Content

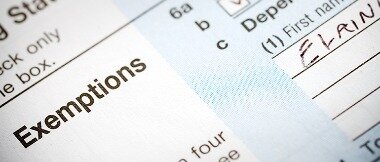

Federal and many state tax systems allow a deduction of a specified dollar amount for each of several categories of “personal exemptions”. Some systems may provide thresholds at which such exemptions or allowances are phased out or removed.

If you were filing a joint return, you and your spouse each got to take a personal exemption. There were special rules if you’re married but file separately. The good thing about tax exemptions is that they’re fairly straightforward.

How To Determine The Number Of Exemptions To Claim

For example, if you’re paying off your student loans, you may qualify for the student loan interest deduction. Tax filers were only able to claim a personal exemption if they were not claimed as a dependent on someone else’s income tax return. A tax exemption is a type of tax break that reduces your taxable income or zeroes it out entirely. In this way, an exemption is similar to a tax deduction, which helps reduce your taxable income when you file your federal tax return. A tax exemption is a type of tax break that allows individuals and select organizations to exclude some or all of their income from federal or state income tax .

You can even deduct the fair market value of items you donate to charity. Keep a record of every contribution you make in the form of a bank record or a receipt from the charity, including the name of the organization and the amount and date of the contribution. If they don’t add up to more than your standard deduction, stick with the standard. generally are expenses you’ve incurred that whittle down the amount of your income that’s subject to tax. However, there are some types of income that typically aren’t subject to tax. Social Security and Medicare taxes will still come out of your check, though.

Have read about tax exemptions but aren’t sure what they are? A tax credit is a dollar-for-dollar reduction of your tax liability. If you’re eligible for a $4,000 tax credit, you’ll actually get to subtract that $4,000 figure directly from your taxes, thus saving that amount in full.

Exemptions And Deductions

To apply for tax exemptions, organizations have to apply for recognition of exemption. This results in the formal recognition of the organization’s status by the IRS. Usually, organizations that don’t operate for profit and provide valuable service to the communities can apply for tax exemption. The requirements for tax exemption for an organization is covered by Section 501 of the Internal Revenue Code. Under the code, nonprofits and other charitable institutions receive certain exemptions from federal, state and local income taxes. There used to be a personal exemption, which could be claimed in addition to the standard deduction by people who did not itemize their tax deduction. Instead, there’s a whopping big standard deduction, passed with the 2017 Tax Cuts and Jobs Act.

Under tax deductions and exemptions definition, exemptions are portions of your personal or family income that are ‘exempt’ from taxation. The Internal Revenue Code allows taxpayers to claim exemptions that reduce their taxable income. Both personal and dependent exemptions lower the amount of your taxable income. That ultimately reduces the amount of total tax you owe for the year. Exemptions and deductions both reduce your taxable income. The number of exemptions you can claim depends on your filing status and the number of dependents you have. The kinds of deductions you can claim, however, depend on your expenses.

What Is A Tax Exemption?

While tax-exempt status for organizations may not be as important to individual taxpayers, it may be a good idea to check for it if you’re planning to donate to one. If you donate money to an organization that doesn’t qualify for tax-exempt status, it means they don’t meet the requirements set by the IRS and your contributions may not be tax-deductible. To exclude a certain type of income, you typically have to meet certain conditions, so make sure you double check the income qualifies before excluding it from your taxable income. Federal taxable income certain types of interest income received on bonds issued by states or political subdivisions thereof. See International tax for a discussion of territorial tax systems. Most systems exclude from the tax base income of nonresidents from sources outside the taxing jurisdiction. U.S. states and Canadian provinces provide for formulary apportionment of certain business income to achieve a similar result.

Itemized deductions are individual tax deductions you can take in lieu of the standard deduction. Common itemized deductions include mortgage interest paid, property taxes, medical expenses and charitable donations.

For tax year 2017 , the personal exemption was $4,050 per person. A few years ago, taxpayers were able to exclude $4,050 or more off their income by claiming personal exemptions. b A tax filer is in the 0% bracket when their taxable income is $0.

Tax exemption refers to the income and transactions that are not subject to federal, state and local taxes. Most taxpayers qualify for personal tax exemptions that reduce their tax bill the same way a deduction does. In addition, federal and state governments frequently exempt certain organizations from paying taxes when they serve the public, such as charitable and religious organizations. Standard or itemized deductions are considered below-the-line.

The more exemptions you’re able to take, the more you can lower your tax bill. It phases out completely at $384,000 for single taxpayers ($436,300 for married couples filing jointly). You can claim personal tax exemptions on Form 1040EZ, 1040A, or 1040. Dependent tax exemptions can only be claimed on Form 1040A or 1040. Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax. Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. Federal and state governments frequently exempt organizations from income tax entirely when it serves the public, such as with charities and religious organizations.

In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the amount of tax a filer owes. Taxpayers subtract their credits from the tax they would otherwise owe to determine their final tax liability. That means that a $100 tax credit reduces the amount of tax a filer owes by a maximum of $100. U.S. tax filers are allowed to claim personal exemptions on their taxes. As long as no one else claims you as a dependent on his or her return, you can take one personal tax exemption for yourself on your own return. The personal exemption is a preset amount that typically changes year after year. If you’re married and file a joint return with your spouse, then each of you is allowed to claim a personal exemption.

- Some governments grant broad exclusions from all taxation for certain types of organization.

- In many cases, dependents are minor children of the taxpayer, but taxpayers may claim exemptions for other dependents as well.

- Tax liability is then calculated based on a filer’s taxable income.

- The tax-exempt status of an organization lets people know that financial contributions they make to the organization are tax-deductible.

- This may influence which products we write about and where and how the product appears on a page.

Tax exemption also refers to removal from taxation of a particular item rather than a deduction. You may be able to deduct the expense of work-related education from your taxes if you itemize. Tuition, books, supplies, lab fees, some transportation and travel costs and even the cost of research can all be deductible.

Tax Deductions Vs Tax Exemptions Vs. Tax Credits

See, e.g., the Multi State Tax Compact, discussed in a note below. See, e.g., Malaysian Ministry of Higher Education chart of exemptions and benefits for private higher education institutions. Most states and localities imposing sales and use taxes in the United States exempt resellers from sales taxes on goods held for sale and ultimately sold. In addition, most such states and localities exempt from sales taxes goods used directly in the production of other goods (i.e., raw materials).

You can reduce your taxable income by multiplying the dollar value of a personal exemption, which is a predetermined amount, by the number of your dependents. For example, in 2017, the personal exemption is $4,050. It’s the same amount for your spouse and each dependent as well. As a part of tax exemption definition, these exemptions are reduced if your adjusted gross income exceeds $261,500 as a single filer or 313,800 if you’re married and file a joint return.

Others are available for people renovating old houses, installing renewable energy systems, or surviving a spouse. Federal tax law gives each individual or family this deduction just for being taxpayers who file returns. The so-called child tax credit now doubles to $2,000 per child under the new law, from $1,000 per dependent previously.

Personal exemptions have been repealed and replaced by higher standard deductions for both couples and individuals. Deductions above-the-line are initially more advantageous than below-the-line because they reduce your AGI. Typically, a lower AGI means you have fewer restrictions when it comes to taking advantage of other tax benefits, like below-the-line deductions and various tax credits. Above-the-line deductions reduce your adjusted gross income . Below-the-line deductions are subtracted from your AGI to determine your taxable income. There are significant differences between their benefit to you.