My Name is Inez Aldridge I want to know I didn’t get , the first stimulus payment.

- We’ll waive or refund standard replacement fees so there’s no cost to you.

- Those who don’t file taxes can enter their information using the IRS “Economic Impact Payments” online tool for non-filers.

However, the US citizen can file their 2020 taxes as an individual and claim the stimulus check if they meet the income requirements. Stimulus checks should have been directly deposited into the bank account associated with the beneficiary, with paper checks or debit cards being mailed to people who do not have direct deposit set up. It won’t be taxed as income and won’t be offset by any back taxes owed. The IRS has developed an online tool that allows people to check the status of their COVID-19 stimulus payment and see when it will arrive.

Your payment is actually being mailed and the IRS will be updating Get My Payment accordingly. If you’re wondering how and when you will receive your stimulus check, we’ve outlined some guidance for you below. You can use Get My Payment to confirm that we sent a first or second Economic Impact Payment and if your payment was sent as direct deposit or by mail. Some Americans who used tax preparation services have temporary accounts on file with the I.R.S. The answer to this question comes down to whether your stimulus check increases your “provisional income.” A payment has been processed, a payment date is available, and payment will be issued either by direct deposit or mail.

As part of the program, you’ll receive an email each morning, Monday through Saturday, to notify you of any mail being delivered to you. You’ll also see a grayscale image of the front of the letter.

If the IRS deposits a stimulus payment onto your debit card, you will be able to immediately use the stimulus funds upon deposit. Get My Payment information is only updated once per day, so if you receive a “Payment status not available” message check back the following day to see if your status has changed. If you receive Social Security, VA benefits, SSA or RRB Form 1099 and don’t typically file a return, your information isn’t available in Get My Payment yet. TurboTax Stimulus Registration product to easily provide the IRS with the information they need to calculate and send your stimulus payment. As of January 29, 2021, Get My Payment will no longer be updated for the first or second round of payments. If Get My Payment does not provide a payment date, a payment will not be issued and you will need to claim the Recovery Rebate Credit if eligible. Tax prep companies have said they’re working with the I.R.S. to resolve the issue.

Use this postal service tool to track your stimulus check right to your mailbox, so you don’t accidentally throw it away. Millions of Americans have already gotten their stimulus payments deposited into their bank accounts. However, the IRS has been experiencing some system glitches since the rollout of the “check stimulus status” tool due to the quick launch and high volume of users. Please be patient and check back again if you find you cannot access your stimulus payment status. From the original CARES Act, the maximum payment for an individual is $1,200 (or $2,400 for a married couple filing jointly). Most people will get the full amount, however, some will get less.

You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check. With the updated tool, most people will be able to check the status of both their first- and second-round stimulus payments. If you received more than one first-round payment, the tool only shows you the most recent payment information. Expatriates who have not filed taxes for the years 2018 and 2019 are ineligible to receive a stimulus check, but will be eligible once they update their tax returns.

If you were expecting a federal tax refund and did not receive it, check the IRS’ Where’s My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. Postal Service , your refund check may be returned to the IRS. Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. If it’s been longer, find out why your refund may be delayed or may not be the amount you expected.

Some people who used tax software products like TurboTax to file their 2019 tax return had their payment directly deposited into a bank account they didn’t recognize. The account was most likely a temporary account used for refund loans or other banking products. The IRS and the tax software companies are working to redirect these stimulus payments to the correct account. So, continue to check the “Get My Payment” portal if you’re in this situation. Officials started sending out the stimulus checks last week, with direct deposits arriving in bank accounts first and paper checks or debit cards mailed out to recipients throughout the month of January. Singles who earned less than $75,000 are eligible to receive $600, and married couples who filed taxes jointly and earned under $150,000 get a combined $1,200. The non-filers tool wasn’t used for second stimulus checks, though.

It launched Wednesday and is available on the IRS website. If you didn’t get any Economic Impact Payments or got less than the full amounts, you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you don’t normally file. The Coronavirus Aid, Relief, and Economic Security Act (a.k.a. CARES Act) was signed into law by President Donald Trump on March 27, 2020. This historic stimulus package allocates funds for a number of programs, including $1,200 stimulus checks for many Americans, among other legislative changes. You can also call the IRS to check on the status of your refund.

Note that it can take three days to activate your account. The challenge will be making sure those people are aware of the tool and helping those who don’t have access to the Internet at home, she said. The new tool is “very straightforward, and likely much faster, than requiring non-filers to fill out and submit a tax form,” said Erica York, an economist at the Tax Foundation. Families earning a little more may still be eligible if they have children. The phase-out limit depends on how many children they have.