Over the years, houses tend to increase in value due to appreciation, so carrying the property at the purchase price understates the true amount of owner’s equity. Reports created from a real estate bookkeeping system can also be generated based on a specific date range, such as monthly, year-end, or trailing 12 months. By taking the time to understand and manage cash flow, businesses and individuals can maintain financial stability, reduce the risk of financial problems, and support long-term growth and success. This article covers Wisconsin’s security deposit laws, including timelines for returning deposits, legal reasons for deductions, and documentation requirements. You’ll learn about the rights and responsibilities of both landlords and tenants, as well as steps to take if disputes arise over deposits. With everything in one place, you’ll stay organized and will no longer have to track down a year’s worth of transactions come tax season.

Learn your tax obligations

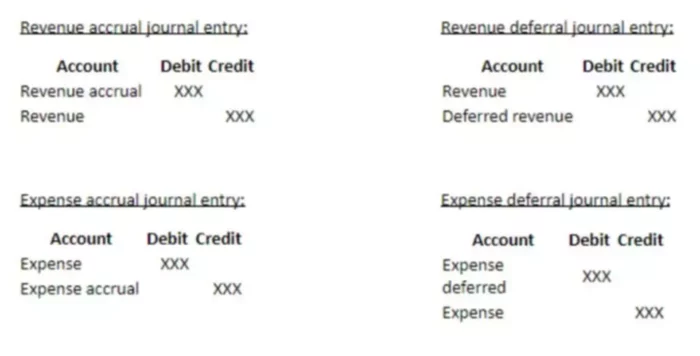

Visit a business banker at your local bank to set up a checking account for each rental property. You can also create a property savings account to keep CapEx funds in. Accrual accounting reports income when the receivable invoice is generated (even if payment hasn’t been received) and expenses when the cost is incurred (but not yet paid for). For one, you could end up owing taxes on income that you never actually received.

How do I keep track of rental property expenses?

While it may be tempting to have all your rental income deposited into your personal banking account, it’s important to create a separate bank account for your rental properties. This keeps your rental income separate from your personal funds and may even be required by local landlord-tenant laws. You can create a new checking account (or business account if you have an LLC) to have all your rental income deposited and to use to cover operating expenses. Real estate bookkeeping usually isn’t the first thing investors think of when investing in property, but it’s an important part of owning and managing rental property. With good bookkeeping, an investor can better identify opportunities to increase rental income, reduce expenses without affecting property value, and better track owner’s equity.

Reconcile monthly and report at year-end

Since most rental income and expenses are predictable and repetitive, you shouldn’t have to manually tag the same types of transactions over and over. Set up rules to automatically tag transactions by category and assign them to properties. Use Azibo’s bulk editor, transaction splitting, and other helpful tools to tag a single or multiple transactions as a specific income or expense category. This saves you hours each month and ensures the most up-to-date reporting with the least amount of work. Understanding the basics of how rental property accounting works is important, even when you use an online financial reporting system to sync income and expenses. Create a bank account for each individual rental property, along with a debit card or credit card.

- Finally, having separate accounts simplifies rental property accounting.

- Rental property bookkeeping is essential to ensure you’re maximizing your profits and minimizing your tax liabilities.

- Basically, accrual doesn’t track cash flow but records accounts receivables and accounts payable.

- Stessa helps both novice and sophisticated investors make informed decisions about their property portfolio.

- In both of these examples you have a reported net income of $500, but your actual cash flow for the month is different.

- One of the best ways to save money with efficient bookkeeping is to track deductible expenses, including valuable landlord tax deductions.

Steps to Understanding 1031 Exchange Rules

There are certain laws and regulations that landlords must follow, so it’s important to be familiar with them. When it comes to rental expenses, there are a few different ways you can categorize them. Learn everything you need to know about choosing the right accounting tool, from spreadsheets to software. Certainly not the most exciting topic, a good part of sound accounting is simply the act of being well-organized. Access Xero features for 30 days, then decide which plan best suits your business.

All-in-one rental finances

This makes it easier to track transactions by property and avoids the risk of commingling your personal expenses with your business expenses. This includes both financial records and any other important documents related to your rental property. Good records will help you keep track of your income and expenses, and they can also be helpful if you ever need to resolve a dispute.

Keeping accurate records of expenses provides valuable insights into the financial performance of your rental properties. This information can help you make informed decisions about the future, such as whether to sell a property or make improvements to increase rental income. If you collect rent online with Azibo, you can export your latest rent roll in seconds. In addition to rent totals, Azibo rent rolls include key information like owner’s name, address, unit type, number of bedrooms and bathrooms, square footage, and lease start and end dates. In one report, Azibo allows you to assess your rental units’ monthly performance and your tenants’ ability to pay rent on time.

Along with accounting, Azibo offers free solutions for rent collection, banking, insurance, loans, and other property management tools. Azibo also does reconciliations, saving you time and eliminating human errors. These days, property owners, real estate investors, and property management firms can find great accounting software. These apps offer excellent accounting features, track key metrics and capital appreciation, and maintain a general ledger. Some of the best property management software include FreshBooks, Buildium, Sage, and Property Matrix.

Investing in high-quality property management accounting software is the answer that comes to mind. The cash method of accounting reports income at the time it is received and bills at the time they are paid. For example, if you deposit $2,000 in rent on June 1st and pay $1,500 in bills in the month of June, using cash accounting you have a profit of $500 for the month of June.

For example, replacing appliances, painting, hot water system replacement, and pest treatment are all expenses that can occur at any time. The golden rule of rental property accounting is to report all of your income and expenses as much as you (legally) can. Before you can do this, it’s important to understand the different types of expenses and income in a rental property. Easy-to-use, free online rental property software from Stessa simplifies the process of tracking income and expenses so that you can run financial reports with a single click. This can be as simple as keeping a separate bank account for your rental property or using accounting software. There are so many tools out there that can help you be better at rental property accounting.

For example, if you use a rental listing website to advertise and lease your property, that expense could be treated as an advertising or professional fee expense. Check with your accountant for the best practice, then be consistent with how you treat the expense each year you file Schedule E on your 1040 tax return. That amount is deducted from the security deposit, credited as income received, then expensed to pay for the carpet damage.

Landlords might pay for several functions they don’t need and miss out on more specific features that a specialized platform like Stessa provides. Learning your tax obligations is an important step in managing your finances and staying compliant with tax laws. Understanding the basics of rental property bookkeeping is essential for ensuring the financial success of your rental business. Using the accrual accounting method, you’ll record it as 1 payment per month in the next 6 months. Basically, accrual doesn’t track cash flow but records accounts receivables and accounts payable.

It’s a list of all the company’s accounts in one place, just like a tax deductions cheat sheet for property management. The more detailed your chart is, the better ‘cheat sheet’ you’ll have. Cash basis accounting allows you to record earnings on the income statement when the money arrives. An even better option is to digitize your bookkeeping by using a system such as Stessa. You can use Stessa to connect accounts quickly and securely so that income and expenses are automatically synced to your performance dashboard.