Content

This site is protected by reCAPTCHA and the Google Privacy Policy andTerms of Service apply. Help Mother Jones’ reporters dig deep with a tax-deductible donation. Today, reader support makes up about two-thirds of our budget, allows us to dig deep on stories that matter, and lets us keep our reporting free for everyone. If you value what you get from Mother Jones, please join us with a tax-deductible donation today so we can keep on doing the type of journalism 2021 demands. Intuit does not advertise its Free File offering on Google, according to SEMRush and Ahrefs. This information is shared with social media, sponsorship, analytics, and other vendors or service providers.

Using lobbying, the revolving door and “dark pattern” customer tricks, Intuit fended off the government’s attempts to make tax filing free and easy, and created its multi-billion-dollar franchise. If you’re republishing online, you must link to the URL of this story on propublica.org, include all of the links from our story, including our newsletter sign up language and link, and use our PixelPing tag.

Do I Qualify For Turbotax Freedom Edition?

Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.

See your Cardholder or Account Agreement for details. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc.

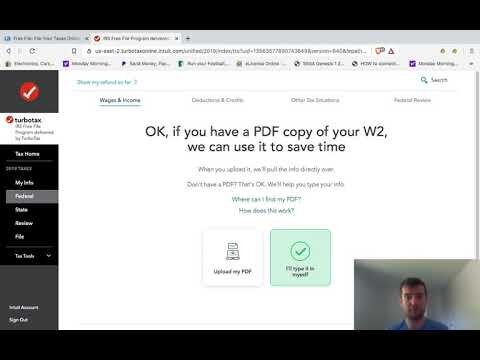

TurboTax also offers a Free Edition for anyone who is filing a simple return only. TurboTax Free Edition is free for people who are filing very simple returns only. When we clicked, and then clicked through to a second page, we found a whole new set of choices and restrictions. Each of the 12 companies that have signed on to the deal with the IRS offer their own Free File product. But they all have different requirements based on age, income and location.

What Is The Turbotax Free Edition?

Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. If you used IRS Free File last year, you may receive an email from the same company that you used, welcoming you back to their official IRS Free File services.

How Intuit Stopped Free File From Spreading

Intuit has given money to all of those groups over the years. All have signed letters urging Congress to make the Free File deal permanent. “The Free File program has been a clear success,” said one letter signed by The Latino Coalition and the Hispanic Leadership Fund. Again, Bernie McKay, the lobbyist who had joined Intuit in the late 1990s and outlasted multiple CEOs, led the company’s campaign. But TaxAct’s Free File gambit had forever transformed the industry. Advertising “free” was a great lure, so TaxAct took the battle to a different venue.

We took a close look at the source code of the TurboTax website and noticed something strange. Even though we clicked on the “FREE Guaranteed” option and met all the requirements to file for free, the company had tagged us as a potential paying customer. Sometimes outstanding debts will cause a refund adjustment. This can happen on the Federal and/or State refund. In either case a letter stating the reason for change will be sent to you from the taxing agency. The notification can show up after the refund. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit.

Intuit’s QuickBooks accounting product remains a steady moneymaker, but in the past two decades TurboTax, its tax preparation product, has driven the company’s steadily growing profits and made it a Wall Street phenom. When Smith took over in 2008, TurboTax was a market leader, but only a small portion of Americans filed their taxes online. By 2019, nearly 40% of U.S. taxpayers filed online and some 40 million of them did so with TurboTax, far more than with any other product. Intuit and other tax software companies have spent millions lobbying to make sure that the IRS doesn’t offer its own tax preparation and filing service. In exchange, the companies have entered into an agreement with the IRS to offer a “Free File” product to most Americans — but good luck finding it. Intuit and the Intuit Financial Freedom Foundation are proud to donate tax preparation services to the IRS Free File Program. “TurboTax Free File Program is geared towards lower-income filers, regardless of tax return complexity, and is only offered through the IRS Free File Alliance program,” the company’s website says.

You Are Leaving H&r Block® And Going To Another Website

“If this trend continued, the IRS was concerned that it could cause many vendors to go out of business,” he wrote. Stock market analysts, he pointed out, had said Free File “represented a threat to future revenues and profits of the publicly traded company participants.” The IRS decided to remove this threat. The first year of Free File was 2003, and for Intuit, things went well. On paper, the Free File Alliance was a collection of 17 companies, all of them vying to serve the American taxpayer.

- If users initially click on the Deluxe software, they are never offered the choice to go to the Free Edition even if the no-cost option would produce the same return.

- What if I receive another tax form after I’ve filed my return?

- She has held positions as a public auditor, controller, and operations manager.

- Advertising “free” was a great lure, so TaxAct took the battle to a different venue.

The company reported this year that TurboTax online had handled 32 million returns. In a statement, it said around a third of that number used Free Edition.

Turbotax Freedom Edition 2020 (2019 Tax Season)

The email should include a link to the company’s IRS Free File site and explain how to file with it. If you choose this email link and qualify, you will not be charged for preparation and e-filing of a federal tax return. Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Other parties’ trademarks or service marks are the property of their respective owners. IRS Free File Program powered by TurboTax supports most federal forms and state forms.

CAA service not available at all locations. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state.