Content

If you’re looking for an excuse not to e-file, it isn’t cost, because the IRS and states do not charge for e-filing. The only costs associated with e-filing are those charged by a tax preparer or tax software. Depending on the software brand and version, electronic filing charges have ranged from free to around $25. You can still pay with a check sent via snail mail if you prefer. As long as the check is in the mail by the due date of your return the payment is considered to be on time. Or you can advise the IRS to debit your checking or savings account for the amount due. No matter when you file your return, you can tell the IRS not to tap your account until the due date.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

Tou won’t get them back this year that early. Mine said it was accepted today(1/24), but the IRS was still not processing until 1/31. Yes I did mine on 24 and got accepted on 27th. But keep in mind that they only selected a certain amount for a test run. We still have to wait until 31 for processing like everybody else. Some of us will probably recieve ours a little earlier that’s all.

Completed taxes with TaxAct this year, no problems and only paid 14.99 for submission of state. Oh and my refund was like 4 dollars more, not a big deal but I will take it.

Before you can file electronically, you’ll need to get this update. To do this, go to the Online menu and select Check for Updates.

Only you would know if you filed with TurboTax or not. If you e-filed, you can check the status of your return. It would show whether your return was accepted, rejected, or no return filed. They may not reveal or discuss any information contained in your return unless you authorize them to do so.

I filed our taxes around the 15th of January of last year and had our taxes back the February 1. Last year I filed early and they told me that the IRS wouldn’t accept it til a certain date. It was accepted early and i had my return by the 10th of Feb. I am hoping this year will be the same. i used turbo tax also but not sure if i done it right it says i couldnt go any farther till i paid twevle dollars.

A third option is to charge the balance due to a credit card. This method will cost you extra money, though; you’ll have to pay a “convenience fee” of about 2 percent to the third party that handles the transaction. States are gradually adding these options. I thought I selected which verison I was using. I am using the Deluxe verison via downloading the TurboTax software. I was able to transmit my taxes, by uninstalling the software then reinstalling it.

- You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

- i used turbo tax also but not sure if i done it right it says i couldnt go any farther till i paid twevle dollars.

- Generally, yes, you can also e-file your state tax return along with your federal tax return.

- Last year the IRS started processing returns on the 30th of Janurary and I received mine on 2/2.

The update worked successfully, however still unable to Transmit State return. There is an update available for your version of TurboTax.

What all do we need to supply the tax preparer at time of filing for this year. I filed and received my return early last like in the first week of Feb. Turbo Tax Lisa, unfortunately there are a lot of other Turbo Tax users on this site that have already had their returns accepted this year making your statement false. I used to use TurboTax every year until this year. Seems they have an issue with auto upgrading your account to the basic and chage you at the end. Talk to customer rep, and she gave me a code to reduce the charges, but could not tell me why I was being charged in the first place. After a quick internet search This problem has not only effected me but ALOT of people complaining about auto upgrading this year.

How Will I Know That The Irs Has Received My Tax Return?

IRS will accept your tax return without a form w-2 on February 15, 2014. You will have to explain your efforts to obtain the w-2 and why you were unsuccessful.

Has anyone received a notice that this year taxes has been accepted and processed. I filed mine on the 17th and it says its pending. I know the IRS doesn’t open up until the 31st but last year mine was accepted early even though they wasn’t processing anything until the end of January. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Click here to read full Terms of Use. You can request a live CPA from turbo tax to help before take the initial steps of calling irs if you can have IRS send a letter so you show it to the turbo tax professional.

I Can’t Transmit My Returns

I ended up just transmitting my Federal. I will have to go back and try NY State again at a later time.

We apologize for any inconvenience this experience has caused and we are working diligently to help the returns get filed. On the below FAQ there is a link “here” that you can click on to receive an update once this has been corrected. Again, we apologize for any inconvenience this has caused. I live in Florida and we don’t have a state income tax. I am unable to file my federal return.

Turbotax Guarantees

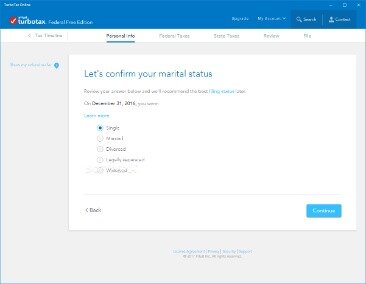

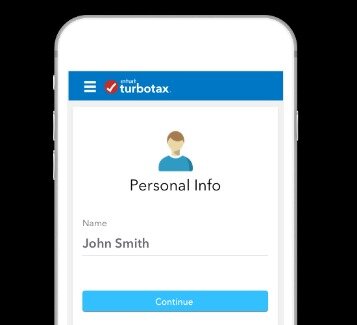

TurboTax, it’s easy to file your taxes. You don’t need to know anything about tax laws and tax forms. TurboTax asks simple questions about your life like, “Did you get married?

I was one of the ones they accepted early and got my refund on 2/2/13. I spoke with Turbo Tax earlier this week and was told the IRS will do some test batches and will be accepting a small amount of returns early this year.

If nothing there, you have not e-filed. TurboTax Live tax experts are available in Spanish and English, year-round and can even review, sign, and file your tax return.

This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. After 20 days, comments are closed on posts.

Search Turbotax Support

I did mines 2 days ago and it was accepted by the IRS already. Form 1099-NEC that now replaces Form 1099-Misc and reports your income. You will need to have that form in front of you when you file with TurboTax Self-Employed.

I’m trying to file for federal extension. At the end of the process, TT online button says “Transmit My Returns”. Does this lend any additional perspective to the potential solution? Do you recommend that I just send the MA state return via mail, or should I wait for a possible solution?

Unable To Transmit Return

Prior to becoming the TurboTax Blog Editor, she was a Technical Writer for the TurboTax Consumer Group and worked on a project to write new FAQs to help customers better understand tax laws. She could also be seen helping TurboTax customers with tax questions during Lifeline.