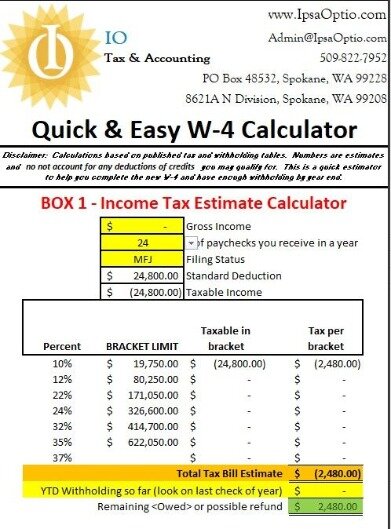

The IRS reported that roughly 72% of 2019 tax returns resulted in an average tax refund of $2,860. If the average filer gets paid every other week, that tax refund could have added $100 to each of their paychecks and still resulted in a $260 refund for the year. Let’s start by adding up your expected tax withholding for the year.

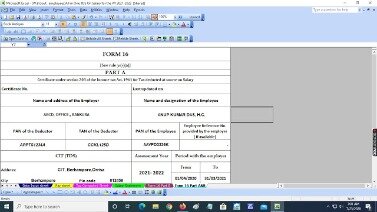

You only complete each section if it applies to your situation. As with the prior version of the form, the new W-4 allows you to claim exempt status if you meet certain requirements. You still have to provide your name, address, filing status and Social Security number.

Deduction Forms

This is especially true if you’re a new business owner or newly self-employed. In that case, you may want to talk with a tax professional.

If you’re unsure how to file your taxes, talk to a financial advisor who specializes in taxes. An advisor can help you navigate the intricacies of the tax code and maximize your refund. An advisor can also help you plan and order your finances so that next year it’s as easy as possible for you to file. One advantage with H&R Block is that it has multiple physical offices around the world. If you want to work with a tax preparer in person, you can do so. TurboTax offers its suite of Live filing options, but these still take place online instead of in-person. The Premier option also handles rental property income and tax deductions.

Step 1: Enter Your Personal Information

If you itemize or take other deductions, you may want to add them here. In 2020, Form W-4 is a bit easier to understand because each section shows why adjustments are being made. There are now three main sections used to help determine your withholding.

This is not the first year the company has offered access to live professionals, but this year’s options are the most extensive yet. To make sure that you have a thorough understanding of the tax filing process, TurboTax offers free online tools to guide you through the process. This includes the TaxCaster Calculator, which estimates how much your tax return will be, a W-4 Withholding Calculator and a Tax Bracket Calculator. TurboTax looks for start-up tax deductions for new businesses to ensure that you get the maximum refund. You can also see your refund changing in real time based on the information you share. Most filers who do not qualify for free filing will likely use Deluxe.

Fidelity disclaims any liability arising out of your use of these TaxAct software products or the information or content furnished by TaxAct. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Tax withholding is simply the chunk of money your employer sets aside from each paycheck to cover your taxes.

With TurboTax, you’re able to set up new rental properties, determine their market rent value and see how they affect your return. You can also report your rental property depreciation to get a large tax deduction, as well. In addition, you get retirement tax help to maximize your IRA savings. The Premier option is targeted at those with investments or rental property. It costs $59.99 to file federal forms and $39.99 per state.

Instead of facing this uncertainty each year, you should update your W-4 when you experience a major personal life change or have a change in income. The first step to filling out Form W-4 is relatively easy to complete. Simply provide your name, Social Security number, and address. You could use the money to pay off debt throughout the year, saving money on the interest you would have paid waiting for your refund. Having extra money in your paychecks throughout the year could help you achieve your financial goals faster.

If you want to change your Federal Tax Withholding per pay period click the button below. Even though the 2020 W-4 Tax Withholding Calculator does not have the final 2020 tax calculation data, this is the best approach to balance your Taxes now. In order to accurately determine the right Tax Withholding amount for 2020, you must estimate your 2020 Tax Return now.

To be accurate, both spouses should fill out the new Form W-4 for each job. Any additional amount you wanted to be withheld from your paycheck.

It not only will provide you the estimated IRS tax withholding amount, it assists you in completing your W-4 as well by changing the entered values (e.g. Dependents, Deductions, etc.). Each calculator section will indicate if and how it corresponds to the W-4 form. Open the W-4 and follow these simple steps with the PAYucator. Keep in mind that the W-4 form is a planning tool; a tax return is not.

