Content

These are detailed on this page, which shows how to report and file these distributions and other information. You may owe the Alternative Minimum Tax if your AMT is greater than your standard tax liability. The eFile App will determine which you will be subject to. “Victims of Texas winter storms get deadline extensions and other tax relief.” Accessed Feb. 25, 2021. If the total is more than the base amount, some of your benefits may be taxable. Then compare that amount to the base amount for your filing status.

The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy.

Here’s How Much You Have To Make To File Taxes

There, you can add Text and/or Sign the PDF. Use these free calculators, courtesy of eFile.com, to determine your filing situation for your 2020 Return. You received distributions from an HSA Health Saving Account or MSA Medical Savings Account.

Below are some of the scenarios that may require a tax filing, even if you are below the threshold. Even if you don’t need to file, you may want to, because you could be eligible for a tax refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income. In the case of nonresidents, A.R.S. § provides that Arizona gross income includes only that portion of federal adjusted gross income which represents income from sources within this state.

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

But wouldn’t it be great if you didn’t have to file at all? Here’s how to know if you have to file a federal income tax return — and why it may be a good idea to file even if you’re not required to. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

Brokerage Reviews

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Additionally, if you’re a married dependent and your spouse files a separate return on which they itemize deductions, you must file if you have gross income of at least $5. This is true regardless of your age or whether you’re blind.

See if you qualify by using this free EITCucator. Reading your Form 2441, Child and Dependent Care Expenses, doesn’t have to be difficult. Learn how to use it when filing your tax return. If the return is more than 60 days late, the minimum late filing penalty is 100% of your unpaid taxes or $330 . Your tax filing status and gross income are the prime determiners of whether or not you need to file. Remember, with TurboTax, we’ll ask you simple questions and determine the best filing status for you based on your answers.

Audit services constitute tax advice only. Consult an attorney for legal advice. Learn about tax history and how technology has allowed e-filing to become the most popular form of filing. If you have a qualifying child but owe no tax, you can file to be refunded the Additional Child Tax Credit.

Currently, seven states don’t tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your state’s revenue, finance or taxation office’s website. The IRS also has a link to every state’s tax office. You might also want to file a return if you have been—or think you might be—a victim of identity theft. Filing a return puts the IRS on notice as to what your true income was for the year, and it prevents a thief from filing a fake tax return using your name and Social Security number. Only individuals whose incomes exceed certain levels must file tax returns.

For example, filing might allow you to receive a refund of any federal income tax withheld, excess estimated payments or an overpayment from last year’s return you applied to this year’s estimated tax. Or you may be able to take advantage of refundable tax credits like the additional child tax credit, theAmerican Opportunity Tax Creditor theearned income tax credit.

Do I Have To File Taxes? Other Situations That Require Filing A Tax Return

The filing status is directly related to the standard deduction limits. Check the current standard deduction limits. A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax the taxpayer owes. For single filers with no children, the maximum credit is $538 for 2020, rising to $543 in 2021.

Your Arizona taxable income is less than $50,000, regardless of your filing status. Your Arizona taxable income is $50,000 or more, regardless of filing status. You are a resident of Arizona if your domicile is in Arizona. Domicile is the place where you have your permanent home. It is where you intend to return if you are living or working temporarily in another state or country. If you leave Arizona for a temporary period, you are still an Arizona resident while gone.

How long do you keep my filed tax information on file? How do I update or delete my online account? Find out if you are required to file previous tax year return. If you adopted a qualifying child, you must file to claim the Adoption Tax Credit. Though nonrefundable, this credit can lower your taxes. See the page to find how to claim it. If you qualify, you must file a return to receive the refundable Earned Income Tax Credit.

If you did not get enough, you can collect the extra when you file. Advance payments of the health coverage tax credit were made for you, your spouse or a dependent who got health coverage through the insurance marketplace. Advance payments of the premium tax credit were made for you, your spouse or a dependent who got health coverage through the insurance marketplace. Here’s how much you have to make to file taxes, and why you might want to file this year even if it’s not required. You’ll know if this pertains to you because you’ll receive a Form 1095-A detailing the payments. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Starting price for simple federal return.

See Peace of Mind® Terms for details. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state.

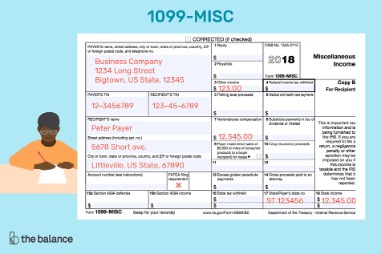

- You’ll get this form if you made trades through a brokerage or made any official barter exchanges.

- Online AL, DC and TN do not support nonresident forms for state e-file.

- Whether or not you need to file is primarily based on your level of gross income and status for the tax year.

- Even if you don’t need to file, you may want to, because you could be eligible for a tax refund.

- Basically, if you owe any self-employment tax, you’re required to file Form 1040.

This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents. But the credit amount is greater for eligible low-wage taxpayers with children.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

So are you planning on filing single , married filing jointly, married filing separately or head of household? You received wages of at least $108.28 from a church or organization that is exempt from employer Social Security and Medicare taxes. We think it’s important for you to understand how we make money.

Do I Have To File A Federal Income Tax Return?

You might also be required to file for other reasons, such as if you’re self-employed or paid on a 1099-MISC form, or bought health insurance from a state or federal marketplace. If you can be claimed as a dependent on someone else’s return, separate filing thresholds apply. Please see IRS Publication 501 for additional information. If you had taxes withheld from your pay, you must file a tax return to receive this money back as a tax refund if you had withheld too much.

Or if you’re the parent or guardian of a dependent who qualifies under these guidelines but can’t file their own return , you must file a return on their behalf. Once you’ve determined that you need to file taxes, your next question is likely to be — when do I have to file taxes?