Content

If you deducted the cost of bad debt or worthless securities, keep records for seven years. Good business recordkeeping lets you prepare financial statements, helps you keep tabs on your expenses, and comes in handy if you ever get sued or audited. There are a ton of different apps out there to help you with organizing your receipts. Neat is another handy app that allows you to organize your receipts.

Instead of worrying whether you should be keeping or getting rid of them, you can archive them permanently. Secure cloud storage services like Dropbox, Evernote, or Google Drive. If you’re deducting meals and entertainment, it’s even more complicated. You might have to submit a list all of the people who were there with you when the expense occurred, and what you talked about (really—the IRS wants to know if you talked shop).

Get More With These Free Tax Calculators And Money

Bonus points if you have a free personal bookkeeper approve your tax deductible expenses, more on how you can do that later. The big secret to keeping receipts is organization; that, experts say, along with conscious effort and a little time each day, can make itemizing expenses less challenging. Chen holds a master’s degree in accounting and taxation from the University of Hartford.

The only time you will need to show the physical receipts for your taxes is if you are audited. In this situation, you will have to show a receipt for each write-off or forfeit the write-off and pay a penalty and interest. However, you do not have to turn in the receipts when you file your tax return, nor do you always need them to calculate your deductions. For example, you might have a business credit card that you only use for deductible business expenses, so you can just write off the amount you paid on that card. When organizing your receipts, especially as a business owner, the IRS recommends developing and maintaining a record-keeping system that clearly shows your income and expenses. It’s also a good idea to keep track of dates and receipts of amounts paid if you often donate money or pay expenses for your job and would like to claim itemized deductions for taxes.

- “You can send physical documents, you can take pictures of documents and put them into the uploader, you can send documents with your scanner and e-mail them—really anything.”

- In case you are audited or the IRS has any questions about items on your tax return, you will have the proof to back up your claim.

- For additional information, refer toRecordkeeping for Employersand Publication 15, Circular E Employers Tax Guide.

- For example, you might have a business credit card that you only use for deductible business expenses, so you can just write off the amount you paid on that card.

- A mileage log showing the dates of these trips and your starting and ending mileage for each trip will document this deduction.

- For receipt record keeping, the IRS concludes that you need a record and proof of payment.

Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%. You can also deduct the fees you incur to unload your home, any commission you paid to a real estate agent, and any fees you paid at closing, such as legal or escrow fees, as well as the costs of repairs or improvements. But these aren’t really tax deductions—they’re deducted from the sale price, which helps lower your gain and reduce your capital gains tax. Owning a home can give you hefty tax write-offs each year, including for points paid when you bought the home and possible deductions for mortgage interest. If your total itemized deductions under the new tax bill fall below the amounts listed above, you’re likely better off taking the standard deduction.

Credits & Deductions

Across America, 1099 contractors, freelancers, and small business owners everywhere continue to stuff their wallets & glove compartments faithfully with paper receipts. However, saving your paper receipts for taxes is a common mistake when it comes to personal or self employment taxes.

For the sake of stressed-out small business owners and freelancers everywhere, let’s put this misconception to rest. The easiest way for taxpayers to save receipts for taxes is to use a business expense tracking app that lets you automatically organize and store them online. If you opt for the standard deduction, retention of your receipts is not important for tax purposes. “However, by choosing the itemization route, the onus is on you, the taxpayer, to keep good records in order to prove, or substantiate, your expense as valid.” Whether you use old-fashioned manila filing folders, a flash drive or cloud storage, tax and personal finance authorities agree on the importance of saving tax documents and records. In addition to using the information for preparing your next income tax return, it may come in handy years from now. Sometimes your stock picks don’t pan out, or you loan money to your deadbeat brother-in-law who can’t pay you back.

Paper Receipts Vs Bank Statements

If that’s the case, you might be able to write off any your worthless securities or bad debts. But make sure you keep related records and documents for at least seven years. That’s how much time you have to claim a bad debt deduction or a loss from worthless securities. Depending on your situation, you could have hundreds of documents and receipts to report for tax purposes. The IRS says you can use any record keeping system you choose, as long as your income and expenses are clear, accurate, and include all necessary details.

Creditors, business lawyers, and insurance companies all sometimes require you to keep records longer than the IRS does. If you do end up going the paperless route, remember to keep a backup copy of your documents in a secure second location, like a password-protected hard drive, or a secondary cloud storage service. Bench—you can upload all your receipts and store them in the Bench app, with no storage limits. We recommend scanning every record and receipt in your business, tagging it with a descriptive name, and archiving it forever. Digitizing your records is also a great way to avoid accidentally tossing them in a move or an overzealous fit of spring cleaning. Plus, let’s not forget that paper records can fade, and are susceptible to damage. Telling the IRS that “the dog ate my tax records” simply won’t fly.

