Content

We will select the correct deduction for your tax situation based on your answers to some simple tax questions. For more information about additional standard deduction for any disabilities, see Exemptions, Standard Deduction, and Filing Information. Are legally blind, refer to Publication 501, Exemptions, Standard Deduction, and Filing InformationPDF. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Married couples who file jointly get to consider each partner’s eligibility in determining their increased standard deduction amount. An older husband and his older wife can claim a standard deduction of $13,600. As with the regular standard deduction, the exact amount of this elderly or blind standard deduction depends on your filing status. It could translate into a deduction hike of up to $4,400 for some filers. On those two longer tax return forms, you’ll find boxes to check if you or your spouse are older or visually impaired. Some older taxpayers may be able to cut their tax bills with very little work.

As with any taxpayer, the total of both types of medical expenses must be more than 7.5% of your adjusted gross income in 2020 before you can claim a deduction. Because a blind taxpayer gets an additional deduction in excess of the standard deduction, they must file using form 1040 or 1040 SR. It usually makes sense to figure your taxes both ways with each spouse itemizing and each spouse taking the standard deduction to find out which yields the best overall tax savings. The standard deduction you qualify for depends on your filing status, your age, and whether you’re blind. The numbers are adjusted each year to keep pace with inflation, and the TCJA virtually doubles them for each filing status, at least through 2025 when the law potentially expires.

What Tax Breaks Are Afforded To A Qualifying Widow?

You might want to prepare your return both ways—particularly if you think you have a lot of itemized deductions—to make sure that you’re getting the greatest deduction possible. The TCJA more or less doubled the standard deduction in 2018 and it simultaneously took away and modified some itemized deductions. The dependent deduction applies to anyone who is eligible to be someone’s dependent, not just those who are claimed on someone else’s taxes. The additional amount for people who are blind or 65 and older is $1,300 each for married taxpayers in 2020. This increases to $1,650 for unmarried taxpayers and heads of household. Medical Expenses If you itemize your deductions using Form 1040, Schedule A, you may be able to deduct medical expenses.See IRS Publication 502, Medical and Dental Expenses.

As a person with a disability, you may qualify for certain tax deductions, income exclusions, and credits. More detailed information may be found in the IRS publications referred to below. The law allows you to deduct what you spend to prevent, diagnose or treat illness, as well as any costs related to your blindness or visual impairment.

If you have a legally blind spouse or child, you can itemize the same deductions as you would if you were blind. Additionally, you have the right to deduct dependent care benefits from your income.

If you are legally blind, you may be entitled to a higher standard deduction on your tax return. The standard deduction amount depends on your filing status, whether you are 65 or older or blind, and whether an exemption can be claimed for you by another taxpayer. For details, see IRS Publication 501, Exemptions, Standard Deduction, and Filing Information. The Internal Revenue Service has special, higher standard-deduction amounts for taxpayers age 65 or older.

Department of Aging and Disability Services field offices are closed to the public as of March 18, 2020 as a protective measure for the safety of our staff and the public. Staff are working and the agency continues to provide needed core services. In the interest of the health and safety of our staff and those we serve, we may not be able to provide certain services that do not allow for appropriate social distancing at this time. For more information on available services, please use this website or call toll-free . Also, most of an individual’s Social Security disability benefits are not taxed. For more information, see Nolo’s article on the taxation of Social Security disability benefits. Bankrate.com is an independent, advertising-supported publisher and comparison service.

If you have to pay someone to care for a visually impaired dependent because he cannot care for himself, you might be able to deduct those costs. If the care is necessary so that you can hold down a job, you have the option of deducting them as medical expenses or dependent care expenses. However, spouses are not dependents in the eyes of the IRS, so care provided for your spouse can only be claimed as a medical expense. The Social Security Act of 1935 made a special provision for “Aid to the Blind,” the National Federation of the Blind was formed in 1940, and an influx of blind war veterans had heightened the concern.

