Content

This is an excellent option for someone who wants to have the highest level of tax preparation expertise but doesn’t want to pay the high cost of engaging a CPA to do the entire job. Just remember that, for TurboTax Live, you’ll pay about twice as much as you normally would for the software. If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industry’s deal with the IRS. If you made less than $66,000 last year, you should have been able to prepare and file your taxes for free with one of the companies participating in the IRS’ Free File program. But each company has its own distinct eligibility requirements. It’s not clear if the other companies would offer refunds.

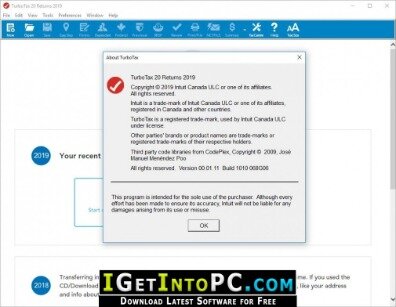

A banner running along the side keeps track of where you stand in the process and flags areas you still need to complete. This is the Deluxe version with added capability for reporting investments and rental income (Schedules D and E, and K-1s). Live, on-screen support option offers human help at extra cost. All third party trademarks, including logos and icons, referenced in this website, are the property of their respective owners. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services. I paid over $100 for direct deposit and did not get it, then they charged additional fees for for them not putting the money in my checking account.

Ready To Try Turbotax Free Edition?

You can also find all federal forms and state tax forms at the links below. Federal/State E-file can create some complexities when you have to pay both federal taxes and state taxes with your returns.

- In most cases, you can e-file — at least, for your federal return.

- This means that if you earn $100,000 in Pennsylvania, you only pay $3,070 in state income tax.

- TurboTax doesn’t have any physical locations like H&R Block, but it does provide access to tax experts .

- TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes.

- Residency is the location of your home where you intend to live when you return from a vacation or temporary business trip.

eFile.com will determine the correct type of state tax return for you to prepare. Find out more about resident, part-year resident, and nonresident state tax returns. Due to a recent policy change by tax authorities (not eFile.com and other online tax websites), you can only efile a state tax return with your federal tax return. If you have already e-filed or filed your federal return, you can still prepare your state return on eFile.com. You enter all your tax data but on checkout you don’t click to efile a Federal Tax Return. The eFile.com tax preparation app – start now – lets you prepare and download your state tax return.

Prepare, File One Or Multiple State Tax Return(s) Only

TurboTax Self-Employed is the top-of-the-line TurboTax edition. It’s designed for anyone who has income from self-employment, which makes it ideal for independent contractors and freelancers. The Premier option can help you with stocks, bonds, employee stock plans, and other investment income. Bitcoin and other cryptocurrencies are even covered in this software program.

When done, print all state income tax returns for one low price – not one price per state. Compare that to Turbotax® and H&R Block® who chargeup to $44.95 per state! eFile.com charges only $28.95 for ALL your state income tax returns.

Compare that to Turbotax® and H&R Block® – they charge close to $40.00 for PER state not all state returns. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. No matter how you file, you can choose to receive your refund several ways. Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between “support” and “defense.” With most providers, audit support (or “assistance”) typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

Our partners cannot pay us to guarantee favorable reviews of their products or services. TurboTax is so confident its software will prepare your return correctly that it’ll pay both the penalty and interest to the IRS or your state tax authority if the error is the result of their mistake. That kind of guarantee can give you a higher level of confidence in the product.

One standout feature for H&R Block is its physical stores. If you don’t want to file your return online, stop by one of its 10,000+ tax offices in the U.S.

Everything You Need To Get Your Taxes Done Right

If you do freelance work or own a small business, you’ll likely need to upgrade to the Self-Employed plan, which costs $84.99. These are the prices currently listed, all of which have already been slashed. H&R Block has provided consumer tax filing service since 1955.

The company calls the truly free version the Freedom Edition. When you file with TurboTax, we’ll ask you simple questions and determine which state tax payments may be deductible. We’ll walk you through, step by step, to help you get your biggest refund, guaranteed. For more information on this and other tax topics visit TurboTax.com.

For a limited time, when you refer a friend to TurboTax, you’ll get a $25 gift card to your choice of 30+ retailers when they complete their taxes. Meanwhile, your friend will get 20% off the edition they buy.

Ready To Try Turbotax?

The tax professionals there will be able to walk you through your filing. There’s also Tax Pro Review, a paid service where a tax professional will review your return for you before filing. Intuit and the Intuit Financial Freedom Foundation are proud to donate tax preparation services to the IRS Free File Program. Pricing for our online products starts with Free Edition, for simple tax returns, and goes up based on your needs and the complexity of your income tax return. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

You can also print copies for your records or save them to your computer for future use. First, it promises to get you the largest tax refund that’s legally possible. It also has an accuracy guarantee that can protect you in the event a mistake is made on your return. Even if you don’t know anything about income tax preparation, this sequence can easily guide you through the process.

Another important consideration is how easy it is to upload documents. H&R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you don’t waste time retyping everything.

Heres How Turbotax Just Tricked You Into Paying To File Your Taxes

And if you earn $1 million, you still only pay 3.07 percent or $30,700. So, it is often more important to show your intent to leave a state than it is to show your intent to become a resident in a new one. If you end up with both states wanting to claim taxes on your income, your evidence of intent will be crucial.

But, before you do, you should know that TurboTax offers a few very important guarantees. You might find that your deductions aren’t substantial enough to itemize, which has become fairly common since the Tax Cuts and Jobs Act raised the standard deduction. According to the Internal Revenue Service , the standard deduction for the 2020 tax year is $12,400 for singles, $18,650 for heads of household, and $24,800 for married couples.