Get started with TurboTax Live and connect with tax experts on-demand for help and advice. At any time, you can hand off your taxes to a tax expert or CPA who’ll prepare, sign, and file your return for anadditional fee. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

TurboTax ItsDeductible lies within Business Tools, more precisely Finances. Also the program is known as “TurboTax ItsDeductible 2006”, “TurboTax ItsDeductible 2005”, “TurboTax ItsDeductible 2004”.

Itsdeductible

Unless his credit card bill is like $80,000+… your fella should have no problems paying it off. Neal, in my practice I try to keep people focused on the AFTER-tax interest that they pay. In Tom’s case, his car costs 5.82% after-tax, and the credit card 2.9% after-tax. I definitely think that Wendy made a great point regarding your friend’s fear about his discipline to pay off the card.

If you do not use TurboTax to prepare income taxes, you can use the figures on a printed report from TurboTax ItsDeductible. My advice is to lowball the estimate from the tax prep software on your tax return, and then if you are audited you can provide the printed estimate which will be higher. Chances are good that they will take your printed estimate at face value during the audit and you will wind up with a larger deduction. As long as everything else is on the up and up (meaning both trying to cheat the IRS which I doubt you’d do and not making mistakes which anyone can do) then you are in a win-win situation. In 1999, Gordon was working in a consulting company he founded with a group of partners. The company focused on industrial engineering and software development for its clients.

Our built-in antivirus checked this download and rated it as virus free. Our website provides a free download of TurboTax ItsDeductible 10.0.

Turbotax Guarantees

Plus, unlimited tax advice all year—Our tax experts are available on demand to answer your tax questions, year-round. I have a fair amount of faith in Intuit’s methodology. Basically the application uses historical ebay data to estimate the fair market value of your donations. Intuit believes that this is a valid approach that the IRS will look favorably on.

Although the company was doing well, the partners wanted to create a new product they could sell to the mass market, increase revenues and earn a continual profit. After an ideation and brainstorming session, the partners landed on a tax software product to service an estimated twenty million Americans. After a year of hard work and an initial angel investment, Income Dynamics, Inc. was formed under Gordon Whitten’s leadership as the co-founder and CEO. Its principal product, ItsDeductible software, is both a program and book allowing consumers to value household goods donated to charity according to IRS guidelines. Another benefit of the software is that it helps reduce your risk of an IRS audit. It accomplishes that by telling you if your total charitable deductions are in line with people in your tax bracket. It’s also pretty cool that you can update your donations anytime throughout the year.

Get a quick estimate of your 2015 federal tax refund anytime, anywhere on your phone via this free tax calculator. Find all deductions and credits you deserve to get biggest tax refund.

I slightly touched on this with my latest post regarding the homebuyer’s tax credit. In other words, don’t buy a house just to get a 10% return. Those words are so alluring and make us want to go out of our way for credits and deductions….but if we are spending more than we otherwise would to get them, then its not worth it. If I was in the 40% federal income tax range (no such thing btw as Federal is 35% top right now), I wouldn’t care about a lousy $10,000. I am really struggling to get back on Its Deductible that I created at the beginning of this week. I have a lot of inkind donations and I need the upgraded value of the items that I donated all during 2012.

Who Should Not Use itsdeductible

Terms and conditions, features, support, pricing, and service options subject to change without notice. I would like to purchase the “ItsDeductible” workbook for tax year 2010. I prefer the paperback edition rather than online products.

And of course I love the fact that you can upload your data right into your tax software. And the software tells you how much those tax deductions are worth, too. When you set it up, it asks you general questions about your income. As a result, it estimates what your marginal tax bracket is and can therefore calculate the total value of items you want to donate. “ItsDeductible” is an online software package that’s free and pretty useful. Tax deductions are great for everyone, especially if you are self-employed.

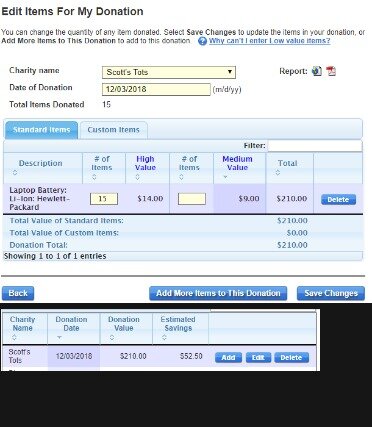

Once you are on the site, you create a list of charities that you donate to. If you don’t know the value of the items you donated, the site helps you find those values. The site keeps track of all the donations you made throughout the year. At tax time, you may be looking for help deducting your charitable contributions on your tax return in order to lower your taxable income and reduce your tax bill. TurboTax, a brand of tax preparation software, offers a tool called ItsDeductible that estimates the value of your noncash donations for you.

- It’s also pretty cool that you can update your donations anytime throughout the year.

- As a result, if you donate many items throughout the year, you’ll end up getting more deductions and saving more money by using ItsDeductible.

- According to the IRS, a charitable contribution is a voluntary gift made to a qualified organization, without anything of value expected in return.

- It’s also really useful to use this tool to look up the value of different items you donate.

- Those words are so alluring and make us want to go out of our way for credits and deductions….but if we are spending more than we otherwise would to get them, then its not worth it.

Try to create an account, fill in all of it, hit enter, gray screen and lock, 2 hours of aggravation and nada. I don’t know what they did this past year, but they ruined It’s Deductible. If you’re going to use a fire hose, make sure it works when there’s a fire. It you can’t logon to It’s Deductible at tax time, it’s broken.

Any chance the “it’s deductible” is an excuse for paying off the credit card bill, because he fears not having the discipline to pay off the credit card bill? He asked for an oppinion from a trusted professional, but still tried to rationalize past it. It usually comes up when someone who CAN’T afford to purchase a house tries to justify it by saying but it’s deductible! This also comes up when someone buys a “toy” just because they can claim it as a business expense. Used it for years, great way to org those sheets of 3 shirts, 2 shorts…until this year.

Therefore, you may want to save photos like these on your own to prove the condition of the goods. According to the IRS, a charitable contribution is a voluntary gift made to a qualified organization, without anything of value expected in return. If you’re not sure whether the organization you donated to is a qualified one, you can ask, or you can look it up using the Tax Exempt Organization Search tool on the IRS website. Your contributions generally can’t be more than 60% of your adjusted gross income , although exceptions may apply. ItsDeductible uses market data from online auction sites, including eBay, as well as thrift stores and resale shops to help estimate a dollar value for your donated item.

This compensation may impact how and where products appear on this site . These offers do not represent all deposit accounts available. It doesn’t get publicized much because audits are a pain in the butt process to go through, but you know that after the audit you will have everything correct.