Content

If you do choose to itemize, here are common deductions to consider. Through the end of 2018, alimony payments have been deductible by the payor, and taxable to the recipient. But for divorce decrees issued after December 31, 2018, alimony will neither be deductible by the payor, nor taxable to the recipient. This is scheduled to increase from $11.18 million in 2018 to $11.4 million in 2019. The annual gift exclusion will be $15,000, unchanged from 2018. But while you’re preparing your 2018 tax return in the spring of 2019, you should completely ignore the information in this article. The law also hits people with high mortgage debt a little harder.

Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. Here’s a quick look at some of our top-rated tax-software providers. We believe everyone should be able to make financial decisions with confidence. Remember, with TurboTax, we’ll ask you simple questions and fill out the right tax forms for you. Help us achieve our vision of a world where the tax code doesn’t stand in the way of success. Amir El-Sibaie is an Analyst with the Center for Federal Tax Policy at Tax Foundation.

You can figure out how much you would pay by following the same steps. Getting your max refund has never been easier with TurboTax®. States that have legalized marijuana use are already amassing huge tax revenues from its sales. Click to learn how you can cash-in from this enormous boom. All the changes should make us especially thankful for tax preparation software. The 2019 changes are really just slight adjustments from the major changes that are taking place in 2018. The main takeaway is to use this information to set your withholding tax, tax estimates, and tax planning in the right direction at the beginning of 2019.

Marginal Or Effective Income Tax Rate

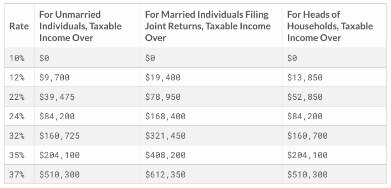

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. NerdWallet broke down the 2018 and 2019 federal income tax brackets. Below are the 2018 brackets, which relate to the tax return you’re filing in 2019. While the new law maintains the seven-bracket system, Congress tweaked the rates and income levels at which they apply. The seven tax brackets used to be 10 percent, 15 percent, 25 percent, 28 percent, 33 percent, 35 percent and 39.6 percent. Those are the brackets that applied to the tax return you filed in 2018.

- Here’s a guide to the 2019 U.S. tax brackets and how they are used to calculate your income tax.

- An individual income tax is levied on the wages, salaries, investments, or other forms of income an individual or household earns.

- The Alternative Minimum Tax exemption amount for tax year 2019 is $71,700 and begins to phase out at $510,300 ($111,700, for married couples filing jointly for whom the exemption begins to phase out at $1,020,600).

- , on the other hand, reduce how much of your income is subject to taxes.

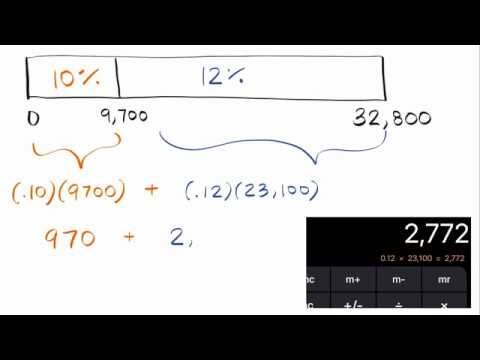

- Your income will first fall into the smallest bracket (10%) and that amount will be taxed that bracket’s rate.

- The lowest rate is 10 percent for incomes of single individuals with incomes of $9,700 or less ($19,400 for married couples filing jointly).

Individual tax provisions are set to expire after 2025, meaning that when you file your taxes in 2026, rates will go back to those before Trump’s 2018 changes. Lowered the threshold for qualified medical expenses – those that exceed 7.5% of your adjusted gross income can be deducted (in 2017, taxpayers under 65 could only deduct expenses that exceeded 10% of their AGI). But, if your total itemized deductions don’t exceed Trump’s higher standard deduction, you won’t be able to take it. A single person making $39,000 in taxable income in 2017 saw a rate of 25%. Only single people should use the single filing status. As mentioned earlier in this article, each filing status has a different tax bracket chart. Find yours below to figure out how much you’ll owe for the 2020 tax year.

Since $90,000 is in the 24% bracket for singles, would your tax bill simply be a flat 24% of $90,000 – or $21,600? That’s because, using marginal tax rates, only a portion of your income would be taxed at the 24% rate. The rest of it would be taxed at the 10%, 12%, and 22% rates. Note that these IRS income tax brackets only apply to federal taxes; check with your state to find out how your income is taxed locally. Federal income tax brackets and rates for 2019 are shown below. Indexing has increased the income brackets by roughly 2% across the board. While tax credits reduce your actual tax bill, tax deductions reduce the amount of your income that is taxable.

The lower rates apply to income in the corresponding brackets. So, a single person who made $100,000 in taxable income last year would fall into the 24% tax bracket. But instead of paying $24,000 to the federal government, the person would pay much less — $18,174.50.

Tax credits can save you more in taxes than deductions. The federal government gives tax credits for the cost of buying solar panels for your house and to offset the cost of adopting a child. There are education tax credits and tax credits for the cost of child care and dependent care, to name a few. Divide that by your earnings of $70,000 and you get an effective tax rate of 21 percent, which is lower than the 22 percent bracket you’re in. First, if you estimate your 2019 federal income tax and discover you’re not having your employer withhold enough tax for 2019, you have some time to adjust your withholdings to avoid a big tax bill come April 2020. If you get to Tax Day 2020 having underpaid your 2019 taxes by more than 10%, the IRS could hit you with an underpayment penalty.

