Content

Tax filers who have not filed their taxes yet, should file with TurboTax today to get their maximum refund and ensure the IRS has their most current information, which the IRS will use to determine stimulus payments. There are as many as 10 million Americans who are not required to file a tax return. Because the IRS will use the federal tax return to determine eligibility and send individual stimulus payments, these individuals are at risk of not receiving their stimulus payment. Additionally, if you received too much stimulus based on your actual 2020 income you will not have to pay it back through a tax return in the upcoming filing season, just like the first stimulus payment.

The IRS advises people to keep an eye out for a plain, white envelope. That piece of mail that passes as junk at first glance may be the stimulus payment you’ve been waiting for. “According to the IRS, stimulus payments are expected to be deposited into bank accounts by the end of January. If you are a TurboTax customer in this group, we have sent you an email directly letting you know,” the company added. As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. Here are answers to some of the top questions you may have about the second stimulus checks.

Latest On Fox Business

Explore our picks of the best brokerage accounts for beginners for March 2021. We do receive compensation from some partners whose offers appear on this page. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Last week, several TurboTax users were reported to be having issues receiving their second stimulus checks. The IRS and Treasury Department expect to begin issuing stimulus checks in the second half of April.

As a part of theCoronavirus Response and Relief Supplemental Appropriations Actrecently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. “Taxpayers in this situation are urged to file electronically with direct deposit to ensure their tax refund – and their stimulus payment – reach them as soon as possible,” the IRS statement said.

An individual without children will not receive any payment if their AGI exceeds $87,000. The agency has yet to announce when taxpayers can begin filing their 2020 returns this year, but tax filing season for individuals typically begins in late January.

Turbotax Stimulus Update As Some Users Might Not Receive Irs Payment Until End Of January

“The IRS reassures taxpayers who do not recognize the bank account number displayed in the Get My Payment tool that deposits were not made to the wrong account; this is not an indicator of fraud. For those receiving their second stimulus payment by mail , “the IRS urges people to carefully watch their mail for either of these during January.” For your dependent to qualify to receive an additional economic impact payment, one of the requirements is that they must be under age 17 at the end of the taxable year. By law, unemployment compensation is considered taxable income and must be reported on your income tax return. Any special unemployment compensation authorized by the CARES Act is considered taxable income. I never received the first stimulus check and have yet to receive the second one.

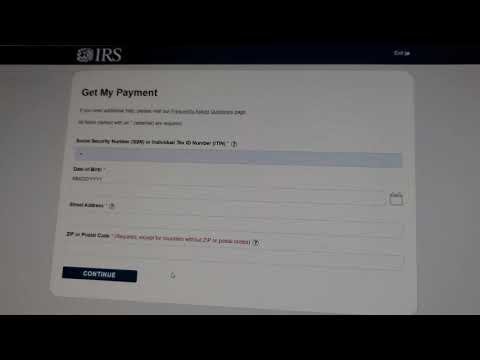

You will be able to check the status of your stimulus check at the IRS Get My Payment tool. I will be leaving your company after 8 years if you can’t make this right.

We have been working tirelessly on a solution with the Treasury and the IRS. As a result, our expectation now is that within days the error will be corrected and stimulus payments will begin being deposited into the correct bank accounts. “We have also re-confirmed with the IRS that they have all of the correct banking information for our customers.” Though, some H&R Block and TurboTax customers may have received this status and received their payments upon both tax companies fixing the IRS error, sending money to the correct bank accounts. “Your payment will be deposited into the same bank account that you received your 2019 tax refund.

H&R Block customers in the same position began receiving their stimulus payments last week. The status change may not be reflected in the Get My Payment tool right away, the company noted. “We have been working tirelessly with the Treasury and IRS to get stimulus payments to our customers,” said TurboTax in an update. “We know how important these funds are for so many Americans, and we regret that an IRS error caused a delay.” “Taxpayers in this situation are urged to file electronically with direct deposit to ensure their tax refund–and their stimulus payment–reach them as soon as possible,” the IRS said. Users who do not receive their full second stimulus payment or only receive a partial payment can claim a Recovery Rebate Credit on their 2020 tax returns.

Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. We know how important these funds are for so many Americans and that everyone is anxious to get their money. We are partnering with the IRS to help taxpayers receive their payments as quickly as possible. Ultimately, the IRS is the sole party with the ability to determine eligibility and distribute stimulus payments.

