Content

When you use TurboTax to prepare your taxes, we’ll ask simple questions about your tax situation and we’ll recommend whether itemizing or claiming the standard deduction will get you a bigger tax refund . If you think your tax bill is chiseled in stone at the end of the year, think again. Here are 10 tax tips for the new year to help you lower your taxes, save money when preparing your tax return, and avoid tax penalties. This does not resolve the software error for defaulting to a standard deduction of $12,200 in ERROR for a person who is claimed as a dependent on another person’s return. This Error needs to be fixed in the software before you can call the case resolved. What was provided was a work around if you knew the tax law and figured out that the turbo tax program was incorrectly calculating the standard deduction in the case above. Earned income refers to salaries, wages, tips, and any fees you receive for work you do.

A couple of these deductions include student loan interest and deductible contributions to Individual Retirement Accounts . Additionally, if you live in a county or municipality that charges an additional rate of tax, such as New York City, you can increase your sales tax deduction even more. TurboTax will take care of these calculations to ensure that you get the best deductions for your specific situation. Most states charge a sales tax on the purchase of goods sold within their jurisdictions. However, there are several tax-free states in which you can shop that do not impose a sales tax on retail purchases. But, regardless of whether you shop in a tax-free state or not, sales taxes can impact your federal tax return.

Having this type of information at your fingertips will save you another trip through your files. Here are 10 tax tips and steps you can take after January 1 to help you lower your taxes, save money when preparing your tax return, and avoid tax penalties.

Provide Dependent Taxpayer Ids On Your Tax Return

This credit is reduced if your 2020 modified adjusted gross income exceeds $80,000 for those filing single or $160,000 for those filing married filing jointly. If you have adopted or plan to adopt a child, you may be able to take advantage of the adoption tax credit.

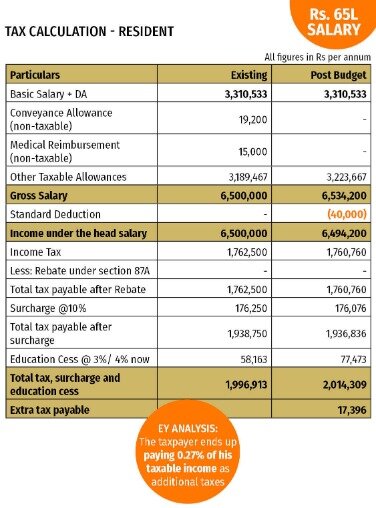

If you are 65 or older your medical expenses have to be more than 7.5% of your adjusted gross income(10% if under 65). TurboTax will ask you simple questions and give you the tax deductions and credits you deserve. Taxpayers who elect to itemize deductions are precluded from also claiming the standard deduction. The federal tax law allows you to deduct several different personal expenses from your taxable income each year. This can really pay off during tax season because the reduction to taxable income reduces the amount of income that is subject to federal income tax. However, not all expenses you incur will provide tax savings; the Internal Revenue Code is very specific about the types of expenses you can deduct and the taxpayers who may claim them. Tax deductions allow individuals and companies to subtract certain expenses from their taxable income, which reduces their overall tax bill.

- As a family, you may have access to more tax deductions and credits than taxpayers without children.

- Don’t assume that your tax-free municipal bonds are completely free of taxes.

- Your MAGI equals the AGI you report on your tax return increased by the amount of your student loan interest deduction.

- For many, the biggest hassle at tax time is getting all of the documentation together.

- If you’re not aware of these deductions and credits, you may be missing out on some tax savings.

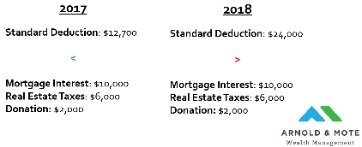

TurboTax will calculate this for you and recommend the best choice. You know that you can get an income tax deduction on the mortgage interest you pay. But there are other tax deductions you can take on your principal residence or second home — such as property taxes. Other programs included in the legislation have already expired, though some have been extended for at least one more year after passage of the Consolidated Appropriations Act at the end of 2020. This includes allowing employees to avoid taxes on student loan payments made by their employer until December 31, 2021. an extension of the $300 deduction for cash charitable deductions if you claim the standard deduction. For instance, the IRS increased the standard deduction amounts from 2019 to 2020.

Home Ownership Tax Deductions

As the new year begins, many people will want to understand which taxes will change in 2021 and what provisions will phase out or be adjusted for inflation. Here’s a high-level summary of some of the items that will change for taxes in 2021. Tax Year 2021 will likely bring some surprises, but some of its changes are already planned. Here’s what you need to know about some of the planned phase-outs, changes and inflation adjustments the IRS will present for taxes in 2021.

And if you file a joint return with your spouse and only one of you qualifies for the increased standard deduction—you can still report it. If you itemize your deductions you can still claim medical expenses regardless of your age.

