Content

TurboTax also includes a link to a Web site listing tax advisors. This Web site is run in conjunction with EXP. Advisors are organized by categories such as families, small business, retirement, etc. Advisors are listed by customer satisfaction rank. Most contact is via e-mail, but some advisors work by telephone.

See the Cardholder Agreement at /terms for details. Santa Barbara Tax Products Group is based in San Diego, California and operates as a subsidiary of Green Dot Corporation. Santa Barbara Tax Products Group was established in 2010 upon the sale of the Tax Products Business Unit of Santa Barbara Bank & Trust , and was acquired by Green Dot Corporation in 2014.

Monats Ga Zum Halbtax

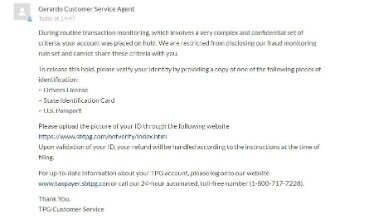

they demanded i send copies of my state I.D. card, my SS card the front page of my 1040 and a current utility bill in my name with the current address which would have to match what they had on file. i was trippin but we complied, after about 2 weeks of getting all of these different docs. i call to make sure they got them and they tell me “”yeah, they got them but the SS# doesnt look right i need to go apply for another! i told them i wasnt going to wait another 3 weeks for them to see a different card, they said i could fax them a copy of the reciept that i applied.

However, they have not changed the pricing to reflect this change. The problem is, they want to continue pricing the product like they did before, when it was a tool that could be used multiple times, yet restrict it like a service where you pay for every use. Intuit is promoting that they are including one free e-file with its software for tax year 2008, but has also increased the price of its products by about $15. In previous years, they would charge $15 extra to e-file, but you could send in a rebate to get that $15 back, which made it effectively free. This year, they charge you $15 upfront, whether you use the e-file or not, which means EVERYBODY PAYS MORE.

In EasyStep mode, TurboTax walks you through all the steps of completing and filing your return. 4/1 After a long conversation with Ruby we are at her attempting to kill the transaction and get me a check cut. I’ll find out later this afternoon if she pulled it off. You should never hire someone based solely on hype, advertising, or recommendations from “friends”.

Using Turbotax

If they put the $1000 refund in their account and then transfered the $850 to your account, the IRS will send you a rebate check. In 2010, SBBT sold its tax products division to SBTPG, a private company. If you need information concerning your Refund Transfer from MetaBank, please call SBTPG at or go to the SBTPG website at This will affect many users who prepare one main return, and then a few more simple ones for children or parents, etc. Even if you only do one return, you should avoid this year’s TurboTax on principle. The core issue is that Intuit is trying to change TurboTax from a tool-based product model to a service-based model.

I solved this problem by storing one tax program on my main iMac drive and the other tax program on an external boot-up drive. Don’t let them get away this price increase that has no basis in common sense.

Originally we purchased a Basic Turbo Tax product. I called to get updated forms for Turbo Tax and was sent another Basic CD, not the updated files. Last week we finished our taxes and tried to download the updates that we were not sent. Our original download lasted 2 hours and 45 minutes. Our next download attempt lasted 3 hours and 23 minutes. Anger at Intuit wasn’t just apparent in the ET and PCMag forums.

Online Banking

Loan is subject to underwriting and approval. Visit your tax preparer to learn about the cost and timing of all filing and product options. Available with preparation of 2020 federal tax return through Feb. 28, 2021. Santa Barbara Tax Products Group is used to process your refund when you elect to have your tax preparation fees deducted from your refund. Therefore, your review page is showing a Direct Deposit to them.

In my own case, I was on the verge of buying TurboTax until I caught the review we published on PCMag and noticed the blurb about activation. Unfortunately, we missed the C-Dilla thing, but as always, sharp-eyed readers caught the omission and gave us a heads-up about it. When it came time for me to buy my tax software, guess which product I picked? I didn’t give TurboTax a second thought, nor will I until product activation and spyware are completely removed from the product. I strongly recommend TurboTax to everyone who needs to complete more than the 1040 EZ Federal income tax form. With TurboTax, you will save time, minimize your chances of making mistakes, and possibly save money by learning about deductions you may have overlooked.