According to the IRS, “because of the speed at which the IRS issued this second round of payments, some payments may have been sent to an account that may be closed or no longer active. The second stimulus payments will be advance payments of the recovery rebate credit just like the first stimulus payments under the CARES Act. If you are eligible and do not get a payment or it is less than expected, you may be able to claim it on your 2020 tax return as theRecovery Rebate Credit.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). A family of four will not receive any payment if their AGI exceeds $198,000. A couple without children will not receive any payment if their AGI exceeds $174,000.

Documents Checklist

Regardless how good of a thing it is for customers, it’s hard to take anything out of that company as good news. Two banking industry sources confirmed the error, which will delay distribution of the badly needed aid.

If you didn’t receive the correct amount of stimulus payment, you can claim a Recovery Rebate Credit when you file your 2020 taxes. TurboTax will guide you through this to make sure you get every dollar you deserve. If your bank information is invalid or the bank account has been closed, the bank will reject the deposit and the IRS will mail your payment to the most recent address they have on file.

- However, not all customers who were affected by the IRS’ error have received payments, TurboTax told customers on Twitter.

- Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

- As a result, our expectation now is that within days the error will be corrected and stimulus payments will begin being deposited into the correct bank accounts.

- Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

- Customers of many tax preparation companies, including TurboTax, H&R Block, Jackson Hewitt and others, noticed earlier this week that their stimulus checks had been deposited into bank accounts they did not recognize.

- I received my first payment with no issues and now the IRS site says info not available.

However, not all customers who were affected by the IRS’ error have received payments, TurboTax told customers on Twitter. “We share the frustration of millions of Americans that an IRS error delayed the delivery of stimulus payments, ” a TurboTax spokesperson said.

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. If you have questions, you can connect live via one-way video to aTurboTax Live CPAor tax expert with an average 12 years of experience and get your tax questions answered. TurboTax Live CPAs and tax experts are available in English and Spanish, year round and can also review, sign, and file your tax return or you can fully hand over your taxes withTurboTax Live Full Service. We are a global financial platform company with products including TurboTax, QuickBooks, Mint and Turbo, designed to empower consumers, self-employed and small businesses to improve their financial lives. Our platform and products help customers get more money with the least amount of work, while giving them complete confidence in their actions and decisions. Our innovative ecosystem of financial management solutions serves approximately 50 million customers worldwide.

Tax-prep software giant TurboTax is telling customers that some people may not have received their stimulus payment because of an “IRS error” but that they expect the issue to be corrected “within days.” “The IRS determines where second stimulus payments were sent, and in some cases, money was sent to a different account than the first stimulus payment last spring,” Tweeted H&R Block, another tax preparation company helping to distribute payments.

The IRS has begun issuing stimulus payments using the most recent information they have on file, likely from your 2019 tax return, either by direct deposit or by check. Congress directed swift distribution of the stimulus payments through pandemic economic relief legislation enacted Dec. 27, and the money is supposed to be sent by Jan. 15. The IRS and Treasury Department issued a statement Dec. 29 indicating that the first payments were landing that night in taxpayers’ bank accounts. We have also re-confirmed with the IRS that they have all of the correct banking information.

The $600 checks hit many bank accounts within a week of Congress passing the $900 billion COVID relief deal, which the IRS said may have created a snafu for some filers. TurboTax confirmed to FOX Business that stimulus payments for millions of impacted customers began to be deposited on Jan 8. “We have successfully gotten stimulus payments to millions of TurboTax customers affected by the IRS error,” TurboTax said on Twitter. It’s in the best interest of tax preparation companies to maintain the confidence of their customers. That may be why they jumped on the problem once it was discovered and say they are working closely with the IRS to rectify the issue.

I received my first payment with no issues and now the IRS site says info not available. has COVID-19 specific guidance to help you with impacts that happened this year and through coronavirus relief. We’ll waive or refund standard replacement fees so there’s no cost to you. If you receive Supplemental Security Income you will automatically receive your stimulus payment with no further action needed.

Heres What You Need To Know About A Possible Third Stimulus Check

therefore stimulus payments will likely not include a payment for a child born in 2020. Therefore stimulus payments will likely not include a payment for a child born in 2020. will use the information it has on file to deliver stimulus checks, including if you registered using the IRS Enter Payment Information tool in 2020. H&R Block said earlier this week that the IRS determines where payments are sent and that it some cases, the $600 payments were sent to different accounts than the earlier round of stimulus payments were sent to in the spring.