If your itemized deductions are greater than the standard deduction, you’ll want to itemize your tax deductions. For example, if you are only eligible to take the standard deduction and you made charitable contributions this past year, you would not be able to claim those contributions as a deduction. If you have any of the above expenses, it’s worth your time to investigate further.

Some common itemized deductions include medical and dental expenses and charitable contributions. Personal income tax returns require the calculation of Adjusted Gross Income before arriving at the final taxable income amount. The deductions you may take to arrive at AGI tend to be less restrictive than below-the-line deductions since their limitations have no relation to your AGI. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Standard Deduction Vs Itemized Deductions: Which Is Better?

For many, the biggest hassle at tax time is getting all of the documentation together. This includes last year’s tax return, this year’s W-2s and 1099s, receipts and so on. If you are in the 25% tax bracket and make a deductible IRA contribution of $6,000, you will save $1,500 in taxes the first year. Over time, future contributions will save you thousands, depending on your contribution, income tax bracket, and the number of years you keep the money invested. Remember, when you use TurboTax to file your tax return, we’ll ask you simple questions and recommend the best filing status for you.

You can’t take this deduction if your modified adjusted gross income exceeds $80,000 if you file single or $160,000 if you file married filing jointly. It made significant changes regarding how some tax deductions and credits work for families. Here are some of the key changes to be aware of and understand. When it comes to reducing your taxable income, itemizing your deductions can really maximize your tax savings.

Don’t forget to include any taxes you may have reimbursed the seller for. These are taxes the seller had already paid before you took ownership. Beginning in 2018, state and local taxes, including property taxes, are limited to $10,000 per year.

If your real estate taxes aren’t paid through an escrow account, review your property tax bills or canceled checks and add up what you paid. Form 1098 shows the amount of mortgage interest you paid during the previous year. It may also include any points, mortgage insurance premiums, and real estate taxes you paid through your mortgage servicer.

However, these older children and other qualifying dependents may be eligible for a new tax credit of up to $500 called the credit for other dependents. Dependents must be a U.S. citizen, U.S. national or U.S. resident alien. And if you don’t want to go it alone, TurboTax can help by asking specific questions to make sure you get every deduction you qualify for. With direct debit, you may delay the debiting of your bank account until the actual filing deadline. The IRS also acknowledges that it received your return, a courtesy you don’t get even if you send your paper return by certified mail.

For a family that qualified for four exemptions, the total reduction of taxable income ended up being $16,200. This amount is then subtracted from your income to arrive at the final taxable income number.

If you don’t use the entire credit in the first year, you may be able to carry forward any remaining balance to future tax returns for up to five years. Because the IRS processes electronic returns faster than paper ones, you can expect to get your refund three to six weeks earlier.

If your children are in college, you may want to consider purchasing a second home in their college town. This may allow you to take advantage of the mortgage interest and real estate tax deductions for second homes on your tax return. You would have to itemize to take these deductions, and they may not provide much benefit depending on your situation. You can deduct qualified education expenses as an adjustment to income on Form 8917. Up to a $4,000 deduction is available if your modified adjusted gross income is up to $65,000 for single filers or up to $130,000 for married filing jointly filers. A qualifying child must meet the relationship, age, residency, support and joint return tests. A qualifying relative must meet the “not a qualifying child, member of household or relationship” test, gross income test and support tests.

This is different than unearned income, which would be returns from investments or interest. A taxpayer can claim either a standard deduction or a series of itemized deductions, whichever is greater. The standard deduction for the 2016 tax year is $6,300 for single filers and $12,600 for married filing jointly tax filers. Head of households can claim a $9,300 standard deduction while those married filing separately can only claim $6,300.

If you are married filing separately, both taxpayers must claim the standard or both claim the itemized deduction, they must match. If you operate a small business as a sole proprietor, you must incorporate business earnings into your personal tax return by preparing a Schedule C attachment. The Schedule C is a separate calculation of your net profit or loss that requires you to report all business income and deductions. So, if you are a single taxpayer who earns $100,400 during the year, the standard deduction reduces your taxable income to $88,000. However, this amount is subject to further reduction by other allowable deductions you claim. The pressure of a looming tax deadline may make it easier to take the standard deduction rather than itemize your deductions, but you should weigh this question carefully.

Planned Changes To The Alternative Minimum Tax

In 2021, these amounts will change to $73,600 with phase out beginning at $523,600 ($114,600 for married couples filing jointly with a phase out beginning at $1,047,200), respectively. Essentially, this new figure measures inflation in a different, often slower way that accounts for consumers’ tendency to shy away from items that undergo a large price increase. For taxpayers, this means they could more easily get pushed into a higher marginal tax bracket than before tax reform because of cost-of-living paycheck increases or annual raises that outpace the chained CPI. The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic. While tax rates generally remain the same, the tax brackets slightly increase each year due to inflation.