Avoid TurboTax this year until they change this ridiculous policy, even if you only prepare a single return with it. If you buy it, they’ll use your sales data to justify this unreasonable change, then who knows what else they will try to charge us for next for doing nothing on their part. And I understand that it’s very difficult for a software vendor to support additional versions of the OS; I should have made it clear that my ire is at Apple. If they’re going to release new versions of the OS, they better make darn sure they’re backwards compatible so the don’t create a nightmare for vendors like Intuit. I registered my software and then when I inquired about a member ID and password it refused to recognize me so I could not download either It’s Deductible or a state form. I realize that the new corporate philosophy is “never talk to a customer”. However, being able to speak to a real person that speaks understandable English seems to be a great idea.

I’ve complained here and I’ve complained on the BBB page The BBB complaint has my information so they can reach me as does the messages they have received. Friday – No check – 3rd call – third lunch hour spent on hold.

TurboTax’s form mode displays forms without the EasyStep wrapper. The icon buttons above the form reveal their function when the mouse pointer touches them. You can enter data into any editable fields of all tax forms. Double-clicking on appropriate cells will automatically open the related form (e.g., double-clicking the taxable interest cell opens Schedule B). TurboTax also helps you document tax information by creating “Supporting Details” fields. These are not sent to the government, but they can be stored and printed.

And, as an extra bonus, the latest release of TurboTax comes with Macrovision’s obnoxious C-Dilla malware. C-Dilla prevents you from copying the CD by disabling your CD-RW drive.

- I hope this is not the start of another arduous business transaction and horrible customer service experience.

- Change is needed – PREPAID BANK CARDS give far too much control and an interest free loan to META BANK and banks operating like it.

- Other online resources in the Deluxe edition include IRS publications, Money Magazine’s Income Tax Handbook, and a Video Library with explanatory and tutorial videos.

- Don’t let them get away this price increase that has no basis in common sense.

- Always do background checks on the people or firms you are looking to hire, before you hire them.

Get form response, wants @#$# number from logging into their page. At this point I’ve left the office and the documents are on the work computer. Thursday – No check – ok call again, spend my lunch hour on hold, no human. Ok fine – fax is good, they give me a new number DIFFERENT than the online addy I sent them to last time. Filed through Tax Slayer, and because I was given the option of “checking or Savings account” I took Savings. And IRS is telling people that TT has the money so someone is lying.

All Posts Tagged Passing Of Money Through Metabanks Hands = Turbotax Refund Fee

I didnt expect to hear back but wanted to let somebody know about Larry. Moe and CUSTOMER SERVICE REP. Well next thing you know i get an E-mail from the manager of the escalation department that my funds were being released to S.B.B.T. right away. the next day i call S.B.B.T. and they tell me they need a copy of my I.D.and.S.Security card. i send it and they have a problem with the S.Security card! i had just received it in the mail, it was brand spanking new!

Well who the hell do they think they are? but first I NEEDED TO GET IN TOUCH WITH THAT BANK, and have them fax them over an indemnity bond. But like a fool i comply because i want whats rightfully mine that they are holding hostage, and until i jump through hoops there isn’t a damn thing I can do about it. i call the originating institution, which is Santa Barbara Bank and Trust and they told me that they never heard of such a thing and i should call my bank back and tell them so. and to tell them if any body should be requesting a bond it should be them!

Rates are given for each advisor and range from $0.33 to $2.95 per minute. EasyStep screens associated with data entry also let you view the associated tax form in the bottom third of the window. You can view just that form by clicking on the Go to Forms button. You can get help or information at any time by clicking the Help button or selecting an option from the Help menu. TurboTax helps you prepare your federal and state income tax forms. The program will walk you through all the steps needed to complete and file your tax returns. TurboTax will use information from your previous return to get you started.

I tried using TurboTax to do my taxes as well as my brother’s on the same hard drive. I ran into a problem that once I started using TT to do my taxes and then tried to use TT to do my brother’s taxes, the program always started up with my tax program and somehow couldn’t access my brother’s.

It drove me ‘nuts’ until I realized that one must use “Get Info” to get the program to boot-up with the particular tax you wish to work with. Still it seemed that not always could I get the TT to bring-up the “Get Info” which offered this option.

Check Withtpg

They are the ones that filed a fraudulent joint tax return under my ss. Now I have to go through all turmoil to get to the bottom of it. Santa Barbara Tax Products Group is the second largest provider of tax refund-related products behind H&R Block Bank. You can also check the status of your refund deposit on their website once the IRS has released the refund to them for the TaxSlayer preparation fees to be deducted. If you don’t receive your stimulus money, you’ll be eligible to get that money on your tax return. If they put on one line that $850 should go to your bank account and $150 should go to their account, it may be that the IRS will send you the rebate direct deposit.