Can You Claim The Home Office Deduction On Your 2020 Tax Return?

If you have enough deductions to exceed the standard deduction for your filing status, you can itemize those expenses to lower your taxable income. For example, if your medical expenses exceed 10 percent of your adjusted gross income in 2021, you can claim those and lower your taxable income. The standard deduction for married filing jointly rises to $24,400 for tax year 2019, up $400 from the prior year. To make estimating your taxes easier, here are the tax brackets, tax rates and additional tax for eachfiling statusfor 2019.

TurboTax will apply these rates as you complete your tax return. You can calculate your personal income tax rates with the efile.com RATEucator by Tax Year. When you prepare your tax return online with efile.com, we apply the correct tax rates and do all the math for you while guaranteeing 100% accuracy. For a more detailed estimate of your taxes, use the free income tax estimator and tax calculator. Unless a major overhaul of the U.S. tax code is passed, like in late 2017, the marginal tax rates don’t change from year to year. In other words, unless a new tax law is passed, you’ll still have seven tax brackets in 2020, with rates ranging from 10% to 37%, as you see in the table.

Tax Code Overhaul Changed Brackets, Deductions

Every dollar from $9,951 to $40,525 will be taxed at $995 (10% of $9,950) plus 12% within the bracket. This pattern continues as your income grows, adding the taxable amount within each bracket to the next highest threshold. However, the income ranges within the tax brackets are adjusted annually to keep up with inflation. For example, the 37% tax bracket will kick in at approximately the same level of purchasing power each year. If you’re a young adult paying taxes on your own for the first time this is especially important.

The answer to this question comes down to whether your stimulus check increases your “provisional income.” Please note that you should consult with a professional tax preparer for advice on whether you qualify for these based on your personal situation to avoid a potential IRS tax audit. These will differ depending on whether you’re self-employed or paid by an employer and also on whether you take the “standard deduction” or itemize.

However, for divorce decrees issued before January 1, 2019, alimony will remain tax deductible to the payor, and considered taxable income to the recipient. Due to the large increases in standard deductions, fewer people will itemize their deductions from 2018 on. But if you do, you’ll be able to itemize unreimbursed medical expenses that exceed 7.5% of your adjusted gross income .

Taxpayers will choose to itemize if that yields a larger tax deduction, or they’ll take the standard deduction if it does not. Instead, you can make sure that you’remaximizing the tax deductionsfor which you legally qualify and that you’re taking advantage of any tax credits you may have. Wondering how you can reduce the amount of income on which you pay taxes? Well, you can make less money, but that’s not typically a goal most people work toward. To do that, carry the total from the previous tax bracket and add it to the percentage you’re taxed in the next bracket, then carry that total over.

That’s a lot of money, but it’s still $35,573 less than if the 37% rate were applied as a flat rate on the entire $1 million (which would result in a $370,000 tax bill). I live in Florida and I am planning to retire next year ,my total income jointly with my wife will be around $78,000 a year. Do I have to file the income tax in the state of Florida or if we move to a state where the income tax bracket is lower will be okay. There are many parts of taxes that make it confusing, and tax brackets are no exception. The purpose of indexing is to eliminate what’s known as bracket creep.

However, you won’t pay 24% of your entire taxable income. Each marginal tax rate applies only to income within that range. Suppose you’re single and have $90,000 of taxable income in 2020.

2021 Federal Income Tax Brackets And Tax Rates

In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. If you’re wondering how the tax changes affect your specific tax situation, use SmartAsset’s income tax calculator to see what you can expect to pay under the new plan. You also got a tax cut if you were or are among the country’s highest earners.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax. The child tax credit totals at $2,000 per qualifying child and is not adjusted for inflation. However, the refundable portion of the Child Tax Credit, also known as the Additional Child Tax Credit, is adjusted for inflation.

He started at Tax Foundation as a Taxes and Growth Fellow in the summer of 2016. After previously working at various software companies, Amir uses his passion for technology and statistics to support the role of evidence-based policy in tax reform. As a 501 nonprofit, we depend on the generosity of individuals like you. Help us continue our work by making a tax-deductible gift today.

The amount of mortgage debt on which the interest is tax-deductible has been reduced from $1 million to $750,000. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. We are an independent, advertising-supported comparison service.

It provides a second set of tax rates that will be imposed if they exceed taxes as their taxable income is normally calculated. Indexing applies not only to tax brackets, but also to other relevant tax numbers, like the standard deduction and the alternative minimum tax . For example, if a particular tax bracket begins at a taxable income of $40,000 one year, that number will be increased to $40,800 for the following year. Percentages will be no better than approximate, since numbers will be rounded up in increments of $25, $50, or even $100. It all has to do with a provision in the tax code known as indexing. Each year, the IRS adjusts tax brackets to account for inflation. For example, if the inflation rate for the past year is 2%, the IRS will adjust all income brackets up by roughly 2%.

What Are The 2019 Tax Brackets?

That will work out well for singles and couples, but it will be a definite negative for anyone with dependents. As you probably know – or you’ll find out when you file your 2018 tax return – personal exemptions have been eliminated under the new tax law.