Understanding these tax obligations is essential for maintaining financial health and avoiding legal pitfalls. The total amount of currency exchanged by customers into casino chips or tokens is termed the “drop”. Cash intake at the drop phase does not constitute revenue or profit. The drop total is a good metric to gauge overall casino customer traffic. First of all, casinos only buy chips from reputable suppliers that maintain tight control over their inventories.

Casino Accounting and Financial Management

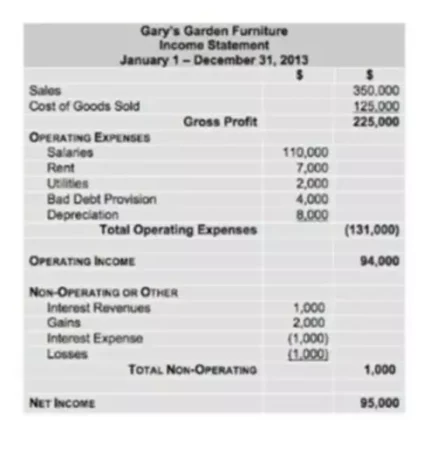

There is also abundant information about new managerial accounting methods for casinos, as well as information about variations in state laws that govern the casino industry. This updated and greatly expanded edition of Casino Accounting and Financial Management will remain the indispensable authority on gaming operations in the twenty-first century. It belongs on the desk of every casino manager and gaming financial professional in the industry. The audit process also involves a detailed review of the casino’s financial statements, including the balance sheet, income statement, and cash flow statement. Auditors use various techniques, such as analytical procedures and substantive testing, to verify the accuracy of reported figures.

- I’ve just described maybe one or two percent of the controls used in a casino.

- Casinos typically offer a wide range of entertainment and dining options, as well as accommodations, to attract and retain customers.

- And finally, when chips are worn out, a specialist chip destruction firm is called in, which grinds up the chips while being watched by security.

- A traditional slot machine accepts coins, which first fall into a hopper, which holds a certain amount of coins that are used to pay out jackpots.

- The Internal Revenue Service (IRS) requires casinos to report all income, including non-gaming revenue, and to comply with federal tax laws.

- Data that breaks out the handle derived from slot machines versus table games such as blackjack can prove valuable when making strategic casino management decisions.

Casino Accounting Procedures

Another important element is the disclosure of financial risks and uncertainties. Casinos operate in a highly volatile environment, subject to fluctuations in gaming revenue, regulatory changes, and economic conditions. This transparency is crucial for informed decision-making by investors and other stakeholders.

Auditing Casino Financial Statements

Project MUSE promotes the creation and dissemination of essential humanities and social science resources through collaboration with libraries, publishers, and scholars worldwide. Forged from a partnership between a university press and a library, Project MUSE is a trusted part of the academic and scholarly community it serves.

Auditing casino financial statements is a meticulous process that ensures the accuracy and integrity of financial reporting. Given the complexity and high stakes involved, external auditors play a crucial role in verifying that the casino’s financial records are free from material misstatements. This process involves a thorough examination of the casino’s internal controls, revenue streams, and compliance with financial reporting standards. The handle is the total amount of wagers made by the casino’s customers. Retain statistics showing how the handle is allocated between the various gaming activities offered by the casino. Data that breaks out the handle derived from slot machines versus table games such as blackjack can prove valuable when making strategic casino management decisions.

Otherwise, chips could be stolen at the supplier and presented at the casino for payment. Once chips arrive at the receiving dock, the security team takes over and matches them against the shipping documents to make sure than none have been stolen in transit. And finally, when chips are worn out, a specialist chip destruction firm is called in, which grinds up the chips while being watched by security. This might all seem like overkill, but keep in mind that chips are directly convertible into cash, so the controls over the chips need to be as comprehensive as the controls over cash. These risks should be carefully evaluated and addressed during the audit to ensure the accuracy and reliability of the financial statements.

When the beginning and ending chip inventories are taken into account, along with all of the transactions in between, the difference is the gross gaming revenue for the table. Delivers “how-to” strategies for handling audit and accounting issues common to entities in the gaming industry. Casinos also face property taxes on their physical assets, including the gaming floor, hotel, and other facilities. These taxes are typically assessed by local governments and can represent a significant expense, particularly for large resort-style casinos. Proper valuation of these assets and understanding the local tax assessment process can help casinos manage their property tax liabilities effectively. Once limited to Nevada and New Jersey, casinos are now finding their way into cities all across the country.

It’s used to lock someone in place as they try to pass into or out of the count room. Casinos are classified as financial institutions in the United States, because they accept cash, they exchange currency, they issue checks, they handle wire transfers, and a lot of similar activities. That means they have to fill out a currency transaction report whenever a cash transaction exceeds $10,000 in a single business day. That report is filed with the Financial Crimes Enforcement Network. These cash transactions can be for things like buying chips, making bets in cash, or depositing money.

Everyone on the count team has to wear a jumpsuit without pockets, so they can’t slip any money into their pockets. The team divides up tasks, so that one person empties the incoming boxes of currency, while a second person sorts and counts the contents, and a third person recounts the currency and fills out a summary form. There’s also a man trap leading into the count room, which is a segregated room that requires key access to enter and exit.

Slot machines most often come with built-in win/loss calculation software, whereas table games must be manually tracked. Use the calculation of the drop minus the total of chips and tokens cashed back in by customers as a check on the accuracy of the win or loss figure. Keep in mind that outstanding playing chips still in the possession of the casino’s players represent a cash liability on behalf of the casino. Employee training and awareness are equally important in maintaining robust internal controls. Staff members must be well-versed in the casino’s policies and procedures, including the proper handling of cash, chips, and other assets. Regular training sessions and updates on regulatory changes help reinforce the importance of adherence to internal controls.

When this happens, the bets are recorded as a deferred revenue liability. Navigating the tax landscape is a significant aspect of casino operations, given the unique nature of their revenue streams and regulatory environment. Casinos are subject to a variety of taxes, including federal, state, and local levies, each with its own set of rules and compliance requirements.

Casino Accounting and Financial Management has been recognized as the essential manual for gaming industry professionals since its first publication in 1988. Malcolm Greenlees provides detailed information about the growing role of state governments in the regulation of gaming. He also discusses regulations covering new venues for gaming, such as riverboats, Native American casinos, and video lottery terminals. In the two decades since the book’s first publication, state governments have enacted tighter and more complex regulatory oversight of the gaming industry. In updating the book, Greenlees includes detailed discussions of new standards in currency transaction reporting and gross revenue taxation.