Content

From practical tips to in-depth tax topics, we’ve compiled various resources to keep you informed. The good news is our EY tax professionals are here to address the complexities of your tax filings. EY TaxChat™ can help you navigate through these complexities of state filing requirements.

- Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software.

- You also will be responsible for paying any applicable taxes relating to purchases through the Site.

- Please check the contact us link in your my account for the support center hours of operation.

- If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

Then, easily track your tax return to see when your refund will hit your bank account. Stuck on your tax return and need technical advice within the program? That’s no problem with our complimentary email and live phone support! A professional support agent will assist you in finding a solution to your question. Unemployment benefits may be a new and unfamiliar tax topic for many. We handle the reporting on your tax returns and provide guidance on tax withholdings and estimated tax payments. If you need additional time to file your federal and state returns, EY TaxChat™ can prepare and file your extension forms for you.

No Matter Your Situation, We Have A Product That’s Right For You

This version lets you itemize and claim several other tax deductions and tax credits. And if you have business income but no expenses, this might work for you, too. TurboTax has a lot going for it, but price isn’t one of them.

They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service. Enter your income and we’ll guide you through the rest of your return to maximize your refund. People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return.

The list price of its software routinely is on the high end of the spectrum, especially when adding the cost of a state return. And if you want access to human help, it costs even more. As a credentialed tax expert, you will be receiving an Intuit laptop, preloaded with all of the tools and systems you will need to help customers. You will need a dedicated high-speed internet connection.

Checking Your Browser Before Accessing Justanswer Com.

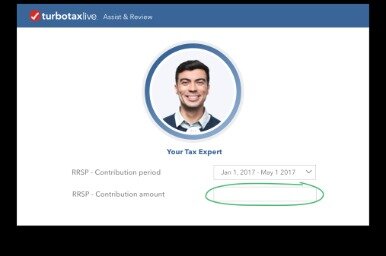

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Live, on-screen tax advice or review of your whole tax return by a tax pro is available if you buy the TurboTax Live version. These users also can submit written questions that a tax pro will answer within 24 hours.

It offers a one-on-one review with a tax pro before you file, as well as unlimited live tax advice throughout the year. You can make an appointment or talk on the fly to a tax pro via one-way video . For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 1-3 of the 1040. Generally, it works only for people who don’t plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit.

Import your W-2s and PDFs from another online tax service or tax preparer. Existing TaxSlayer customers can pull prior year tax information and compare this year’s tax return with last year’s tax return. Offer may change or end at any time without notice. Double-check your entries to be sure you entered all of your information correctly.

Mobile & Software

EY tax professionals consistently work with multistate filers, to submit the proper forms, credits and state tax returns. EY tax professionals will prepare and file your individual returns including forms related to investment income, such as federal Schedules B, D and E. Proper reporting is crucial, as certain types of interest, dividends and capital gains may qualify for reduced tax rates. If you’re subject to the net investment income tax, we prepare the Form 8960, and include the tax deductions available to you.

This ensures your return is processed by the IRS and state without delay. We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges. You are responsible for paying any additional tax owed. This option requires you to provide a valid phone number, email address and bank account information in your return. This is a good choice for those with a checking or savings account who do not want to pay any OUT OF POCKET EXPENSES. This option is the same as a Direct Deposit, except that TaxSlayer filing fees are deducted from your federal refund. To use this option you must be filing a Federal return and receiving a refund from your federal return to cover the expenses listed above. For those who do not qualify the price to file a federal tax return is $17 and the state is $32.

EY TaxChat is an on-demand mobile service that connects you with knowledgeable tax professionals who can prepare and file your return in a secure, online environment. EY TaxChat makes filing personal taxes simpler, faster and more reliable. You don’t have to make an appointment, mail paper documents or understand complicated tax software. Whether you own foreign bank accounts, generate income from international investments, receive compensation abroad or own a foreign rental property or business, you are generally required to report this information on your annual tax returns. We can prepare and file the necessary returns for you, including federal Schedules C, E and SE to report your business income and expenses, and ultimately calculate your self-employment tax.

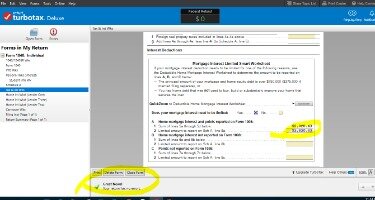

The user-friendly interface of the software is particularly important, but so too are the thorough interview questions. There are a number of additional extras, too, all of which will help you receive the biggest possible refund in the end. And this, believe it or not, is just the surface, since not only is TurboTax fully supported on mobile platforms but it’s also very safe to use thanks to the outstanding built-in and optional security settings. However, this also means that nothing interrupts the filing process, meaning that aside from the questions that you typically have to go through in such a solution, the process of filing is straightforward and hassle-free. Another thing that can also be quite jarring is how the importing of previous years’ tax returns works. With past TurboTax Online returns the process is more or less seamless, although certain data has to be confirmed manually to ensure that no changes are left out.

Taxslayer Terms Of Service

You have the option of paying for the software out of your refund. Other options include applying the refund to next year’s taxes and directing the IRS to buy U.S. Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between “support” and “defense.” With most providers, audit support (or “assistance”) typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

Always know your tax returns are in a safe place that you can access whenever you need, like when applying for loans, student aid including FAFSA, or showing proof of income. Simply sign in to your TurboTax account from any device to view or print all of your completed TurboTax returns from our secure servers for 24/7 online access to ALL tax returns we have on file for you. Access to your returns is available through 10/15/2016. Terms and conditions may vary and are subject to change without notice. Get one-on-one guidance from our credentialed tax pros all year long.

Select the Learn More links or the Helpful Page topics for on screen assistance. You can also enter key words to search additional articles. Jump to the front of the line with priority support via email, live chat, or phone. TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work. TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.