Content

If you filed your 2019 return on e-File.com, your 2019 AGI is ready for you when you prepare and eFile your 2020 tax return. If you DID NOT prepare and e-File your 2019 Tax Return on eFile.com, click here to get your 2019 Adjusted Gross Income. To calculate your MAGI, you have to add certain deductions, such as student loan interest, back to your adjusted gross income. If you didn’t claim any of these deductions, your AGI and MAGI should be the same.

From your gross income, you then subtract specific amounts by making “adjustments” called“above the line” deductions. This is available to taxpayers even if they are taking the standard deduction. To determine your adjusted gross income, start with your gross income.

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

Dependents Credit & Deduction Finder

Consult your own attorney for legal advice. See Peace of Mind® Terms for details. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.

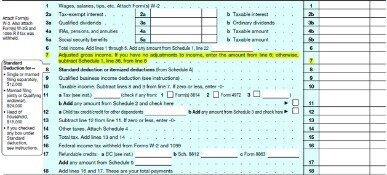

The result tells is your taxable income, the figure that’s used to calculate your federal income tax liability—how much you owe the IRS or the amount of a tax refund you can expect. Three numbered schedules must accompany your tax return if any of them apply to your financial situation and your tax return. Their corresponding information is then entered on your return itself, and in most cases helps determine your AGI. The 2020 Form 1040 is different from the tax returns that were used in earlier years. The IRS has redesigned the Form 1040 several times since 2018.

Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

The PIN is used on the signature page of the income tax return during the e-filing process. Gross income is the amount you earn before withholding money for taxes, IRAs, and other accounts and deductions.

Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account.

For this reason, MAGI would always be larger than or equal to AGI. There are a wide variety of adjustments that might be made when calculating AGI, depending on the financial and life circumstances of the filer. Moreover, since the tax laws can be changed by lawmakers, the list of available adjustments can change over time. Currently, some of the most common adjustments used when calculating AGI include reductions for alimony, student loan interest payments, and tuition costs for qualifying institutions. Let’s say you had some significant dental expenses during the year that weren’t reimbursed by insurance and you’ve decided to itemize your deductions.

What Is The Difference Between Gross Income And Adjusted Gross Income (agi)?

If your state has an income tax and you need to file a state return, you’ll typically also use your AGI as the starting point for your state return. You’ll then apply any state-based deductions, adjustments and credits to get your state taxable income. To calculate your adjusted gross income, you’ll start with your gross income and subtract certain adjustments. When you’re filling out IRS Form 1040 federal income tax return, you’ll calculate your AGI on lines 1 through 8. Your adjusted gross income is the dollar amount used to calculate your tax bill.

But your total income is not necessarily all the income you’ll have to pay tax on. That’s where adjusted gross income comes in.

You will receive an email confirming that your return has been accepted by the IRS. You should hear back from the IRS in hours concerning the status of your return. If you do not receive an email, make sure you do not have a spam filter blocking it. If your return is rejected, don’t worry as you can sign into your account and see the reason why the IRS rejected it with step-by-step instructions to correct and resubmit your return. 5) Select if you want to have your refund mailed or deposited to your bank account and click Continue. 3) Your return will be completed and when it is finished, click Continue. Click View Return if you want to view/print your forms.

your gross income from jobs, investments, Social Security, pensions, businesses, alimony, real estate, farms, and unemployment. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you used TurboTax, read this helpful FAQ on where to find last year’s AGI to sign this year’s tax return.

Moving expenses incurred by your spouse or dependents qualify as well. The total of all these sources of income is arrived at on line 9 of Schedule 1 and transfers to line 8 of the 2020 Form 1040. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ).

What Are The Tax Implications Of Converting A Traditional ..

