Content

TurboTax Live Self-Employed CPAs and Enrolled Agents can search for industry specific tax deductions and credits you didn’t even know you were eligible for and they can also review, sign, and file your taxes. When you start a small business and you do not incorporate or form a partnership, you report the results of your operations on Schedule C and file it with your Form 1040. Have you started your own business, freelance, or work as an independent contractor? Then get ready to pay the self-employment tax, which is a tax you never had to pay as an employee. “I needed my tax return fast. And using TurboTax, I was able to get a larger refund than expected and faster than I thought possible.” Continue through the screens, entering the requested information.

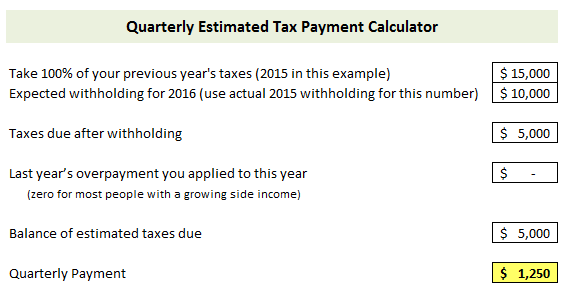

You must report all your sources of income to the IRS on your tax return, even if you don’t receive a 1099 form from your customers. If you were close in estimating what you would owe when you completed Form 1040-ES and made those quarterly payments on time, you shouldn’t owe the IRS much additional tax. If you find yourself in this situation, a good choice is to pay additional estimated taxes ahead of time, to avoid a nasty bill at tax time. However, this might limit the amount of money to use in your business until your tax return is due. Most people pay just over 100 percent of their prior-year income tax liability, as long as their business income doesn’t change dramatically.

Estimated Taxes: How To Determine What To Pay And When

You can request an extension electronically with TurboTax or mail Form 4868. So long as your withholding on any other W-2 income is sufficient to take care of the liability on that other W-2 income, my recommended percentages will suffice just fine. If you can’t get back into your return try this, On the Tax Timeline page you have to select Add A State to get back into your return.

- Missing quarterly deadlines, even by one day, can mean accruing penalties and interest.

- You can calculate it on IRS Schedule SE and include the form with your tax return.

- Then you would report one-half of your self-employment tax, $2,473, ($4,945 X .50) on Form 1040 as an adjustment to income, which reduces your Adjusted Gross Income and the amount of income tax you owe.

- If you just send in no less than 20% of your gross business earnings each quarter, you’ll find in the end that you may have actually overpaid, thus resulting in a refund.

- We’ll make it easy for you to figure out if you have to pay estimated taxes and if so, how much.

You can tell qb is the item is taxable or non taxable + the assets ? The IRS has specific mailing addresses based on the state where you live. Please be aware that your payments should be postmarked by the due date to avoid penalties. If you land a major contract that increases your income, it may be prudent to revisit the worksheet to ensure that you are paying the appropriate amounts. have multiple sources of income, we’ll help you get every deduction you qualify for. The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it.

Calculating Estimated Taxes

Not paying the 15.3 percent tax on $3,825 difference in this example saves you $585. When figuring self-employment tax you owe, you get to reduce self-employment income by half of the self-employment tax before applying the tax rate. Say, for example, that your net self-employment income is $50,000.

If you miss an estimated tax payment, make your payment as soon as you can. The penalties and interest the IRS charges depend on how much you owe and how late you are, but you can minimize the damage by making your payment as soon as possible. 2020 has been an eventful year for taxes, from extensions and exemptions to loans and stimulus checks. Wondering how all of those changes might affect your tax deadlines for the 2020 tax year, taxes you’ll file in 2021?

When it comes tax time, TurboTax will ask you simple questions and fill out all the right forms for you to maximize your tax deductions. There are ways to avoid a penalty even if you underpay your obligation. The government knows you can’t predict the future with absolute certainty, especially when you’re self-employed, so they give you some leeway. Then you would report one-half of your self-employment tax, $2,473, ($4,945 X .50) on Form 1040 as an adjustment to income, which reduces your Adjusted Gross Income and the amount of income tax you owe. But when figuring your self-employment tax on Schedule SE, Computation of Social Security Self-Employment Tax, the taxable amount is $46,175.

When Are Quarterly Estimated Taxes Due For 2021?

However, if you do not receive income evenly throughout the year, the required estimated tax payment for one or more periods may be less than the amount figured using the regular installment method. To prepare estimates for next year you start with your current return, You can just type W4 in the search box at the top of your return , click on Find. Then Click on Jump To and it will take you to the estimated tax payments section. Say no to changing your W-4 and the next screen will start the estimated taxes section.

So, if your income is concentrated, for example, in the fourth quarter of the year you may be able to use the annualized income method. TurboTax Self-Employed guides you through the annualized installment method at tax-time. TurboTax will ask you simple questions about your self employment income and fill out the right tax forms you. If you have worked as an employee, you know that what you get in your paycheck is usually less than what you really made.

If you overpaid for the 2020 tax year, there’s typically no penalty for filing your tax return late. With TurboTax Business you will prepare and file the 1065 partnership return. With that same program a K-1 will be issued to each owner of the business and each owner will need their own K-1 in order to complete their personal 1040 tax return. So you can’t even start the personal 1040 return until you have completed and filed the 1065 partnership return and all K-1’s have been issued. @CarlMy husband and one other person have recently formed a multi member LLC.

The potential penalties and interest of missed payments can be bad, but they are nothing compared to not preparing for a tax bill at the end of the year. Recalculate the estimated taxes at mid-year to see where you are. You have special criteria to meet, but you may end up paying less in estimated taxes. You’re considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing. Do you expect your federal income tax withholding to amount to at least 90 percent of the total tax that you will owe for this tax year? If so, then you’re in the clear, and you don’t need to make estimated tax payments. If you’re an employee, your employer withholds taxes from every paycheck and sends the money to the IRS, and probably to your state government as well.

Been self-employed myself for just over 12 years now, and love it. The TurboTax software does not handle quarterly tax payments at all. The program is designed and intended for the sole purpose of filing yearly tax returns, and that’s it. If you are an employee, your employer withholds income taxes from each paycheck based on a completed W-4 Form. Usually, that’s enough to take care of your income tax obligations.

How To Make The Correct Estimated Payments

For calendar year taxpayers , the due dates are April 15, June 15, September 15 of the current year and January 15 of the following year. Remember, with TurboTax, we’ll ask you simple questions about your income and expenses, and fill out the right tax forms for you to maximize your tax refund. Schedule C is used to calculate your business income for the portion of the year that you were self-employed—all the income your business took in, less business expenses. The resulting number is what you’ll use to calculate your self-employment tax on Schedule SE and what you’ll report on your Form 1040 as income. If your expenses were $5,000 or less, you can use Schedule C-EZ instead. The important thing is that you begin making quarterly payments as soon as you begin making money as a self-employed person. They’re due on April 15, June 15, September 15 of the current yearand January 15 of the following year.

You’ll need to estimate the amount you owe and make your payment by the April 15 tax filing deadline. Generally, you have three years from the tax return due date to claim a tax refund.

While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for. Always go back over your tax return to make sure you deducted every business expense you were entitled to. Look for differences between your estimated expenses at the time you completed Form 1040-ES and what they actually turned out to be. If you were wrong in your forecast for either income or expenses, you can adjust going forward into the new year. The most important detail to understand is how much and what type of income places you in the position of paying estimated taxes. Self-employed taxpayers normally must pay quarterly estimated taxes.