Content

Still, those with have larger estates, especially business owners and individuals with extensive real estate holdings, may benefit from sophisticated planning. Arrange homeownership to support mortgage interest and property tax deductions for the partner who will benefit the most. Determine whether the higher income partner should pay tax-deductible expenses. If marriage is not desired and both parties will file singly, check to see if one can claim the other as a dependent. The IRS allowed the amount reported as interest deductions but disallowed the balance of over $10,000. Wheeler took the matter to Tax Court, which held that she was not “either a legal or equitable owner” of the home before being named as such. Thus, only the payments made after Wheeler officially became an owner could be tax-deductible mortgage interest outlays.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account.

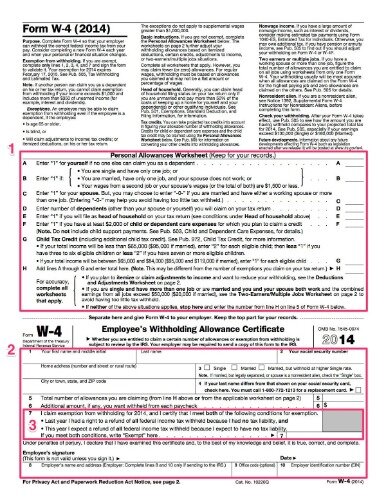

Filing as head of household provides you with a larger standard deduction and allows you to take advantage of tax brackets that are more favorable than those available to single taxpayers. If you are not eligible to use the head of household filing status, you can always file your return as a single taxpayer. If a couple wants to keep their finances separate for whatever reason, or they aren’t willing to take responsibility for the other’s tax obligations, they may choose to file separately. And if there’s a large difference between two spouse’s incomes, the lower-earning spouse may benefit from filing separately. Another drawback for joint filers is what the IRS calls “joint and several tax liability.” That means each spouse is responsible for taxes owed and penalties and interest that may arise from a joint tax return. That’s true even if you reported no income , or if you both filed a joint return and then got divorced later. But in certain cases, you might be able to qualify for relief from the responsibility of tax owed on a joint return or even seek a refund of tax paid.

Don’t worry, people file amended returns all the time, and nothing bad happens to them. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Married Filing Jointly: Is It The Status That Leads To Tax Bliss?

Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Please remember that your use of this website is governed by Bankrate’s Terms of Use.

Unmarried cohabitants should both have wills drafted by experienced attorneys, as state intestacy laws generally do not favor unmarried surviving partners. For assets that pass outside of a will, such as retirement accounts, beneficiary forms should specify the unmarried partner as the desired recipient. Just as the tax code favors married couples when it comes to gift tax, the same is true for estate tax.

A number of states had civil unions and registered domestic partnerships before the legalization of same-sex marriage. For same-sex couples, such states may have automatically converted these couples status to marriage after same-sex marriage was legalized on either the state or national level. Some states, such as California, allow domestic partnerships if one member of the couple is aged 62 or older, so they will not lose certain benefits should they remarry. However, such domestic partnerships are not recognized on the federal level as the same as marriage, and these couples cannot file as married, filing jointly. While you probably can’t file jointly with your girlfriend on your tax return, you may be able to claim her as a dependent. That may be the closest you can come to “unmarried filing jointly” status. To qualify, she must have earned less than $4,150 in taxable income in 2018, lived with you for the entire year as a household member, and is not claimed on anyone else’s return as a dependent.

Unmarried couples where one partner has little or no taxable income may also be able to save on long-term capital gains taxes. The partner with ample earned income can transfer appreciated assets to the partner with scant income, who can sell those assets.

If you lived apart from your spouse for the last half of the year, and if you keep up a home for a dependent child, you might qualify for Head of Household. No, you may not file as head of household because you weren’t legally separated from your spouse or considered unmarried at the end of the tax year. To be considered unmarried at the end of a tax year, your spouse may not be a member of your household during the last 6 months of the tax year and you must meet other requirements. Married couples can make unlimited gifts to each other with no tax consequences, but this is not true for unmarried couples. For non-spouses, the annual gift tax exclusion is $14,000 a year as of 2016; that is, a taxpayer can give up to $14,000 worth of assets to any number of recipients with no tax consequences. Another tactic for unmarried couples is to put investments in the name of the low-income partner. That could result in a 0% tax rate on dividends as well.

Can You File A Joint Return If You Are Married & Don’t Live Together?

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. Many unmarried couples own a home together, which can sometimes create complications at tax time. If your partner met the above guidelines, you could take advantage of the dependent tax credit, which could save you up to $4050. However, after the 2018 tax year, the new tax law eliminates the personal and dependent exemption, meaning you can’t claim your partner on your tax return.

