Content

Description of benefits and details at hrblock.com/guarantees. The IRS grants four types of penalty relief, but many taxpayers don’t ever ask. Learn how to request penalty abatement from the IRS. Need copies of your old Forms W-2 or 1099?

Additional fees and restrictions may apply. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state.

But don’t forget that interest begins to accrue the day after the due date and compounds daily, so it may not be worth it to follow that path. However, if you file for an extension, that’s only for filing your tax forms. You’re still expected to pay on time. Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years. Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them.

Penalties for failing to pay your taxes on time are actually lower than for filing late. For each month past the payment date you will be assessed 0.5% of your total tax bill as a penalty. This fee also maxes out at 25% of your tax bill. However, interest still accrues on the unpaid taxes over and above the penalty for failing to pay on time. If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance.

The IRS usually starts this process, called a substitute for return , about three years after the due date of the return. When you file a return to replace an SFR, the IRS will closely scrutinize the replacement return and compare it to information statements on file. Because of that scrutiny, the IRS will take more time than usual to process the replacement return – more than four months in some cases. The IRS may have filed a return for you. The IRS will closely scrutinize business returns because the IRS knows that businesses have the largest potential for noncompliance. There’s a large potential tax bill on the older returns. The most common red flags are Forms 1099-MISC, property sales, and large wages with no withholding.

You must establish that you cannot pay your balance through an installment agreement or by any other means. If you fail to file your tax return on time, the IRS can and will penalize you a late filing fee. This year the fee is 5% of the taxes you owe for each month past tax day that you fail to file. The penalty maxes out at 25% of the taxes you owe. There might not be a hard limit to how many years you have to file back taxes, but that’s not to say that the IRS doesn’t want your returns sooner rather than later. You must have filed tax returns for the last six years to be considered in “good standing” with the IRS. And if you want to claim a tax refund for a past year, you’ll need to file within three years.

Authorize Your Tax Pro To Help

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing not available in NJ, NY, RI, VT and WY. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details.

Beware Of Penalties

In these cases, she says, “the worst thing that you can do is nothing at all.” Reaching out to the agency to tell them you may owe taxes is always preferable than having the IRS find you. You paid or set up a payment plan for any tax due. Also, if you have a payment plan, you must be current. Interest begins to accrue on unpaid taxes one day after the bill was due. Interest compounds daily until the bill is paid in full.

Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Learn why you should still file your return even if you can’t pay from the tax experts at H&R Block. How do I update or delete my online account? You’ll report your income and expense information for the year you are filing, so you’ll need to have those records on hand. For example, if you need to file for 2015, download a Form 1040 for 2015. TaxSlayer allows you to complete prior year tax returns for up to three years after the return is due.

What If I Filed My Taxes But Didnt Pay My Tax Bill?

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy. You can unsubscribe at any time by contacting us at The new federal tax withholding tables weren’t issued until early last year, so employers didn’t have a chance to calculate the correct amount of withholding from the beginning of 2018.

Learn the three main benefits of engaging a power of attorney to research your IRS account and resolve your tax problems. Get the facts from the experts at H&R Block. Call the IRS, or your tax pro can use a dedicated hotline to confirm the unfiled years. File with a tax Pro At an office, at home, or both, we’ll do the work. Every form you received from your employer has also been sent to the IRS.

Here’s what you need to know—and do—if you haven’t filed your taxes in years. Penalties are about to get way steeper for taxpayers who still haven’t filed a 2019 income tax return and owe the IRS a balance. The IRS has strict guidelines in place indicating who needs to file a tax return. If your income falls at or above the minimum income requirement, you’ll need to file even if you think you won’t owe anything or receive a refund.

If you owe less than $50,000, this is a great option to tackle your tax bill. But you must file within three years after the return is due or else you will not be able to collect your refund. What you need to do is file back taxes .

If any refund remains, you’ll receive the balance within a few weeks after the tax on your previously unfiled returns is paid. You can only claim refunds for returns filed within three years of the due date of the return. Everything before that is lost and you cannot collect that return. If you’ve gone a decade without filing a tax return and nothing has happened, that doesn’t mean you’re off the hook. If you have any income at all, the agency can use that to essentially file a tax return on your behalf. If you don’t file your taxes or file for an extension, you will accrue penalties that can be up to 25% of the taxes you owe. If you owe $5,000, your penalty will be $1,250.

- You may be able to fill out past-due tax returns through online software or with an accountant, but you’ll need to print the forms and mail them to the IRS.

- Also, the new tables didn’t completely factor in other changes, including the suspension of dependency exemptions and reduced itemized deductions that were part of the tax law change.

- File with a tax Pro At an office, at home, or both, we’ll do the work.

- TaxSlayer allows you to complete prior year tax returns for up to three years after the return is due.

In the best-case scenario, non-filers could be missing out on money owed to you, experts say. In the worst case, you could be on the hook for penalties and interest, and enter into a protracted battle with the IRS. There is a difference between failure-to-file and failure-to-pay.

What Tax Documents Do I Need To File Back Taxes?

If you owe money to the IRS, you can set up payment agreements if you can’t pay back your returns right away. There several types of payment plans, depending on what you need. If you don’t set up a payment plan with the IRS and you avoid paying the IRS, the IRS will send their collections department after you. There’s one other reason not to delay. The IRS’ timeline to go after non-filers is essentially unlimited. “here’s no statute of limitations for assessing and collecting the tax if no return has been filed,” the agency says.

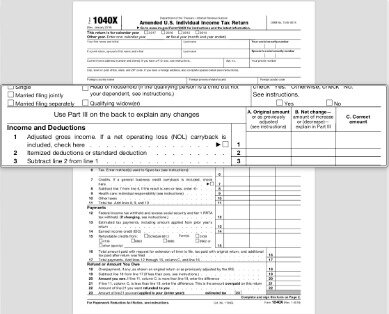

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return. And, finally, what about your state tax return? The due date for most state tax returns was July 15.