Content

In 2021, it had valued its value at more than $800 million. The company is listed on the Boston Stock Exchange and is one of the largest futures and options trading companies in the world. The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider.

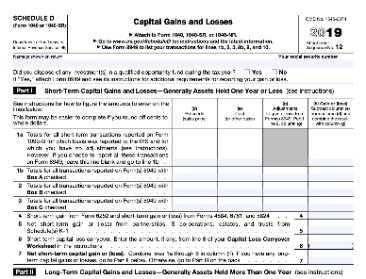

For your TurboTax tax return, you can upload a summary of your capital gains / losses. To get a summary capital gains file for TurboTax, contact our live chat support and ask for an aggregated TurboTax CSV. If you still need to get your crypto tax forms, you can use our cryptocurrency tax software to calculate your taxes and create your tax forms. Once you complete your federal taxes online, you can save your information to finish your state return quickly .

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The above steps outlined the process for reporting your cryptocurrency taxes within the online version of TurboTax. The desktop version of TurboTax doesn’t officially support crypto. For this reason, it’s recommend you use the online version for your crypto tax reporting.

It’s your responsibility to keep track of your transactions. You can do so by downloading your order or trading history from your exchange’s website as a CSV file. If you’re a frequent trader, you should be doing this at periodic intervals throughout the year, since your exchange may limit you to three months of data, for example. TurboTax is the only tax preparation website that walks you through the process of recording a cryptocurrency sale. This tax topic is not included in the Deluxe version, though. PCMag editors select and review products independently.

Latest Tax And Finance News And Tips

This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties.

- This form of money is still in its infancy, so don’t expect to use it for online shopping, though some vendors have started accepting it.

- If you didn’t select “I Sold or Traded Cryptocurrency” in the initial prompts as discussed in Step 3, you can add it in this Income & Expenses section by clicking “Add more income” on this screen.

- TurboTax officially announced that they are offering support for Bitcoin and cryptocurrency tax reporting as a result of their partnership with crypto tax software company, CryptoTrader.Tax.

- We outline that step-by-step process in this article here.

- While the IRS released its initial guidance in 2014, you still might wonder what is considered a taxable event and how you should report it in order to be in compliance.

It’s tax time and everyone will be busy consolidating their tax documents and filing taxes for the year 2018. Apart from consulting CPAs for complicated situations, almost everyone in the USA uses TurboTax. It has simplified accounting and tax returns so much that it’s almost a household for many Americans. CryptoTrader.Tax takes away the pain of preparing your bitcoin and crypto taxes. Simply connect your exchanges, import trades, and download your tax report in minutes.

The premier price is not worth it if I’m going to have to manually calculate all my crypto transactions as I can manually calculate them with other services for a lower cost. I think this is going to become a more prevalent issue in the next week or so as more people begin running their taxes as various institutions begin providing tax documents for their customers. @jcorraini Sometimes hidden formatting on a .csv file can create issues. As you may know, you can only enter 50 transactions manually, or you can import up to 2251 transactions. There are many services online that can help you aggregate your transactions and help you calculate your gains and losses. While the IRS released its initial guidance in 2014, you still might wonder what is considered a taxable event and how you should report it in order to be in compliance. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Turbotax Editors Picks

However, there still is a way to get your cryptocurrency tax information into the Desktop version of TurboTax. We outline that step-by-step process in this article here. Once you finish, click ‘complete’ and you will see a summary of your cryptocurrency transactions within TurboTax. Here at the bottom of the Income & Expenses section, select “Start” or “Edit/Add” cryptocurrency data. TurboTax needs the service name, asset name , purchase date, cost basis, sale date, and sale proceeds. You may have to contact your exchange if your CSV files’ labels don’t match those in TurboTax exactly.

Consolidating trades from various exchanges manually and reporting them as capital gains or losses on your TurboTax would be a tedious task. CryptoTrader.Tax calculates your tax liability using the same methods tax professionals use. Rest assured that you are paying the correct amount and minimizing your crypto tax liability. Review your transaction data and download your completed crypto tax report. CryptoTrader.Tax is the simplest and most reliable crypto tax software and calculator. You will now see a page where you can upload your crypto tax file. If TurboTax rejects your file for being above the 2251 transaction limit, see instructions below.

