Content

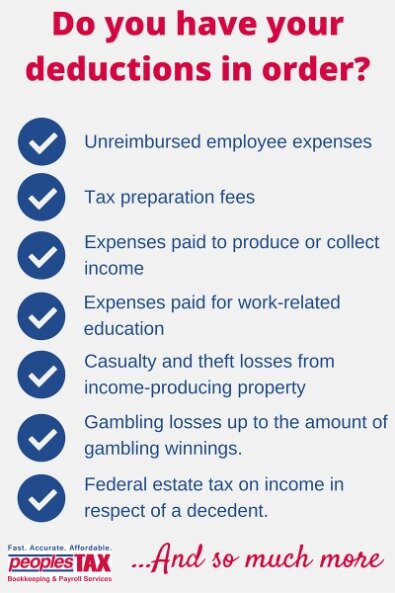

That includes instances like driving to see a client, to a store to pick up supplies for your business, or to a conference in another state. And when it comes to deducting those travel expenses, you must choose to deduct either the standard mileage allowance or the actual cost of your gas, oil, and other expenses. The standard mileage allowance for 2018 is 53.5 cents per mile. One of the results of the Tax Cuts and Jobs Act was removing the deduction for un-reimbursed employee business expenses until 2026 tax returns. This means that employees can no longer reduce their taxable income by deducting employee business expenses or job search expenses. Overall, most taxpayers might actually fair better with the higher standard deductions compared to the previous employee expense tax deductions.

Davidson holds a Bachelor of Arts in American civilization from the University of Pennsylvania. Intuit and QuickBooks are registered trademarks of Intuit Inc.

If Your Business Travel Is With Your Own Vehicle

You must sleep away from home to be able to deduct these costs as travel expenses The travel must also be “temporary” . Make sure you know which travel expenses are deductible – and which are not. “IRS issues guidance on Tax Cuts and Jobs Act changes on business expense deductions for meals, entertainment.” Accessed July 8, 2020. Assuming that you are traveling away from home for the required length of time, you may elect to deduct half of a Standard Meal Allowance , rather than half of the actual cost of your meals, laundry, cleaning and tips. Of course, if you entertain business guests at home or away you may be able to deduct a portion of the cost, if you meet the usual deductibility rules formeals and entertainment.

- She returned with renewed enthusiasm for her profession and with knowledge regarding several new vendors.

- If your spouse travels with you, you usually can not claim any deduction for your spouse’s expenses.

- For each trip, make sure to diligently record the date, the number of miles and the purpose of the trip.

- If you use a vehicle that was purchased by a business, you cannot claim business mileage.

- If you receive a per diem or reimbursement that does not cover your entire travel costs, you can claim a tax deduction for qualified out-of-pocket expenses.

This is cost should not be associated with your regular commute to and from your regular place of business. When you are self-employed and traveling between your tax home and business destination you can deduct the cost of travel by train, bus or airplane. You must allocate your expenses for foreign traveleven ifyour trip was primarily for business reasons. The advantage to using the standard meal allowance is that you don’t have to keep records of actual meal expenses, although you still have to keep records to prove the time, place, and business purpose of your travel. The biggest disadvantage is that the standard meal allowances are not very generous. Chances are that your actual expenses–and therefore your deductions–would be larger.

Can Air Ticket Tax Be Deductible When Filing A Tax Return?

For example, an employee traveling as a work requirement doesn’t have control over the trip, but the business owner would. The IRS has a specific definition for business travel, for the purpose of determining whether you can deduct these travel expenses for business purposes. The IRS says business travel is travel away from your tax home that is “substantially longer than an ordinary day’s work” and that requires you to sleep or rest while away from home. You can claim the price of a toll, if you incur that expense while traveling away from your tax home for a business-related reason.

Special rules apply to conventions held outside the North American area. You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can’t deduct travel expenses paid in connection with an indefinite work assignment.

You also have a tax home—the city where your main place of business is located—which may not be the same as the location of your family home. Airplane wifi, hotel wifi, and so on is completely deductible when you’re traveling for work. This also includes other communication expenses like hotspots and international calls. Unless your spouse or other companion is your employee, you generally can’t deduct his or her travel expenses. However, you can still deduct the amount your hotel room would have cost for one person, which is often the same or not much different than it is for the two of you. You can deduct costs to travel by train, bus, or airplane between your tax home and your business destination.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket. Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with.

Employee Or Job Tax Deductions

In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5000—whichever amount is higher. If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit. For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense.

The room charge and taxes are deductible, as are laundry expenses, but additional personal charges such as gym or fitness center fees, and fees for movies or games are not deductible. Per diems are amounts that are considered reasonable for daily expenses while traveling, for meals and miscellaneous expenses. Per diem rates are set for U.S. and overseas travel, and rates differ depending on the area. To claim your hotel stay as a deduction on your taxes, the IRS requires you to travel away from your “tax home” – the area where most of your work takes place. The IRS states that travel by airplane between your home and your business destination can be a deduction for business travel. If you were provided an airline ticket or you’re riding free as a result of a frequent traveler or similar program, your cost is zero and you have nothing to deduct.

However, subject to the limitations on meal expenses, she can deduct the cost of the two business lunches. If your spouse travels with you, you usually can not claim any deduction for your spouse’s expenses.

Tax Deductions For Business Travel Expenses

Travel expenses you incur in connection with acquiring or starting a new business are not deductible as business expenses. However, you can add these costs to your startup expenses and elect to deduct a portion of them and amortize the remainder over 180 months. Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit. There are two ways to deduct business travel expenses when you’re using your own vehicle. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride. If you travel outside the USA but spend less than 25% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

If part or all of your tip is outside the U.S., the IRS rules are different. Your international travel may be considered business-related if you were outside the U.S. for more than a week and less than 25% of the time was spent on personal activities. You must also sleep away from home to be able to deduct these costs, and the travel must also be “temporary” . The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating a vehicle, and the rate for medical purposes is calculated with variable costs in mind. To deduct these expenses, you need to have slept away from home and your travel must be temporary .

You may be able to take a tax deduction for lodging expenses related to a temporary work assignment away from your tax home. However, IRS rules only allow you to take deductions for travel expenses incurred during work assignments less than one year long. For example, if you must travel from your tax home in New York City for a one-week assignment in Miami, Florida, your lodging expenses are tax deductible.

Your trip is long enough or far away enough that you can’t reasonably be expected to complete the round trip without obtaining sleep or rest. This doesn’t mean that you need to stay overnight at the destination; for example, it may be that you had an all-day meeting and needed to get a few hours sleep in a hotel before driving home. It will be easier to plan your business trips, and to combine business with vacation when possible, if you become familiar with the IRS’s ground rules. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax.