Content

See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations.

It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. You were a nonresident alien for any part of the Tax Year and did not elect to be treated as a resident alien for tax purposes. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you.

These costs can be paid by cash, check, credit card, or money from a loan. The term qualified higher education expense refers to money paid by an individual for expenses like tuition, books, fees, and supplies to attend a college, university, or other post-secondary institution. These expenses can be paid by a student, spouse, parent, or another party such as a friend or another relative. The Internal Revenue Service provides individuals with tax incentives with respect to qualified higher education expenses.

More From Turbotax:

All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

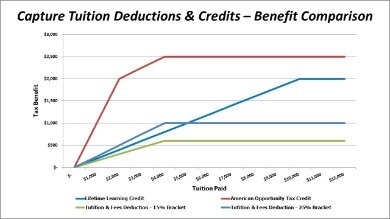

So be sure to check for updates from the IRS before you try to file your tax return claiming any education benefits. When you want to claim an education-related tax break, Uncle Sam won’t give you a credit or deduction for every school-related dime you spend. Only certain types of expenses will qualify you for an education-related deduction or credit — and different tax breaks are available for different costs. Qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. The government uses tax policy to encourage activities such as paying for education and saving for retirement. While the names and amounts vary, the IRS generally provides for some type of educational tax credit to help offset the costs of qualifying tuition and related expenses. The tuition must be paid to an eligible educational institution.

Taxslayer Support

This includes most accredited public, nonprofit, and privately-owned–for-profit postsecondary institutions. If you are not sure if your school qualifies, you can ask or see if your school is listed here. When you claim a credit, such as the American Opportunity Credit or the Lifetime Learning Credit, only certain types of educational expenses will count. Tuition and fees are commonly considered qualified education expenses, but the details can vary beyond those costs. The IRS considers these as employee business expenses. You can deduct only the amount of miscellaneous deductions that is more than 2 percent of your adjusted gross income. If you purchase the computer and use it only for school and work, and it’s necessary for your work that you have the computer, you can include it in your miscellaneous deductions.

Finally, if the beneficiary incurs expenses related to a study abroad program sponsored by a qualified institution for credit, those expenses would be considered qualified. The expenses themselves would still need to be qualified, meaning it would cover room & board, but not travel costs. Expenses used to claim the American Opportunity Tax Credit or Lifetime Learning Credit – Expenses used to generate the AOTC or Lifetime Learning Credit must be excluded from qualified expenses. This is to prevent “double-dipping” of federal tax benefits. The definition of a qualified expense is intentionally broad, but there are some common expenses that do not qualify.

Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

Qualified Education Expenses For Education Credits

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period.

Before this change, you could have claimed a deduction if the education was required by your employer or by law. QHEEs must be paid directly by the student themselves, their spouse, parents, another relative, or friend in order to qualify. These fees may or may not be paid directly to an eligible post-secondary institution. Eligible schools include private, public, for-profit, and nonprofit institutions. All schools send out a Form 1098-T—Tuition Statement for QHEEs to the student for tax purposes. Taxpayers may claim QHEEs under the tuition and fees deduction by using Form 8917 with their completed tax return. A qualified higher education expense is any money paid by an individual for expenses required to attend a college, university, or other post-secondary institution.

- See Peace of Mind® Terms for details.

- Enrolled Agents do not provide legal representation; signed Power of Attorney required.

- Once activated, you can view your card balance on the login screen with a tap of your finger.

- You must pay the qualified education expenses for an academic period that starts during the tax year or the first three months of the next tax year.

- If your AGI is from $60,001 to $80,000 ($130,001 to $160,000 if married filing jointly), the maximum amount of your Tuition and Fees Deduction will be reduced.

Additionally, tuition and fees still count as qualified education expenses for the American Opportunity and Lifetime Learning credits. The Student Loan Interest Deduction is an above-the-line deduction, which means that you do not need to itemize deductions in order to claim it. Above the line deductions reduce your taxable income and ultimately lowers your adjusted gross income. To qualify for the deduction, the student loan on which you paid interest must be a commercial loan taken out exclusively for the purposes of paying for education. The loan may only apply to a student who is enrolled at least half-time in a degree program.

These expenses are important because they can determine whether or not you can exclude the interest off of a qualified savings bond from your taxable income. If you have an amount in Box 1 or Box 2 of the Form 1098-T and there is no amount in Box 5 then your qualified expenses would be that amount plus any other qualifying expenses such as books and supplies. Before you pursue an education-related tax break, it’s important to know what the IRS considers a qualified education expense — and what it doesn’t. And keep in mind that different tax breaks have different criteria for what’s considered a qualifying expense.

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. Available at participating offices and if your employer participate in the W-2 Early AccessSM program. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Typically this amount is included in Box 1 or Box 2 of the 1098-T Form. You can learn more in Record-keeping for your 529.

Tax Credits That Can Get You A Refund

Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. US Mastercard Zero Liability does not apply to commercial accounts .