Content

Not to worry, TurboTax will keep you up to date and provide you with the resources you need so you can have peace of mind. We know these are challenging times, but you are not in this alone. TurboTax is here to help you navigate the different coronavirus relief programs that you might be eligible for. Get up to date information, tax advice and tools to help you understand what coronavirus relief means to you empowering you to get more money in your pocket in this time of need. Easily keep track of your charitable donations all year. Then get the most deductions on your tax return. We’ve partnered with TurboTax to help make preparing and filing your taxes simpler and affordable.

TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work. TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

Comments that include profanity or abusive language will not be posted. The Families First Coronavirus Response First Act, provides relief in the form of refundable tax credits for sick leave and family leave for both eligible self-employed and small business owners.

Over 10 Million Federal And State Returns Filed This Year

When you join Patelco, you become both a member and an owner. A Patelco membership includes this credit union difference, plus benefits that are unique to our members. See how much you can save on your credit card or auto loan. And that’s why I use turbotax every year to be able to import all the data.

You acknowledge and agree that TaxSlayer and any of its website co-branding providers have no responsibility for the accuracy or availability of information provided by linked sites. Failure to Comply With Terms and Conditions and Termination.

- If you’re looking for a cheap option for tax preparation, you’ve probably considered Intuit’s TurboTax software.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Existing TaxSlayer customers can pull prior year tax information and compare this year’s tax return with last year’s tax return.

- By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

- There are two types of dividends – ordinary and qualified.

We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges. You are responsible for paying any additional tax owed. This option requires you to provide a valid phone number, email address and bank account information in your return. To use this option you must be filing a Federal return and receiving a refund from your federal return to cover the expenses listed above. For those who do not qualify the price to file a federal tax return is $17 and the state is $32. All prices here, and on all outward facing TaxSlayer.com sites, are subject to change at any time without notice. Price is determined at the time of print and/or e-file.

WECU’s website terms, privacy and security policies may differ from this site. Safe deposit boxes are a great way to keep your valuables and important information safe and accessible! We have seven convenient branch locations around Whatcom County. Feel safe and secure by shredding your sensitive documents at WECU’s bi-annual Shred Days. WECU members may bring two file-sized boxes or grocery bags of sensitive documents to shred. Join our community and gain a financial partner for life. AutoSMART™ is a great online resource that helps you take control of the car buying process, from start to finish.

Is Buying Turbotax’s Max Audit Protection Worth It? I Have Itemized Deductions But Nothing Complicated

Discount varies by rental date, location and vehicle type. In the US check your insurance and/or credit card for rental vehicle coverage. Renter must meet standard age, driver and credit requirements. 1.00% off current Patelco Credit Union rate with a max loan term of 60 months. Current rate will vary based on credit worthiness and terms.

TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise.

Leverage free tools such as calculators to figure out the different tax credits you may be eligible for. In response to coronavirus, the IRS announced several changes to the tax filing season. The recently passed CARES Act funded financial assistance for self-employed and small businesses experiencing economic hardships caused by coronavirus (COVID-19. Many small business owners and self-employed individuals have been affected by Coronavirus (COVID-19). Price does not include tax, title, tags, governmental fees, any emissions testing charges, and any finance charges . Unless otherwise stated separately in the vehicle details, price does not include processing, administrative, closing or similar fees of $149 or less. We make every effort to provide accurate information including but not limited to price, miles and vehicle options, but please verify with your local Enterprise Car Sales location before purchasing.

None of whom use turbotax or any other self help software. So at the end of the day, these softwares don’t even have to provide the service to 0.5% of the people who would get audited. Not really, just keep good records of what you’re deducting. So long as your position is reasonable, the worst that would happen in an audit is that the deduction is disallowed and you pay the back taxes due.

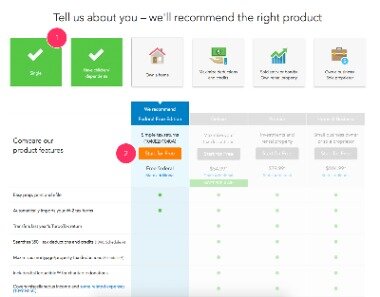

Do You Run A Business?

Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links.

Actual prices are determined at the time of print or e-file. Offer is subject to change or end without notice. If you get a larger refund or smaller tax amount due from another tax preparation engine with the same data, we will refund the applicable purchase price you paid to TaxSlayer.com. TaxSlayer.com’s “Free” products are excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

If you’re looking for a cheap option for tax preparation, you’ve probably considered Intuit’s TurboTax software. For years, I used TurboTax when I was working a corporate job at Northrop Grumman. It was easy to use, affordable, fast, and more importantly, accurate. We’ll add a bonus 5% when you put some of your federal refund on an Amazon.com e-gift card. Purchase just about anything from Amazon.com, including gift cards to restaurants, Southwest Airlines, and Starbucks. TaxSlayer guarantees 100% accurate calculations or we will reimburse you any federal and/or state penalties and interest charges. We guarantee you will receive the maximum refund you are entitled or we will refund you the applicable TaxSlayer purchase price paid.

The CD/download versions contain all the tax forms you need. TT Deluxe CD/download does have Schedule D and anything else you need for handling your investments.

It’s only meant for the simplest of tax situations. News, discussion, policy, and law relating to any tax – U.S. and International, Federal, State, or local. Even if you’re audited you can call turbo tax and speak to someone there and they can help guide you. Happened to me one year and I asked them how the calculation was on one line and they helped walk me through it.

You can save up to $100 when you file with TaxSlayer! You get all forms, all credits, and all deductions for less than The Other Guys. Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current. The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time.

You want all your tax documents on hand, in one place. Import your W-2s and PDFs from another online tax service or tax preparer. Existing TaxSlayer customers can pull prior year tax information and compare this year’s tax return with last year’s tax return.

Cost of filing state with complex federal return. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Get started with TurboTax Live and connect with tax experts on-demand for help and advice. At any time, you can hand off your taxes to a tax expert or CPA who’ll prepare, sign, and file your return for anadditional fee.