Content

The best interest of a taxpayer making less than $34,000 a year is being able to easily file her taxes for free and not being presented sub-optimal options with confusing names. The most shameful part of TurboTax’s actions is that it ensnared Americans who could least afford to pay. The $119 TurboTax charged could have been used to put food on the table, save for a rainy day, or invest for long-term financial security. Users like an 87-year-old veteran with a gross income of $11,000 from Social Security and a military pension were steered toward paid products. As a thank you for her service, TurboTax allegedly charged her $124 to file even though she should have been eligible for free tax filing. (In the wake of ProPublica’s reporting, Intuit relented and changed the code, but that was after the filing deadline for 2018 taxes, meaning that many who searched and filed their taxes by April 15 had already needlessly paid).

But Congress is now moving to put the Free File program into law, including its restriction on the IRS creating its own free service. We wrote about that earlier this month and the opposition to this provision by freshman Democratic Reps. Katie Hill, Katie Porter, Alexandria Ocasio-Cortez and others. The House ultimately passed the bipartisan Taxpayer First Act, which also contains some provisions that consumer advocates support, such as restrictions on private debt collection of unpaid taxes. No, that’s reserved for the widely advertised commercial products that are only free for people with the simplest taxes. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit.

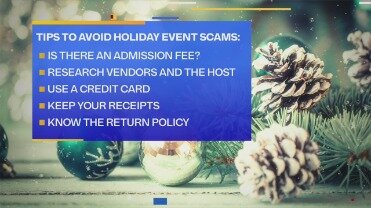

These scammers often target families that have lost a loved one to a particular disease, knowing that the family might wish to make a donation in the loved one’s name to help prevent future tragedies. If you receive a telephone call or even an in-person solicitation to make a donation to a charity, don’t give the person cash or your financial information. Instead, verify the legitimacy of the charity by using the IRS Exempt Organizations Select Check tool. , to confuse and steer people away from truly free versions of their services. If you’re republishing online, you must link to the URL of this story on propublica.org, include all of the links from our story, including our newsletter sign up language and link, and use our PixelPing tag.

Securities and Exchange Commission, alleging that the company routinely placed profits ahead of ethics. Lee said that early on, the reports on returns that Intuit’s fraud teams flagged as bogus were sent immediately to the IRS. Government Accountability Office , the IRS estimated it prevented $24.2 billion in fraudulent identity theft refunds in 2013. Unfortunately, the IRS also paid $5.8 billion that year for refund requests later determined to be fraud. The GAO noted that because of the difficulties in knowing the amount of undetected fraud, the actual amount could far exceed those estimates.

Intuit will provide you with instructions on how to stay current with your Intuit product, and it will provide you with information on how to securely download an update from your computer. It will never ask you for your banking or credit card information in an email. Also, it won’t ask for private information about your employees in an email.

Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. The FCC is cautioning small businesses, as well, as some have reported getting scam calls about virus-related funding or loans and online listing verification. Again, the IRS won’t ask for information or payments over the phone.

One of the biggest isDun & Bradstreet, which, as I detailed in a 2013 exposé, Data Broker Giants Hacked by ID Theft Service, was compromised for six months by a service selling Social Security numbers and other data to identity thieves like Peleus. Several seasoned members of this fraud forum responded that the IRS had indeed become more strict in validating whether the W2 information supplied by the filer had the proper Employer Identification Number , a unique tax ID number assigned to each company. The fraudsters then proceeded to discuss various ways to mine social networking sites like LinkedIn for victims’ employer information. “And then we have the banking industry, which is making a fortune off of this whole problem.

some sort of out-of-band verification for email addresses — sending an email or text to the customer with a personal identification number . If you do receive such a message, the IRS asks that you forward it to Do not reply to the original message. One particularly bold gambit involves scammers using the IRS name and logo to warn taxpayers about the very scam they’re perpetrating, before soliciting sensitive personal information. Note that attackers are increasingly targeting tax professionals in addition to taxpayers. Once the funds hit your bank account, the scammers, impersonating someone from the IRS or a collection agent, will contact you to demand the return of the ill-gotten money — either by depositing into an account or sending it to an address. The IRS has issued several alerts and warnings about common scams that all want to take your money. If someone claiming to work for the IRS calls you, the IRS says you should write down the number you received the call from, the name of the caller and then hang up.

Another tax scam involves promises that you can obtain a large Social Security refund or rebate. Even when you are legitimately owed a refund, criminals will inflate amounts in the tax return and steal the refund. Invest your money in certain shelters, they claim, and you’ll avoid paying taxes.

Beware Social Security Fraud

TurboTax also offers a Free Edition for anyone who is filing a simple return only. TurboTax Free Edition is free for people who are filing very simple returns only.

You can then call the IRS directly at or visit irs.gov/balancedue to view your account. Don’t click that link, it could be malicious – Phishing emails usually contain malicious links that will take you to a spoofed site that asks you to enter you log on and account information. That’s why it’s always better to type the address of a website directly into your browser, so you know you’re going to the actual site and not a spoofed one.

Walk the other way if he suggests falsifying documents or bending the law, like offering to “correct” a 1099 form by reporting your income as zero. Remember, if a tax preparer files a fraudulent return in your name, the IRS can assess penalties and interest, and you might even face criminal charges. Not everyone who offers to do your tax return is a legitimate tax preparer. Phony tax preparers and tax preparation websites are interested only in stealing your money and financial information. The agency won’t send emails out of the blue about your taxes or refunds. A tax-related phishing email often mentions “IRSgov,” instructing you to update your IRS online account right away. The most telling sign that it’s a scam is the missing dot between “IRS” and “gov” in the web address. For example, you might be asked to click on a link to confirm your identity or update your information.

