Content

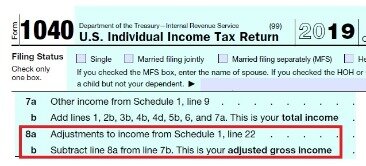

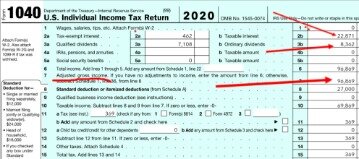

Tax software will help you identify all earnings that need to be reported to the government by asking questions in the tax interview, or you can ask an accountant for advice. After you have added up your full taxable income , you can take several “above-the-line” deductions to lower that taxable amount. These are called “above the line” because they apply whether you itemize your deductions or take the standard deduction. They’re also called “adjustments to income,” and they’re calculated on IRS Schedule 1. Your AGI, or adjusted gross income, is the amount calculated from your total income the IRS uses to determine how much the government can tax you. Your gross income is the sum of all the money you earn in a year, including wages, dividends, alimony, capital gains, interest income, royalties, rental income and retirement distributions.

If you reported self-employment business income on Schedule C, you would include that in your gross income as well. Bonuses, tips, alimony and even gambling winnings are also part of gross income. You generally do not include life insurance payments, child support, loan proceeds, inheritances or gifts in your AGI, though. Adjusted gross income is a variation of your gross income that accounts for certain deductions that usually make it lower than your gross income.

Need To Know More About Adjusted Gross Income?

Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

By contrast, gross income is the total amount of money you earn in a year before incometaxes or other deductions are taken out. Because of this distinction, AGI is typically the foundation for calculating how much you’ll owe in taxes. How do I update or delete my online account? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. What if I receive another tax form after I’ve filed my return? Many states in the U.S. also use the AGI from residents’ federal returns to calculate how much they owe in state income taxes.

Adjusted Gross Vs Modified Adjusted Gross Income: The Difference

Currently, some of the most common adjustments used when calculating AGI include reductions for alimony, student loan interest payments, and tuition costs for qualifying institutions. Your AGI also affects your eligibility for many of the deductions and credits available on your tax return. In general, the lower your AGI, the greater the amount of deductions and credits you will be eligible to claim, and the more you’ll be able to reduce your tax bill.

Depending on your tax situation, your AGI can even be zero or negative. Online tax preparation services and software programs both calculate AGI for you and automatically enter it into the correct line. Regardless of these convenient features, make sure you enter these amounts correctly when transferring the information from the forms your employer gives you to the Form 1040. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion.

AGI-related limits also apply to deductions for tuition and charitable contributions. You can generally deduct qualified charitable contributions you made only until the deduction amount reaches 50% of your AGI. Therefore, your AGI has a significant effect on which deductions and credits you can take, as well as how much they’re worth. Those who itemize can deduct only the amount of qualified medical and dental expenses that are higher than a certain percentage of their adjusted gross income.

These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

Wedding Budgets: Who Pays For What?

Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services. A federal government website managed and paid for by the U.S. Sign up to get the latest tax tips sent straight to your email for free. AGI cannot exceed total income reported and is often lower. total income is greater than $80,000 ($165,000 for married filing jointly). capped at $2,500, with 100 percent of the first $2,000 and then 25 percent of the next $2,000 eligible as a deduction.

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply.

Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

- In this article, the tax experts at H&R Block will walk you through the Secure Act retirement bill and any changes that may affect your retirement savings.

- AGI cannot exceed total income reported and is often lower.

- capped at $2,500, with 100 percent of the first $2,000 and then 25 percent of the next $2,000 eligible as a deduction.

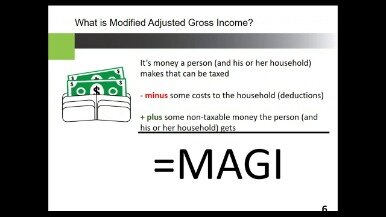

- These modified versions of AGI may add certain items to AGI that were excluded in computing both gross income and adjusted gross income.

- Both cardholders will have equal access to and ownership of all funds added to the card account.

- If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return.

How long do you keep my filed tax information on file? Adjusted gross income can directly impact the deductions and credits you are eligible for, which can wind up reducing the amount of taxable income you report on your tax return. AGI is essentially your income for the year after accounting for all applicable tax deductions. It is an important number that is used by the IRS to determine how much you owe in taxes. AGI is calculated by taking your gross income from the year and subtracting any deductions that you are eligible to claim. Therefore, your AGI will always be less than or equal to your gross income.

The resulting figure is your adjusted gross income. The Internal Revenue Service uses your adjusted gross income to determine how much income tax you owe for the year. To e-file your federal tax return, you must verify your identity with your AGI or your self-select PIN from your 2019 tax return. Under the package that passed the House of Representatives on Saturday morning, individuals with incomes of up to $100,000 and couples earning up to $200,000 would receive a reduced payment. For the third round, payments will completely phase out at $80,000 for individuals and $160,000 for joint filers, according to the Associated Press.

Once you decide whether you’ll take the standard deduction or itemize your deductions, you’ll subtract that total deduction amount from your AGI to get your taxable income. Adjusted gross income is all your income minus adjustments the federal government allows you to make to reduce your income. Learning Center articles may describe services and financial products not offered by Protective Life or its subsidiaries. Descriptions of financial products contained in Learning Center articles are not intended to represent those offered by Protective Life or its subsidiaries. Also, if you sold any items on eBay, Craigslist, or another online store, you have gained income from profits by selling goods. Gross income also includes net gains on disposal of assets, such as selling a home or car, or any money obtained through self-employment, consulting, side jobs, and other sources of income.

Thankfully, most of us leave the majority of the tax prep work to the tax experts. However, when it comes to the different ways in which your taxable income can be described, things can get confusing.

CAA service not available at all locations. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. or your tax preparer will calculate your adjusted gross income as part of the process of preparing your tax return. There are a wide variety of adjustments that might be made when calculating AGI, depending on the financial and life circumstances of the filer. Moreover, since the tax laws can be changed by lawmakers, the list of available adjustments can change over time.