You can find the amount of federal income tax withheld on your paycheck stub. Let’s say you have $150 withheld each pay period and get paid twice a month. Even though tax returns are due in April, you pay your tax bill a little at a time all year long through a process called tax withholding. As alluded to above, there is also a Self-Employed Live filing option. While TurboTax is very user-friendly and does the hard work of finding deductions that you qualify for, taxes can still be confusing.

If you claim any dependents on your tax return, use the results from the W-4 Withholding Calculator to complete this section. If you make a change in the middle of the year, it’s wise to fill out a new form at the beginning of the next year. The adjustments made may result in incorrect results if enacted for a full tax year rather than just part of a year. These are not usually subject to withholding but most likely affect the amount of tax that you have to pay, and so reporting it on your W-4 could be beneficial. Giving that money to Uncle Sam to hold on to isn’t ideal, though. When the federal government keeps the money for you, you lose the opportunity to use the money in other ways.

Turbotax Online

TurboTax’s range of filing options caters to different financial situations, whether you’re single, married, a homeowner or self-employed. There are extensive features included with each plan to maximize efficiency and transparency. It’s easy to import information and there are explanations of why and how refunds fluctuate.

You can also get it as a check or on a prepaid Visa debit card. TurboTax also allows you to use the refund to buy U.S. savings bonds or apply it to next year’s taxes, which shows up as tax credit. You can pay for TurboTax with credit, debit or prepaid cards. There’s also an option to deduct the purchase price from your federal refund, so you don’t have to pay out-of-pocket. When it comes to your business, TurboTax also helps you stay on top of your expenses throughout the year. Filing with this option (or with TurboTax Self-Employed Live) grants you a complimentary one-year subscription to QuickBooks Self-Employed.

You can also fill one out any time you want to adjust your withholding. The easiest way to do that is to use TurboTax’s W-4 Withholding Calculator. It will walk you through a series of questions about your income, tax deductions, and credits, and it provides instructions for completing Step 3 and 4 of the form. The Tax Cuts and Jobs Act of 2017 significantly changed federal tax laws, so workers and their employers needed a more up-to-date form to calculate the amount of federal tax to withhold. If you don’t know whether you’ll likely receive a refund or owe money, TurboTax’s tax withholding calculator can help you figure out what to expect. Then, you can decide if you need to fill out a new Form W-4. All you need to do is fill out a new Form W-4 and give it to the correct department at your employer.

In essence, Step 3 – Dependents – and Step 4 line item 4 – Deductions – of the new W-4 have become the new Allowances as you might know them from older W-4 Forms. For example, if you estimate and increase the Dependents and/or Deductions on the W-4, you will decrease your tax withholding amount on your next paycheck.

- The forms included with each of TaxAct’s filing options are very similar to TurboTax and H&R Block’s.

- You can also see your refund changing in real time based on the information you share.

- To make sure that you have a thorough understanding of the tax filing process, TurboTax offers free online tools to guide you through the process.

- This option includes all the features and forms of the previous two plans.

- Every time you earn income, you’ll most likely owe income taxes.

Its extensive options, features and accessibility ensure that you’re getting the most out of tax season. First, you can add extra income from outside of your job, such as dividends or interest, that usually don’t have withholding taken out of them. You can use other adjustments to make your withholding more accurate. If you only work one job or you’re filling out a Form W-4 for the highest paying job and you have dependents, you claim them here. This section accounts for the tax impact of the child tax credit and the other dependents credits. The most accurate option is using an online estimator like TurboTax’s W-4 withholding calculator. This section is for if you work multiple jobs at the same time or are married filing jointly and both you and your spouse are employed.

Thenadd the two togetherto get your total household tax withholding. Whenever you start a job at a new company, you’ll be asked to fill out a W-4 form that will help your employer figure out how much to withhold from each paycheck. The forms included with each of TaxAct’s filing options are very similar to TurboTax and H&R Block’s. For the 2018 tax season, which is what you file in early 2019, TurboTax has factored in all the changes that resulted from the new tax code. You’ll receive notification when your return is accepted by the IRS. Once approved, you can usually expect your refund within 21 days. To receive your refund, you can directly deposit it into a checking, savings, brokerage or IRA account.

See how easy it is to estimate your tax savings based on your yearly work-related expenses. Just remember, while you need to fill out a W-4 for each employer you work for, you should only complete Steps 2 through 4 for your highest paying job. Your company’s human resources or payroll department should be able to provide a copy of Form W-4. If not, you can always download Form W-4 from the IRS website. If you’re saving for a vacation, you won’t earn interest letting the federal government hold your money as you would if you put the money in a high-yield savings account. Here are the 4 key changes you need to know about the redesigned Form W-4.