We will not be your representative or provide legal advice. If you are not satisfied with how we responded to your inquiry, then you are entitled to a refund of the applicable purchase price paid by you for the federal and/or state TurboTax 2013 product you purchased. TurboTax Federal Free Edition customers are entitled to payment of $14.95 and a refund of your state purchase price paid. Claims must be submitted within sixty days of the date you received your audit guidance, but no later than June 17, 2017 .

To validate your claim, and as a precondition of refund payment, Intuit may require your TurboTax 2013 data file and/or other supporting information such as copies of your printed tax returns. Designed for taxpayers with simple tax returns (1040EZ/A), TurboTax SnapTax enables you to prepare and e-file your federal taxes on the go directly from your mobile device – free. And now, SnapTax is the first and only full tax preparation app that lets you file your taxes in English or Spanish from your mobile device. Audit Support Guarantee is applicable to Federal and State audit letters and/or notices.

With the free app, you can snap a picture of your return and file it (for $15). If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services.

Turbotax Snaptax

“I’ve come to call it the 95% rule” said Amir. “If you do anything really innovative, that means it is different. 95% of people will oppose anything really different.” Amir points out that this “95/5” dynamic is just a part of human nature, exemplified everywhere you look. “Sure we had early excitement, and at first we were only really sharing our progress with friends at Intuit and a small set of customers, so the reaction was positive, we were getting encouragement,” Amir said. As promising as the early testing had become, the team’s struggle to turn the technology into something that would help millions of customers had just begun. Carol and Amir put the phone with the prototyped “snap a W2” in the guy’s hands and he came alive.

- TurboTax has other free mobile apps that make it easy for taxpayers to estimate their federal refund, track their charitable contributions and track the status of their federal tax refund from the palm of their hand.

- • $0 Fed, $0 State, $0 to File with Free Edition for simple tax returns only.

- If you use SnapTax, you cannot have dependents or own a home or real estate.

- It does cost $24.99 to file, but you don’t pay until you’re done—which is good, because the app isn’t for everyone.

- The WIRED conversation illuminates how technology is changing every aspect of our lives—from culture to business, science to design.

Powered by OCR functionality from the ABBYY FlexiCapture Engine, the new app from TurboTax literally lets users file their taxes using their mobile phones – enabling them to get the job done in a couple of minutes. If you received an audit letter based on your 2013 TurboTax return and are not satisfied with how we responded to your inquiry, we’ll refund the applicable TurboTax federal 1040 and/or state purchase price you paid. TurboTax Federal Free Edition customers are entitled to payment of $14.99 and a refund of your state purchase price paid. ProSeries® andLacerte® are Intuit’s leading tax preparation offerings for professional accountants. The iPhone connects to the Internet via Wi-Fi as well as cellular data networks, enabling you to download the TurboTax SnapTax app, as well as file your taxes over the Internet.

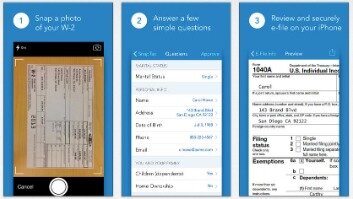

SnapTax uses optical character recognition technology to snap a photo of a W-2 and transfer data to the tax return. Answer some basic questions, check the return for accuracy and tap “File Now” when your ready to electronically file your return. There’s a running tally of the refund, or taxes owed, every step of the way. Your tax information is literally at your fingertips.

Audit Support Guarantee

We understand your time is valuable and appreciate your review of our response today. I hope that we will have the opportunity to regain your trust in the future. • Personalized home page – A single place to view your progress, track your return status, and get access to tax tip articles on life events, deductions, and much more. • TurboTax coaches you every step of the way and automatically verifies as you go, so you can be confident your taxes are done right. • Get your taxes done right anytime from anywhere. Seamlessly switch between your devices and securely pick up right where you left off when it’s convenient for you.

If you are filing the 1040 for federal there is no cost, but state filings will cost you $14.99. It does cost $24.99 to file, but you don’t pay until you’re done—which is good, because the app isn’t for everyone.

If you’re not wedded to using TurboTax, H&R Block’s 1040 EZ Tax App, available for both iPhone and Android, is the one for you. You’ll get the convenience of filing from your smartphone, plus the reassurance of knowing you’ll get free audit support and representation from an H&R Block agent. , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy. I understand this year did not go the way we had wanted.

Holding the real phone, running real code, was completely different for the customers,” Carol said. Carol found that Amir’s parallel technology investigation was going to be the critical path, because looking at the paper prototypes, people just didn’t believe the idea was possible. Test customers had not seen an application where a photo was instantly transformed into useable data.

To qualify, you must successfully e-file, print and mail your individual federal or state income tax return using TurboTax 2013. Send it to Intuit Inc., Returns Department, 112 Hidden Lake Circle, Duncan SC 29334. Please use a traceable mailing method and maintain copies of submitted items for your records. Claims of non-payment will require photocopy substantiation of all required items.

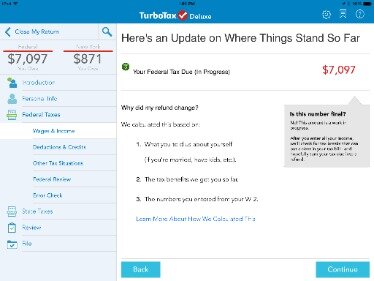

Turbotax Deluxe Vs Home & Business

His work has appeared in “The Los Angeles Times,” “Wired” and “S.F. Weekly.” Vandersteen has a Bachelor of Arts in journalism from San Francisco State University.

Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. After 20 days, comments are closed on posts. Intuit may, but has no obligation to, monitor comments.

Please allow up to 6 weeks for processing and delivery. If after 8 weeks you have not received your check, contact us.

Tax Laws On Unfiled Taxes

While the price increase may seem like a challenge, upgrading your TurboTax product ensures that our service is better suiting your needs. Our mission is to provide you with the accuracy you deserve for every tax season. We value your data & that is why I ask you to reach out to TurboTax support on Facebook, Twitter or email us here at regarding your receipt for this purchase. TurboTax used to cost $0 to maybe $40 a couple of years ago.

You simply download the app , snap a photo of your W-2, answer a few questions, and file from the app or online. The popular tax filing software company offers a full suite of apps to help you file, estimate your refund, and find out when you can expect to find that chunk of cash sitting in your bank account.

TurboTax is owned by Intuit, the same company that runs the very well-known finance app Mint. They are taking that knowledge of money and Android apps into their new SnapTax app that lets you file a 1040EZ in just minutes. All you have to do is fill out the form on paper and then snap a picture of it.

File 2020

Amir delivered a technology prototype three weeks later, and everything changed. As Amir tells us, “this was in the days before optical character recognition of forms on a smartphone was common place.