Customers Rate Turbotax 4 2 Out Of 5 Stars

You can now automatically import your crypto taxes into TurboTax. With TurboTax, you can rest assured that your taxes are done right, and you’ll get your maximum refund, guaranteed. A TurboTax Live Premier CPA or Enrolled Agent can also review, sign, and file your tax return. If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are also subject to the self-employment tax. Currently, TurboTax Online can only import up to 2,251 crypto transactions via its cryptocurrency import. PCMag, PCMag.com and PC Magazine are among the federally registered trademarks of Ziff Davis, LLC and may not be used by third parties without explicit permission. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag.

Now, you can upload up to 250 Coinbase transactions from Coinbase at once, through compatible .csv files to TurboTax Premier. And the uploaded .csv files will include the cost basis of your Coinbase transactions so TurboTax Premier can easily help you file your cryptocurrency transactions. From your tax report dashboard in CryptoTrader.Tax, download your “TurboTax Online” file. This file consists of your cryptocurrency gains and losses from your trading activity. If you haven’t already built out your gains, losses, and income tax reports within CryptoTrader.Tax, now is the time to do so. Simply create an account, connect your exchanges and wallets, and generate your necessary crypto tax reports with the click of a button.

No appointment necessary—work at your own pace, any time, on any device. We’ll calculate your gains or losses and make sure they are reported accurately.

Keep in mind, TurboTax will not congregate all of your crypto data for you. If you traded on multiple exchanges and had many transactions, you will need to build out your report and crypto tax profile with CryptoTrader.Tax. Head over to TurboTax and select either the premier or self-employed packages as these are the ones that come with the cryptocurrency feature. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. It is possible to include your crypto with your tax return via the TurboTax desktop / CD / downloaded edition. Note that the transaction limit in this case is higher than the their web version, at 3,000 transactions.

The third major advantage of using the platform of etoro for their investors is that it gives them access to all kinds of information about their chosen cryptosystems. This includes not just market information about the currencies being traded, but also information on trends in the market. They can also see what their competitors are doing in regard to their investments and make some good decisions themselves. There’s no need for them to spend time sifting through piles of data in order to find out what is happening in the market, since they can get all of it from the one place. Cryptocurrencies have been making buzz lately due to their predicted rise in value over the coming years. Many people have been investing in them due to their promise of significant profit. However, for those who are new to trading these cryptosystems, it can be quite difficult to determine the right time to buy or sell.

After importing your CSV, you should see all of your transactions appear within TurboTax. Keep in mind, TurboTax has a limit of 500 transactions being imported into the platform. If you have more than 500 transactions, you will not be able to upload your CSV. Please assess the issue rather than pointing your users to to documentations that no longer solves the issue. and update your coinbase csv parser codebase while your at it to support coinbase recently modified formatting. There is no longer a “gains/loss” calculator on Coinbase, unfortunately. Seems they are trying to get people to signup for the overpriced crypto tax website they partner with.

Cryptocurrency And Taxes: What You Need To Know

File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted. Then, easily track your tax return to see when your refund will hit your bank account. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. You should see all of your cryptocurrency gains and losses imported.

This will allow you to import just your summarized short and long term gain / loss to TurboTax. Only use this option if you are mailing in the complete 8949 separately with the Form 8453. TurboTax Premier is capable of handling over 1,500 transactions, so you’re covered no matter how much you trade. Designed for all levels of investing and investment types, from simple stocks to complex rental income. Some people “mine” Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger.

To alleviate this, most of this part has been automated by cryptocurrency tax software like BearTax. You can connect to most of the popular exchanges via their API or File Upload. If the exchange is not supported, their staff can get your transactions processed if you can email them on

The headers are creating an error because they are not what turbotax expects for the columns. This is going to be quite time consuming for quite a lot of people.

Only taxable transactions get imported from your CryptoTrader.Tax TurboTax Online file, so simply “Select All” on this step . After you enter this data and click Continue, a summary of the transaction will appear. You can either add more transactions or continue with the return if you’re finished. A final summary tells you whether it was a short-term or long-term gain or loss, and if the transaction will be reported on your tax return. First of all, let’s make sure we’re all on the same page when it comes to this new kind of money. Cryptocurrency units are referred to as coins, even though there’s no physical coin. You store coins in a digital wallet or use an exchange or brokerage.