Content

Dealing with taxes as a rideshare driver can seem intimidating, but it doesn’t have to be. Our previous surveys have shown that 54% of our readers “self-file” their rideshare taxes, and many of them use online filing services to do so. If you’re accepting ride-sharing fares more than occasionally, you may be required to file quarterly estimated income taxes. It’s up to you to take care of federal and state income taxes, as well as Social Security and Medicare. Combined, these taxes can easily reach 30% to 50% of your income, so make sure to set aside money to pay them.

Just by navigating to the “tax information” area of the Uber account and heeding the instructions, you will receive the lowest price for which you qualify. The Get It Back Campaign helps eligible workers claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income workers to tax benefits like the Earned Income Tax Credit , the Child Tax Credit , and Volunteer Income Tax Assistance .

How To Use Your Uber 1099s: Taxes For Uber Drivers

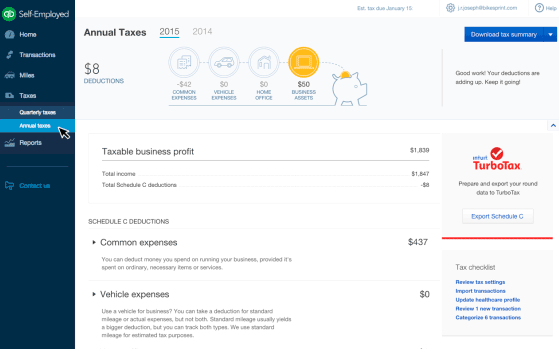

Their support allows us to spend time researching and building articles around rideshare expenses, taxes,how to deduct your miles, and monitoring the hidden costs of driving. I’ve also personally used TurboTax since I was 18, Harry uses Quickbooks to run his books and it’s a product that we both stand behind. To get you off to a good start with your business tax deductions, Uber provides you with a tax summary that breaks down the totals of both your 1099-K and 1099-NEC. You will most likely report the income from your 1099s on Schedule C, Profit or Loss from Business. Since Uber reports this income information directly to the IRS, you don’t have to include the actual 1099 forms with your tax return. Schedule C can also be used to list your business-related expenses.

I got my 1099 awhile ago, but the tax summary never showed up. The portion of your mobile phone expenses attributable to your ride-share work can be used to reduce your self-employment income. As of 2020, the rate is 57.5 cents per mile driven for business use. You can deduct the actual expenses of operating the vehicle, including gasoline, oil, insurance, car registration, repairs, maintenance, and depreciation or lease payments.

Tips To Save Money With Uber Turbotax Free Offer

Just be sure to file your return by midnight on March 31, 2021 to take advantage of this offer. If you’ve ever used TurboTax, then the ‘Self-Employed’ version is very similar, but it can also handle all of the business-related deductions that you will want to take from driving. Also, if you drive for multiple services, you’ll be able to input multiple 1099s. It can also handle all of your personal, property and investment-related taxes.

Carefully track your miles because the IRS requires a mileage log. Apps like Stride Tax and MileIQ ($5.99 billed monthly) can help make tracking easier.

You’ll report the income you earn as a rideshare driver on Schedule C, Profit or Loss from Business, which you’ll file along with Form 1040. It should be noted that Uber does not give tax filing advice, and that TurboTax is the source of any tips ultimately provided to participants. TurboTax can also provide assistance in how to make the most of available operational expense deductions for Uber drivers. Qualifying drivers may be able to secure the Self-Employed version of its software for free. In order to verify your own eligibility, log into your account and, again, hit the TurboTax link. Uber Turbotax Free can offer you many choices to save money thanks to10 active results. All information on this site is provided for educational purposes only and does not constitute legal or tax advice.

Get More With These Free Tax Calculators And Money

In tax year 2020, the IRS reintroduced Form 1099-NEC for reporting independent contractor income, otherwise known as nonemployee compensation. This article covers the 1099-MISC instructions to help you navigate this updated form. Intuit’s bread and butter is making complicated things simple to understand.

If you use the same vehicle for both your ridesharing business and your personal transportation, you must keep accurate records to separate the two uses. You’re allowed to deduct only the expenses that apply to the business use of your car. The IRS can disallow any business expenses you can’t support with mileage logs, receipts, or other documentation. The Uber tax summary of total online miles includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. When you subtract your business expenses from your income, you will enter the difference—known as the business income or loss—on line 3 of Schedule 1 for Form 1040. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

- Though you can maximize your savings by using the Uber TurboTax discount, there are additional routes through which you can obtain real savings without a service code.

- However, you can usually deduct the additional fees as business expenses, so you pay taxes only on what you earned.

- If you owe the IRS money at the end of filing your taxes, it’s not the end of the world.

- I was initially having issues getting the discount while using the chrome browser.

- As an Uber driver-partner, you’re an independent contractor, not an Uber employee.

- So if you drive for Uber or Lyft or deliver for Postmates or DoorDash, this is the product you may want to use.

It’s important to note that even if you drove part-time for Uber and have a normal job with a W-2, you will still need to use this version of TurboTax in order to file a Schedule C. This year, we’ve partnered with TurboTax and QuickBooks Self-Employed to walk you through the filing process. If you end up using our link, you’ll get a discount on whichever program you choose to use. This subreddit provides a place for Uber drivers to discuss their experiences and for riders to ask about what it’s like to drive for Uber. This subreddit has zero corporate influence from any outside entity.

Form 1099-K reports the total amount your passengers paid for the rides you provided. This includes all the money you collected from passengers, including the Uber commission and other fees. As a result, the amount shown on Box 1a of the form is greater than the amount you actually received. However, you can usually deduct the additional fees as business expenses, so you pay taxes only on what you earned.

I started driving for Uber and Lyft in 2015 and eventually quit my day job as an aerospace engineer to run The Rideshare Guy full time. These days, I’m a trusted media expert on all things rideshare and have a number of contributors across the country who are all driving for Uber and Lyft and other gig companies. Export all of your data to TurboTax next year for your business and mileage deductions. Once you e-file, it usually takes a week or so for you to get your refund after the IRS approves your return, and there shouldn’t be any fees added on. You probably tracked all of your mileage and expenses this year. The best version of TurboTax for rideshare drivers is TurboTax Self-Employed since it’s tailored towards independent contractors. So if you drive for Uber or Lyft or deliver for Postmates or DoorDash, this is the product you may want to use.

Once it did its scan, I was able to figure out how much I spent on my car for all of 2016 in about 30 minutes . If you didn’t keep any records than it may take a while to sort through every transaction, but it is worth doing to get higher deductions. I asked the agent what “miles” constitute deductible miles for an Uber driver, and they explained that as long as I was available to accept a ride, I could deduct my miles . This was a good answer, although it could have been a little more specific around miles between rides or when logged out of the app and re-positioning . Yet it was still accurate and they seemed to understand the nature of our business better than I expected.

Filing tax returns is always a daunting proposition even under the most conventional of circumstances. For Uber, Lyft, and other rideshare drivers, the task can be even more confusing given the maze of possible deductions and credits potentially available in a particular year. In addition, hiring a professional accountant to take a close look at a return is not something that many rideshare drivers can afford.

Drivers who earned at least $600 from non-driving activities in the past year. Even if you don’t receive the 1099-NEC, you’ll likely still have to file taxes. Drivers who earned at least $20k and had 200 total transactions from passengers in the past year. Even if you don’t receive the 1099-K, you’ll likely still have to file taxes. It includes a breakdown of the number of rides you’ve given, your gross earnings from rides, non-ride earnings , tolls, and mileage info.