Content

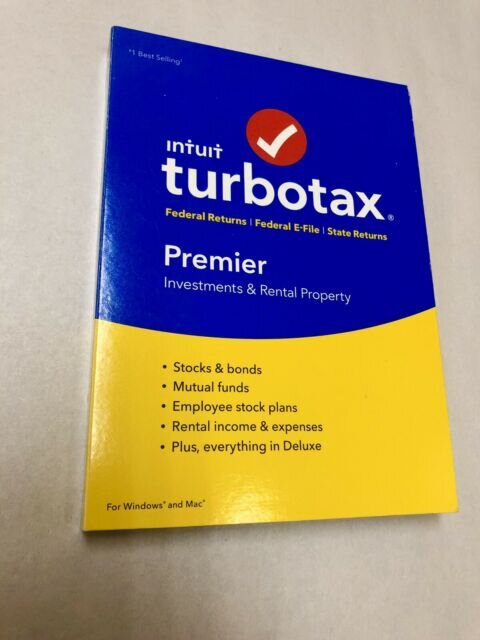

Accurately value items you donate to charity with ItsDeductible – no more guessing. Plus, TurboTax will track other donations such as cash, mileage and stocks, to help you get every tax deduction you’re entitled to for your charitable donations. This button opens a dialog that displays additional images for this product with the option to zoom in or out. TAXES DONE RIGHT – TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way. Designed for all levels of investing and investment types, from simple stocks to complex rental income.

- The addition of a Walmart Protection Plan adds extra protection from the date of purchase.

- One of the biggest pain points for investors is entering all of their reportable transactions into their tax return.

- Additional fees apply for e-filing state returns.

- Used to complete your taxes and provides help for investment sales, such as stocks, bonds, mutual funds and employee stock plans.

With TurboTax, you can rest assured that your taxes are done right, and you’ll get your maximum refund, guaranteed. We automatically save your progress as you go, so you can always pick up where you left off. If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). To file 2019 taxes, please select a TurboTax product.

Ready To Try Turbotax Premier?

Our innovative ecosystem of financial management solutions serves approximately 50 million customers worldwide, unleashing the power of many for the prosperity of one. Please visit us for the latest news and in-depth information about Intuit and its brands and find us on social. Finish your tax return in one visit or do a little at a time. TurboTax automatically saves your progress as you go, so you can always pick up where you left off. Once you complete your federal taxes, TurboTax can transfer your information over to your state return to help you finish quickly and easily. You won’t miss a thing, TurboTax will double-check your tax return for accuracy before you file.

Even if you choose not to have your activity tracked by third parties for advertising services, you will still see non-personalized ads on our site. Used to complete your taxes and provides help for investment sales, such as stocks, bonds, mutual funds and employee stock plans. The reviews quoted above reflect the most recent versions at the time of publication. The software is up to date on the latest tax laws and will double-check your work before e-filing it to the IRS and state agencies. TurboTax has your back every step of the way—and you can even call live representatives if you need a little extra coaching.

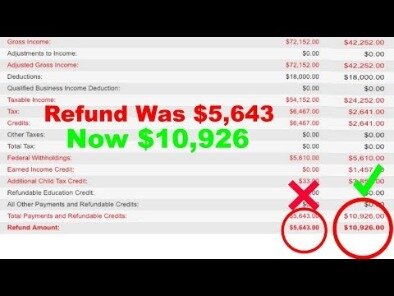

Get Your Maximum Tax Refund

Beyond the office, our wide selection of school supplies including backpacks, notebooks, pens and laptop computers to help your student excel. Office Depot and OfficeMax have a variety of school uniforms, teacher resources, the latest technology for laptop computers and notebooks, and school supply lists to keep your back to school shopping focused. Additional fees apply for e-filing state returns.

With our detailed guides and FAQs, it’s never been easier to do your taxes on your own. Get unlimited access to the helpful TurboTax community if you have questions about doing your taxes. We’ll show you who qualifies as your dependent, and find tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit , and child tax credit.

E-file fees do not apply to New York state returns. Prices subject to change without notice.

You can file taxes for a different year by selecting the year above. State and IRS Tax Refund & Stimulus Tracking Guide by Tina Orem Everything you need to track your stimulus check, federal tax refund and state tax refund — plus tips about timing. You have the option of paying for the software out of your refund. Other options include applying the refund to next year’s taxes and directing the IRS to buy U.S.

Save on printer ink and toner to keep your office efficient and productive. Utilize our custom online printing and IT services for small businesses to stand out from the competition through our Print & Copy services. Create promotional products, custom business cards, custom stampers, flyers and posters to strengthen your brand.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. If you sold stocks, bonds, mutual funds or options for an employee stock purchase plan in 2019, this is the TurboTax package you’ll want, too. Once you complete your federal taxes online, you can save your information to finish your state return quickly . We’ll automatically import your information from last year’s TurboTax return to help save time and increase accuracy. We’ll even import personal information about you and your family if you prepared your taxes with TaxAct or H&R Block CD/Download software. A direct deposit to a bank account is the fastest option.

New this year is TurboTax Full Service, which does away with tax software altogether. Instead, you upload your tax documents and a human puts together your tax return. You meet the tax preparer on a video call before they begin working, then you’ll meet again when your return is ready for review and filing.

Available Versions And List Prices

Copyright © 2021 by Office Depot, LLC. All rights reserved. All use of the site is subject to the Terms of Use. Prices and offers on may not apply to purchases made on business.officedepot.com. Maintain a well-stocked office breakroom.

Here’s a look at the various ways you can find answers and get guidance when filing your return with TurboTax. Embedded links throughout the process offer tips, explainers and other resources. And help buttons can connect you to the searchable knowledge base, on-screen help and more.

On here, the shorts are listed for $7.00 each. If they tags on them saying $5.96, I do expect to get a partial refund of $1.04 per pair as the price on the tag does need to be honored.

TurboTax imports electronic PDFs of tax returns from H&R Block, Credit Karma, Liberty Tax, TaxAct and TaxSlayer. This version lets you itemize and claim several other tax deductions and tax credits.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money. We believe everyone should be able to make financial decisions with confidence.

Prices range from $130 to $290 for federal returns, depending on complexity, plus $45 to $55 per state return. For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 1-3 of the 1040. Generally, it works only for people who don’t plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit. For those that don’t want to connect via one-way video, TurboTax Live Premier also gives taxpayers the ability to connect to their tax expert with chat and email. And TurboTax Live tax returns are backed by our 100% Accurate Expert Approved Guarantee. Yahoo Lifestyle is committed to finding you the best products at the best prices.

With the ability to import your investment and mortgage information, keeping tabs on your investment and rental income is easier. Get step-by-step guidance on how to file all kinds of investment income, including stocks, bonds, mutual funds, and rentals. For property owners, pensioners, and investments. TurboTax Premier is an efficient software program to self prepare returns.

With its intuitive design and experience and variety of support options, TurboTax is in many ways the standard for the do-it-yourself tax-prep industry. Its products come at a price, however, and similar offerings from competitors this year may provide a better value elsewhere. If you want someone to represent you in front of the IRS, you’ll need TurboTax’s audit defense product, called MAX.