Disability Tax Benefits

A person who is legally blind is eligible to receive a “Connecticut Identification Card,” similar to a photo operator’s license. Application should be made through the Department of Motor Vehicles, telephone . The accounts give disabled people the ability to save money to help pay for their expenses without jeopardizing their eligibility to receive government assistance. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

In addition, there is a similar break for the blind, regardless of age. Oftentimes people who are blind incur higher-than-usual costs for eye care, including surgical procedures, visits to specialists and eye medication. Medical expenses that are in excess of 7.5 percent of adjusted gross income are deductible, if the blind taxpayer itemizes deductions. For a blind person who makes $50,000 annually, medical expenses in excess of $3,750 are eligible to be deducted from their taxes. Braille reading material is also considered a medical expense for any amount that exceeds the cost of non-Braille reading material. You and your spouse must both take the standard deduction, or you must both itemize your deductions if you’re married but filing separate returns.

Age is not a factor in considering the extra deduction for blindness; young filers with this impairment are eligible for a larger standard deduction, too. A larger deduction amount also applies to older and blind taxpayers who are able to use head-of-household or married-filing-separately status. If you’re able to check one or both of these boxes, then ignore the standard deduction amounts shown on your return. Instead, head to the instruction book for Form 1040 or 1040A where you’ll find a worksheet to compute the larger amount you can subtract. You may require special equipment or accommodations as an employee or self-employed individual. The tax code allows you to subtract expenses for things you must have in order to work.

Eyeglasses and contacts are considered medical expenses, as are the soaking and wetting solutions needed for contacts. You can claim your transportation costs to receive medical care, such as taxi fares. If the visually impaired person is your dependent child, you can deduct the cost of sending him for special education, such as learning Braille, if his doctor recommends it. When Congress created a standard deduction to simplify filing in 1944, advocates worried that the blind would be at a disadvantage, since they could take their benefit only if they itemized their returns. Four years later, lawmakers made the benefit (which had been raised to $600) a tax exemption, available no matter how a blind person decided to file. When a legally blind person finds a job, she often requires tools to enable her to do her job. The IRS allows the cost of these tools to be deducted from tax returns.

You reach age 65 on the day before your 65th birthday, according to IRS rules. Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university, and prior to her accounting career, she spent 18 years in newspaper advertising. Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books.

Personal And Sales Taxes

Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Doreen Martel is a writer specializing in finance, nonprofit organizations and real estate. She has worked in the financial industry for more than 20 years. Martel is a graduate of Dean College in Franklin, Mass., holding a certificate in accounting. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX.

You can’t mix-and-match with one spouse itemizing and the other taking the standard deduction. Many taxpayers have found that the standard deduction amounts offers a bigger deduction than all their itemized deductions combined. In 2019, The Tax Foundation estimated that only about 13.7% of taxpayers would itemize their taxes during their 2020 filing. Claiming the standard deduction is much easier than itemizing; it’s just a matter of filling a predetermined deduction amount.

Generally, you can only take advantage of the breaks for expenses for yourself, your spouse and your dependents. Bills for which you received reimbursement or that you paid with pre-tax dollars, such as from a flexible spending account, shouldn’t be claimed. That would be double-dipping, and the IRS has rules against that.