See Online and Mobile Banking Agreement for details. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Description of benefits and details at hrblock.com/guarantees.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. The rules for these types of relief are complicated, so see a tax professional for help if you find yourself in this situation. This content was created in partnership with the Financial Fitness Group, a leading e-learning provider of FINRA compliant financial wellness solutions that help improve financial literacy. Use any of the other free tax estimator and tax calculator tools that help you find answers to your personal questions. Your marriage was annulled with an official court decree of annulment.

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

Suppose Andy and Brett are an unmarried couple. Brett is a freelancer, while Andy works for a company with a health plan that includes coverage for unmarried partners, so Brett can be covered by Andy’s plan. The premium paid by Andy’s company to cover Brett will be considered taxable income. In this example, Andy may have to pay for Brett’s health insurance premiums with after-tax dollars, as well as pay income taxes on the company’s cost of the benefit for Brett.

Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities.

Is It Better To File Jointly Or Separate When Making Over $100k?

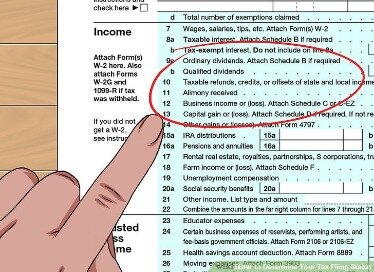

For an individual earning $30,000 in 2018, the tax bracket is 12%. For a married couple filing jointly, making $60,000, the tax bracket remains 12%, which is a significant difference from years prior. Keep in mind though that the IRS does not require you to be legally married for an entire tax year before filing a joint return. Even if your wedding is on December 31, the IRS will consider you as being married for that tax year. This allows you and your new spouse to enjoy all the benefits of filing jointly for the year in which your wedding happened. For example, a married couple filing a joint return for 2020 who has taxable income of $70,000 would pay 10% on the first $19,750 of taxable income ($1,975) and 12% on the remaining $50,250 ($6,030).

Moreover, tax planning might not be a prime concern for unmarried couples. Instead, the key might be making sure Julia’s assets pass to Helen, as per her intentions, if she is the first to die.

- There is no magic number of years in any of these states that automatically make a union a common law marriage.

- H&R Block does not automatically register hours with WGU.

- In June 2007, Wheeler’s name was added to the mortgage and placed on the deed to the home; she began making mortgage payments directly at that time.

- An unmarried couple without common-law marital status cannot file a joint income tax return.

She could give the shares to Helen, who would owe 0% tax on the sale, rather than the 15% or 20% Julia would owe. Julia’s $14,000 gift tax exclusion will not cover the transfer, however, so Julia would have to file a gift tax return, Form 709, to report the excess $86,000 gift. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. Offer period March 1 – 25, 2018 at participating offices only.

Tax Tips For Homeowners 2021: Tax Credits And Breaks

Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting for companies such as Forbes and Credit Karma. Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. You may qualify for Head of Household filing status if you were single and you paid more than half the costs of keeping up a home, and you had a Qualifying Dependent or Person.

Otherwise, both individuals must file as single taxpayers. Because of preferential tax brackets that apply to the married filing jointly status, couples who file a joint return will oftentimes pay less income tax in comparison to filing separately. In addition, joint filers are eligible to take a standard deduction that’s double that of a single taxpayer. Filing a joint return with your spouse may get you the highest standard deduction and a lower tax bill, plus you might qualify for benefits not available to married couples filing separate tax returns. If you use the married filing jointly status, though, both of you are responsible for the tax and any interest or penalties owed, even if one of you didn’t earn any money for the year. For married couples, filing jointly as opposed to separately often means getting a bigger tax refund or having a lower tax liability. Your standard deduction is higher, and you may also qualify for other tax benefits that don’t apply to the other filing statuses.

Joint filers report their income, deductions and credits on the same federal return — even if only one spouse had income in the tax year. Both spouses will also list dependents on that joint return, both Social Security numbers will appear on the return, and both must sign it to use the joint status. Filing a separate married return provides relief from joint liability. Each spouse is only responsible for the accuracy of their own separate tax return and for the payment of any separate tax liability associated with that return. But married taxpayers who file separately lose their eligibility for quite a few tax deductions and credits, so they can end up paying more in taxes.

If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Who Is Eligible To Use The Married Filing Jointly Status?

A representative for the decedent can amend a joint return to a separate return for the decedent for up to 1 year after the due date of the return, including any tax extension that was filed. One solution would be for Andy and Brett to get married. If that is not desirable, it might be preferable for Brett to purchase his own health insurance, perhaps through their state’s Affordable Care Act exchange. Advisors can help by calculating the after-tax cost of including Brett on Andy’s health insurance and comparing it with Brett’s costs for obtaining his own plan. Self-employed health insurance premiums may also be tax-deductible.