Content

If you arrived in the US after December 31, 2020, you do not have to file any tax forms in 2021. Both employees, former security team members for the company, stated that the company had ignored repeated warnings and suggestions on how to prevent fraud.

Days you are in the United States as a crew member of a foreign vessel. By accessing and using this page you agree to the Terms of Use.

Filing Irs Form 1116 To Claim The Foreign Tax Credit

This is because the TaxAct software includes access to five of the most common tax forms expatriates need . Plus, expert tax help is available for an additional fee, and there are even filing options for self-employed expats.

- This is because two of the three fee-based options include support from a tax expert at a cost that’s more affordable than any of the other fee-based programs on our list.

- The IRS uses two tests—the green card test and the substantial presence test—for assessing your alien status.

- On December 12, 2008 the company announced that it had rescinded the new policy.

- If you are going to use the foreign earned income exclusion, enter your foreign source net profit as foreign earned income, it would be eligible for the foreign earned income exclusion.

- We considered a dozen providers to find the best tax software for expatriates.

The company’s new “Pay Per Return” policy was criticized for adding a $9.95 fee to print or e-file each additional return after the first, including returns prepared for members of the same household. On December 12, 2008 the company announced that it had rescinded the new policy. For these reasons, expat tax specialist firms often save expats far more money than they cost, as well as a whole load of time and hassle, by giving advice based on experience that a software just cannot provide. All of our picks offered an affordable tax software solution good for a variety of expatriate filing needs and situations. If you’re unsure whether you’re required to pay taxes in the country you reside in, make sure to get advice from a tax professional. If you don’t meet the criteria to use the TaxAct Free File Edition for free, you can still use the software as a non-qualifier for a fee of $64.95 per federal return and $44.95 per state return. Megan Hanna is an expert in commercial banking, accounting, credit repair, managing debt, and personal loans.

If all of your foreign-taxed income was 1099-reported passive income, such as interest and dividends, you don’t need a 1116, provided that any dividends came from stock you owned for at least 16 days. Part 2 to list taxes paid in both the foreign currency and their U.S. dollar equivalent. Form 1116 first asks you to classify your foreign income by category.

In the U.S., tax forms are filed in the current year for the previous year. Intuit, the owner of TurboTax, spent more than $11 million on federal lobbying between 2008 and 2012. Intuit “opposes IRS government tax preparation”, particularly allowing taxpayers to file pre-filled returns for free, in a system similar to the established ReadyReturn service in California.

Have Your Materials Ready Before You Access Sprintax ..

Under “resourced by treaty” agreements, all of your income, including any money you made in the U.S., counts as income from the treaty country when figuring out the taxes you owe it. Eligible taxes include income tax you paid to local and provincial governments. They do not include sales, value-added, real estate or luxury taxes paid to a foreign government. When counting the number of days you’re present in the U.S. during the three-year period, you don’t include every single day. Instead, count only a fraction of the days in two of the three years. Suppose, for example, you’re trying to figure out your status for the 2020 tax year because you lived in the U.S. for 60 days.

Instead, the majority either employ a tax preparer, who uses software, or input their information into online software themselves. Expatriates living abroad are generally required to file U.S. taxes as they would stateside. However, you’ll get an extra two months to file and pay your federal taxes.

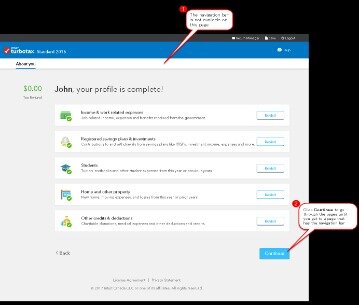

Turbotax Online

If you have a complicated tax situation (e.g., you need to file taxes for a foreign business), you’ll probably need to choose a different option. This is because the forms that are available to expatriates via TurboTax are limited. Even so, it’s a good option for expats with relatively simple tax situations, including those who are self-employed. On January 21, 2009, TurboTax received considerable public attention at the Senate confirmation hearing of Timothy F. Geithner to be the United States Secretary of Treasury. Geithner made it clear that he took responsibility for the error, which was discovered in a subsequent IRS audit, and did not blame TurboTax. Intuit responded by releasing a statement saying “TurboTax, and all software and in-person tax preparation services, base their calculations on the information users provide when completing their returns.”

Besides offering expat tax services from a tax advisor, individuals who prefer to do their own taxes can use the H&R Block Expat Tax Services software program to file their U.S. taxes online. This is particularly good for self-employed expats as the top plan includes Schedule C. Plus, for an additional fee, expatriates earning partnership, estate, or trust income can access Form K-1. TaxAct is a tax software company founded in 1998 and headquartered in Cedar Rapids, Iowa. TaxAct offers three different tax software plans good for expatriates, ranging from $24.95 to $64.95 for each federal tax return. You’ll get access to five of the most common tax forms expatriates need . Plus, for an additional fee, you can get support from a tax expert.

Can I Use Sprintax If I Have Graduated?

International students who worked in the US or received income are legally required to file a tax return. You’ll have an option to use the software to fill out your state forms. If you do not want to pay the fee, you can download the forms for free from New York’s tax website.

This includes those with basic employment income as well as self-employed individuals. It also includes people who are prepared to do their taxes themselves, as well as those who need some expert support. No, If you are an international student and need to file Form 1040-NR, you will not be able to use TurboTax. Unfortunately you have to find another method to prepare your tax returns. Moved to Germany in August 2017 and have been paying German income tax. Single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing the foreign tax credit form.

Looking For More Information?

It’s important to note that the standard free version doesn’t include access to the forms most expatriates need to file their taxes. However, if you meet IRS qualifications, the TaxAct IRS Free File Edition might work for you.

On the other hand, if you’re a tourist, or an expatriate about to leave the country, you can apply to have the VAT removed or refunded. Refunds are allowed only on “significant” purchases, Wilson said. The United States is one of a handful of countries that require this comprehensive taxation. Among the concerns of living outside the United States—making a living and leaving loved ones behind, for example—are the tax issues that develop if you retain your U.S. citizenship. Citizens and Resident Aliens Abroad, for more detailed information about self-employment tax for U.S. citizens and residents abroad. Yes, but you must have a U.S. address and credit card with U.S. address. Start by filling out a full schedule C the same as you would as if you were working in the US.

All of the options on our list allow expatriates to file their taxes online. However, it’s important to determine how much support you’ll need and how complex your tax situation is before deciding to do it yourself. Several of the options we reviewed offer support from a tax expert, but this usually comes for an added fee.