These deductions are estimated and listed when you file your taxes. Most deductions, or the above-the-line deductions, are listed on Schedule 1 and reported on Form 1040. Itemized deductions, which may not apply to every person, are listed on Schedule A and also reported on Form 1040. AGI is gross income that is adjusted through qualified deductions that are permitted by the Internal Revenue Service . These qualified deductions reduce an individual’s gross income, thus reducing the taxes they need to pay. Your AGI also affects your eligibility for many of the deductions and credits available on your tax return. In general, the lower your AGI, the greater the amount of deductions and credits you will be eligible to claim, and the more you’ll be able to reduce your tax bill.

Certain rules apply, such as that the alimony must be provided for in a court order. Your ex-spouse used to be taxed on this income instead, but not anymore. The adjustment to income for classroom expenses for teachers and educators is $250. It increases to to a total of $500 if you’re married, filing a joint return, and both you and your spouse are educators. You and your spouse can’t each claim a $500 adjustment to income. Rules and limits apply to some of these adjustments to income. You can’t always claim the full amount of what you spent on these expenses.

But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Your AGI for tax year is on Line 8b. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor.

If you’re filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your MAGI. or your tax preparer will calculate your adjusted gross income as part of the process of preparing your tax return. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Generally, the more deductions and credits you take, the lower your taxable income.

Please help us keep our site clean and safe by following our posting guidelines, and avoid disclosing personal or sensitive information such as bank account or phone numbers. Key IRS Forms, Schedules & Tax Publications for 2021 by Tina Orem Here are some major IRS forms, schedules and publications everyone should know. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

All users of our online services are subject to our Privacy Statement and agree to be bound by the Terms of Service. is a business technology writer and researcher whose work focuses on financial services and cross-cultural diversity and inclusion. On line 8b of your 1040, subtract line 8a, your total adjustments to income, from line 7b, your total income. Fill out Schedule 1, which is essentially a worksheet for determining your various positive and negative income adjustments. , you should be able to log in to those accounts to find a copy of your return.

- An above-the-line deduction is an item that is subtracted from gross income in order to calculate adjusted gross income on the IRS form 1040.

- You will simply need to print and mail your return once it is finished.

- To qualify, tax return must be paid for and filed during this period.

- You only need a prior-year AGI if you are e-Filing your tax return to the IRS.

- You generally do not include life insurance payments, child support, loan proceeds, inheritances or gifts in your AGI, though.

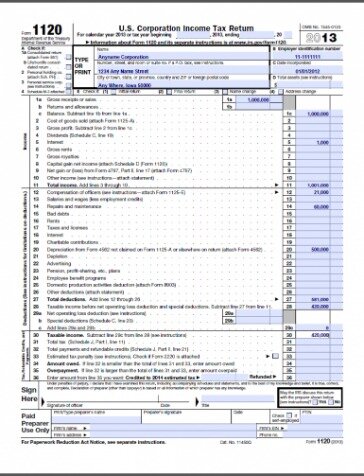

- Their version of gross income would be gross sales or revenues.

You can avoid paying this tax if you can reduce your AGI below those thresholds. The adjustments you subtract from your gross income are known as “above-the-line” adjustments (which you can take even if you don’t itemize your deductions). To define adjusted gross income, you first need to understand gross income.

Here Are The Deductions That Disappeared Due To Tax Law Changes

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If you used online tax software, you can typically login and download a copy of your prior year’s 1040 tax return to find your AGI. If you plan to e-file your tax return, you may need to first find the amount of AGI from last year’s return in order for the IRS to verify your identity. You can find your AGI on the form you used to file your last year’s return. For tax years beginning 2018, the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms.

Net income is used for both businesses and individuals, while AGI is only applicable to individuals. Gross income is the entire amount of money an individual makes, including wages, salaries, bonuses, and capital gains. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act . This means if you report $12,000 in unreimbursed dental expenses and have an AGI of $100,000, you can deduct the amount that exceeds $7,500, which is $4,500.

H&R Block employees, including Tax Professionals, are excluded from participating. How long do you keep my filed tax information on file? Adjusted Gross Income is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.