Content

In order to use the HCTC program the person needs to be an eligible recipient of a qualifying trade adjustment assistance program. And he/she should be currently on an approved break from such training or receiving unemployment insurance in lieu of training. If a person is 55 years or older than this and a PBGC payee then also he/she is eligible. Claiming the HCTC requires that you are an eligible recipient of a qualifying trade adjustment assistance program, currently on an approved break from such training or receiving unemployment insurance in lieu of training. You may also qualify if you are 55 or older and a PBGC payee. You can take the HCTC for 2015 if you were an eligible trade adjustment assistance recipient, alternative TAA recipient, reemployment TAA recipient, Pension Benefit Guaranty Corporation pension payee, or qualifying family member. IRS will accept a copy of Form 1099-R as proof of PBGC payee status for the year for which a taxpayer is claiming HCTC.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Use Form 8885 to figure the amount, if any, of your health coverage tax credit .

Pay

Subsequently, all individuals were removed from the HCTC Advance Monthly Program. DWD will then mail a determination letter to both you and the IRS, if you are eligible. The requested file was not found on our document library. If you don’t have a MyPBA account, call our Customer Contact Center at .

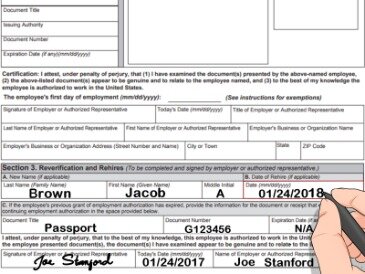

Benefits under the program have been adjusted and expanded several times. In order to register with the IRS you have to fill out the and mail Form A to the IRS. Your form must accompany all the supporting documents that are required to enroll. You can also receive advance payments of the HCTC if your application is accepted by the IRS. Since these amounts are paid from the HCTC program, do not include these in form 8885 as part of your health insurance payment. In the second part the individual declares the total amount that he/she has paid directly to the qualified health insurance provider.

Visit our Contact Us page for hours and more info. You can request a copy of Form 1099-R, which will be mailed to you within four business days. The IRS will accept a copy of your Form 1099-R issued by PBGC in lieu of the letter of eligibility from PBGC for the year that you are claiming HCTC. Your Form 1099-R serves as proof of PBGC payee status for the HCTC. On the off chance that you will take help from a dedicated and expert tax profesional then you can have confidence about things.

HCTC helps cover the cost of health insurance while you participate in the TAA program to make your health insurance premiums more affordable. Want to claim your health coverage tax credit?

Get More With These Free Tax Calculators And Money

Eligible individuals must have or seek a health plan that qualifies for the credit in which they pay above 50% of the premiums. HCTC is a Federal tax credit program administered by the Internal Revenue Service .

Department of Labor and those receiving benefits through the Pension Benefit Guaranty Corp. over age 55. The HCTC covers a significant portion of participants’ health insurance premiums, allowing vulnerable sectors of the workforce to maintain health care coverage.

If an eligible individual passes away then his/het qualified family members can also claim the credit. For being a candidate the requirements are the same as any other health plan.

The person must have paid more than half of the premiums. And he/she should not be claimed as a dependent on any other person’s federal tax return. Qualified family members of a deceased person eligible for the HCTC may also be eligible for the credit. The Health Coverage Tax Credit is a refundable credit of a percentage of qualified health insurance coverage payments available to qualified taxpayers.

Form 8885 2017

In fact, three different credits may be claimed on this line item – the Health Coverage Tax Credit, the Prior Year Minimum Tax Credit, and the Undistributed Capital Gains Credit. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers. they or their spouse’s employer did not pay 50% or more of the cost of coverage. “To elect the HCTC for 2014, you must file an amended return. Complete the 2013 Form 8885 for 2014 after crossing out ‘2013’ and writing ‘2014’ at the top of Form 8885.” If you want to know how to get started or have any other queries then you can take help from our large team of experienced and dedicated tax professionals.

In addition, individuals previously enrolled in the HCTC Advance Monthly Program must submit a new Form A, HCTC Monthly Registration and Update to reenroll in the program. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19.

93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. Your Form 1099-R for benefits paid by PBGC in 2020 will be mailed to you through the U.S. Your IRS Form 1099-R will be available to download and print from MyPBA beginning February 2, 2021.

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Remember, if you use TurboTax to prepare your taxes, we’ll ask you simple questions and fill in all the right tax forms for you. TaxHow’s mission is to provide simple and clear solutions to all taxpayers, making tax preparation easy and almost fun. We strive to translate IRS-speak into simple and relevant articles that provide you with the information you need – when you need it. Find out how to file your federal and state taxes easily, quickly and most importantly – accurately. Individuals can contact their insurers to be re-enrolled in HCTC eligible coverage.

Credits & Deductions

For more information, visit the IRS pageClaiming the Health Coverage Tax Credit. Please note, PBGC will mail all 2020 Forms 1099-R by February 1, 2021.

- TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology.

- If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

- If you don’t have a MyPBA account, call our Customer Contact Center at .

- Since these amounts are paid from the HCTC program, do not include these in form 8885 as part of your health insurance payment.

Even if you can’t claim the HCTC on your income tax return, you must still file Form 8885 to elect the HCTC for any months you participated in the advance monthly payment program. Failing to make a timely election will require you to report advance monthly HCTC payment amounts as an additional tax owed on your tax return. The HCTC is a federally funded program designed to assist people certified as displaced workers by the U.S.

You won’t need to stress over any of the perspectives. There is no compelling reason to stress over the exactness also.

The straightforward explanation behind this is, these tax experts are very much aware of all the tax codes and most recent standards and guidelines. Their long periods of experience leaves them with just about zero odds of committing any errors while taking care of your things. After filling out the form you also need to provide all the supporting documents.