Start building good organization habits now, and don’t be afraid to check in with your tax preparer if you have specific questions about your business. They’ll appreciate that you’ll be prepared and have everything gathered and organized during tax season. According to the IRS, you need to keep your records for a minimum of three years. However, you may want to refer to this website as there are special circumstances that require you to keep records for a longer period of time. For example, if you underpaid your taxes by 25% or more, the IRS can go back as far as six years. Under new rules for 2018, certain types of deductions, nicknamed miscellaneous itemized deductions, are no longer available. In addition, the standard deduction amounts are rising to $12,000 for single taxpayers, $18,000 for heads of households and $24,000 for married couples filing jointly.

Under the TCJA, the 2%-of-AGI threshold no longer applies, but you can no longer deduct the following. For example, while travelling for medical care, you can only deduct up to $50 per person per night of lodging. There’s another often-overlooked benefit when you visit your doctor. The same goes for an RV or boat—check the registration paperwork to see if you are paying property taxes on those, too, and keep in mind the $10,000 cap on total SALT taxes. If your state calculates a percentage of the vehicle registration based on the value of your car, you can deduct that percentage as part of your personal property taxes. The deduction for private mortgage insurance premiums has been brought back through the 2020 tax year.

If you itemize deductions and you know you have to pay for work-related expenses, you should start saving those receipts. In case you are audited or the IRS has any questions about items on your tax return, you will have the proof to back up your claim. If you do not have this documentation, you will find yourself spending time and money trying to find the proof. Worse, if you are not able to come up with a receipt, your claim will not be honored and you may even have to pay additional taxes and penalties. Don’t forget to check your state’s tax record retention recommendations, too. The tax agency in your state might have more time to audit your state tax return than the IRS has to audit your federal return.

Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. The IRS allows you a deduction specifically for medical expenses but only for the portion of expenses that exceed 7.5% of your AGI. Thus, if your AGI is $50,000 in 2020, you can only deduct the portion of your medical expenses over $3,750. If your insurance company reimburses you for any part of your expenses, that amount cannot be deducted. Additionally, if insurance reimburses you in a future tax year for any portion of expenses claimed in the current year, you will need to add the reimbursement as income in the future year. You donated your skinny jeans and wagon-wheel coffee table to Goodwill which in turn reduced your taxes by increasing your charitable deductions.

The Art Of Keeping Receipts For Your Taxes

If you meet this description, you’ll want to save all sales receipts. The Internal Revenue Service allows you to deduct expenses that are ordinary and necessary for the operation of your business. However, if you are audited, you need to show receipts for these deductions.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. But if your tax professional or accountant is giving you trouble, get a new tax preparer or bookkeeper. When there’s no downside to being hyper-conservative, it’s no surprise that some accountants continue to insist on the record-keeping practices of the 1930s. Modern technology leaves behind enough digital breadcrumbs to constitute the proof you need. Calendar events, emails, or just giving the restaurant a call can all take the place of a paper receipt.

If your bank doesn’t have online banking, it’s best to hang on to bank records for three years. Even if you don’t need a document to do your taxes, you might need it for something else. Expenses that are less than $75 or that have to do with transportation, lodging or meal expenses might not require a receipt. But you still need to tell the IRS where and when the expense occurred, and what it was for.

Now that tax season is over, you can forget about taxes for a while! (Unless, of course, you got a filing extension.) But what should you do with all the forms, receipts, canceled checks and other records scattered across your desk?

Some cash purchases might not need receipts, as long as they’re “reasonable and ordinary.” This principle is called the “Cohan rule,” established in the famous Cohan vs. Commissioner Circuit Court of Appeals case. This means that for most goods under $75 count, you might not need a receipt. But if the IRS comes knocking at your door, you better pray that you did good record keeping. As odd as it sounds, nothing in their guidelines mentions needing paper receipts. For additional information, refer toRecordkeeping for Employersand Publication 15, Circular E Employers Tax Guide. If you deduct travel, entertainment, gift or transportation expenses, you must be able to prove certain elements of expenses.

To be eligible you and your spouse must both make an earned income, unless your spouse is a full-time student or disabled. Additionally, your dependent has to be under the age of 13, or disabled in some way. Health care premiums for dental, medical, vision, Medicare B or D that you did not pay for using pretax money. You should keep a detailed record of not only your business expenses but also your personal expenses.

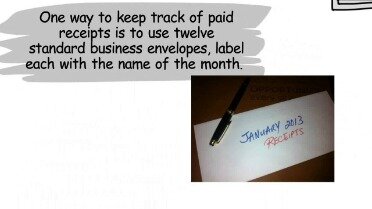

The key to success lies in commitment to a system that makes it more like a daily habit than a chore. You should keep a digital copy and a hard copy of all of your records. The two types of records you will need to keep are permanent records and short-term records. Instead of guessing, “I think I paid that contractor $1,000,” by quickly pulling up a spreadsheet, you will know you paid him $850 on July 17. “One of the key advantages of going digital is that your tax information is better protected from natural disasters,” says Dolmage.

If a receipt does not clearly show what you purchased or how it will be used for your business, note that on the receipt. For example, if you save the receipt for a business lunch, write down the name of the client and the purpose of the meeting.