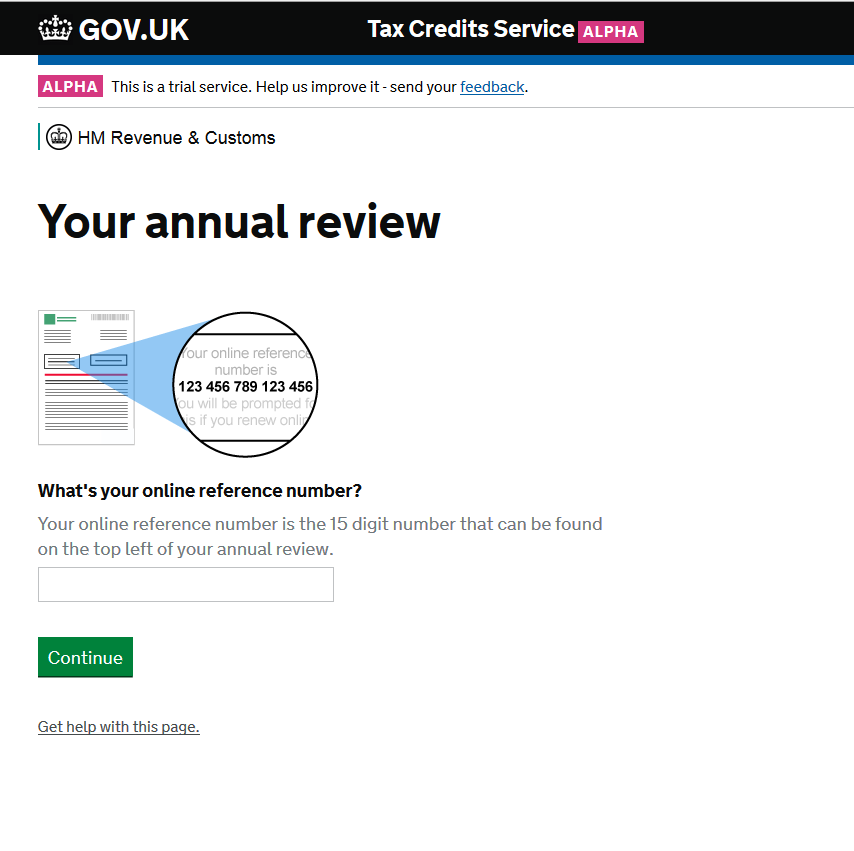

You can e-File 2020 Tax Returns until Oct. 15, 2021, but late filing or late tax payment penalties might apply if you owe taxes. Below, find standard deductions organized by tax return filing status, age, and an extra deduction amount if the taxpayer is legally blind. Taxpayers who can be claimed as dependents on someone else’s tax return have variable standard deduction amounts. As of the 2019 tax year, your standard deduction is limited to either $1,100 or your earned income plus $350, whichever is more.

Alternatively, you can add up everything you spent on qualifying tax-deductible expenses over the year, such as medical expenses and charitable giving, then subtract the total from your income instead. Taxpayers with disabilities and parents of children with disabilities may qualify for a number of IRS tax credits and benefits. Listed below are seven tax credits and other benefits which are available if you or someone else listed on your federal tax return is disabled. The IRS regulations include a variety of possible deductions for the visually impaired under the category of medical expenses. Magazines and books in Braille are partially deductible; you can claim the difference in cost between Braille reading materials and the same editions printed in standard format.

Even if your income is low enough to put you in the “doesn’t have to file” category, you may want to consider your eligibility for the Earned Income Tax Credit, or EITC. Regardless of whether you had federal tax withheld or don’t owe any federal tax, you can get a hefty refund in the form of EITC if you qualify. How much you receive varies according to income, filing status and number of child dependents. Box 12 on the 1040 tax-return form is where blind filers can claim unique deductions. This translates into a larger tax break, allowing you to subtract a bigger standard tax deduction from your adjusted gross income. A blind taxpayer is any individual in the U.S. whose lack of vision qualifies them for a special tax deduction accorded to blind persons. Blind taxpayers get the same standard deductions as taxpayers over age 65.

- Regardless of whether you had federal tax withheld or don’t owe any federal tax, you can get a hefty refund in the form of EITC if you qualify.

- For a blind person who makes $50,000 annually, medical expenses in excess of $3,750 are eligible to be deducted from their taxes.

- A Certificate of Legal Blindness from the Bureau of Education and Services for the Blind can be used as proof of blindness.

- The EITC is a tax credit that not only reduces a taxpayer’s tax liability but may also result in a refund.

- Have a physical or mental disability that limits your employment, refer to Publication 529, Miscellaneous Deductions.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

If vision in the better eye is less than 20/200 with contacts or glasses, or if the field of vision doesn’t exceed 20 degrees, the IRS considers the person legally blind. If the only way to correct your vision to exceed 20/200 or 20 degrees is contacts, but you can’t wear them for more than a brief time due to ulcers, infection or pain, you still qualify. The only catch is that you must ask your optometrist or ophthalmologist for a certified statement of your limitations; the statement should also indicate whether your vision is expected to improve. In 2011, the difference was $1,150 for couples filing a joint return if one spouse qualified and $2,300 if both spouses qualified.

Legally blind taxpayers may get relief on tools to enable them to work. You can calculate and estimate back taxes with the eFile.com 2017 Tax Calculators. Then, complete, sign, and print the tax forms here on eFile.com. As Qualifying Widow it increases by $1,350 if you are 65 or older. As Qualifying Widow, it increases by $1,300 if you are 65 or older.