But instead of manipulating software to hide higher levels of pollutants coming out of a car, TurboTax manipulated software and the metadata on its own site so certain results wouldn’t show up in Google searches. The tactic likely prevented millions of Americans from filing their taxes for free.

Category: Web Fraud 2 0

You can also get the latest on any phishing scams we know about from our Online Security Center. Whether it’s phishing, identity theft, or hidden fees, tax season can bring out the scammers in full force.

If you lost a family member from a disease or another tragedy, con artists can close in. These scammers target taxpayers who might want to make a tax-free donation to a particular charity. If you get a phone call or email soliciting money to fight disease or assist victims, don’t give out cash or financial info. Instead, look up the charity on the Exempt Organizations Select Check tool to see if it’s legitimate. If the caller threatens you with police arrest, deportation or immediate criminal action—they’re not from the IRS. Phone calls demanding immediate cash payments are made by criminals who impersonate tax agents.

The IRS also will never communicate or request personal information via unsolicited email. It is important that you do not click on the links, open the attachments or provide any personally identifiable information in response to these emails. The sender will copy logos, headers and other content used in legitimate company emails, but they often leave telltale clues that can tip you off to their true motives.

The Top 5 Tax Scams You May Not Have Heard About

If you’re expecting a refund, file your return as early as possible to freeze out potential scammers. Not only have the fraudsters shifted from attacking the IRS to robbing state coffers, but the methods they use to steal taxpayer data also are evolving. Kodukula explained that traditionally most of the bogus refund requests were the result of what the company calls “stolen identity refund fraud” or SIRF. The data released by the Treasury Inspector General for Tax Administration , which oversees the work of the IRS, suggests the IRS does indeed appear to have improved at flagging and ultimately denying fraudulent federal tax returns. In an interim report on the 2014 tax filing season, TIGTA said the IRS identified and confirmed 28,076 fraudulent tax returns involving identity theft.

- Don’t think you’re the only one singled out for this tactic; aggressive, threatening phone scams occur regularly across the country.

- Even though TurboTax could tell we were eligible to file for free, the company never told us about the truly free version.

- Luckily, the Komando listener figured out this TurboTax version was malicious before her husband and daughter uploaded any tax returns.

- If you do receive such a message, the IRS asks that you forward it to Do not reply to the original message.

- Scam artists adopt false identities as a way to extract personal information from their targets or to plant destructive software into a person’s computer.

The IRS is issuing stimulus checks to recipients of Social Security income directly based on their Form SSA-1099 or RRB-1099 and no further action is needed to receive it. Don’t allow unknown parties remote access to your computer based on a phone call that seems to be from your ERO. Report fraudulent calls to the IRS stakeholder liaison contact for your area. Don’t open attachments or click web links from senders you don’t recognize. If colleagues send attachments seemingly out of the blue, give them a quick call to confirm the email is legitimate. If you’re concerned, call your ERO to confirm your software is up-to-date and functional. Watch out for emails with the subject line “Security Awareness for Tax Professionals” directing you to a fake e-services registration site via an embedded web link.

Use anti-virus software to check any attachments you receive via email before opening them, and talk to new prospects on the phone to get a better sense of whether they are a legitimate client or not. Last year, she received several threatening, tax-scam calls on her voice mail, but simply opted not to return them.

Most states didn’t start processing returns until after March 1, which is exactly when a flood of data breaches related to phished employee W2 data began washing up. As KrebsOnSecurity first warned in mid-February, thieves have been sending targeted phishing emails to human resources and finance employees at countless organizations, spoofing a message from the CEO requesting all employee W2’s in PDF format. Here’s a shortlist of some of the most common scams making the rounds — and what to do to keep both your identity and tax return safe and secure, including reporting the trick to the IRS. Just as telephone scammers have polished their pitches to sound convincing, so too have email scammers created evermore official-looking emails designed to trick you into thinking the IRS is contacting you. The typography, the logos, even the email addresses bear a striking resemblance to official correspondence. The words can sound official, too, referring to a tax bill or promising a refund you’re not expecting.

It starts with your phone ringing — the most prevalent tax scam making the rounds this year. Don’t think you’re the only one singled out for this tactic; aggressive, threatening phone scams occur regularly across the country. Most phishing emails contain a link to a fake site, where personally identifiable information can be captured and submitted to the cybercriminals. This is supported by audio recordings of conference calls between Intuit’s senior executives that were shared with KrebsOnSecurity. Robert Lanesey, Inuit’s chief communications officer, said Intuit doesn’t make a penny on tax filings that are ultimately rejected by the IRS. we started to see not only our fraud numbers but also our revenue go down before the peak of tax season a couple of years ago,” Lee recalled. “When we stopped or delayed sending those fraud numbers, we saw the fraud and our revenue go back up.

Tax Bracket Calculator

While we do see these types of emails, we uncovered an interesting variation on this scam in 2016. Williams added that it is not up to Intuit to block returns from being filed, and that it is the IRS’s sole determination whether to process a given refund request.

Companies that make tax preparation software, like Intuit, the maker of TurboTax, would rather you didn’t know. The more we work together to identify and alert other customers about phishing scams, the safer everyone will be. For recent updates on the types of scams targeting taxpayers and tax professionals, visit the IRS page Tax Scams/Consumer Alerts. Watch out for emails that your ERO sends apparently out of the blue, especially if they claim you’re facing a security risk, and do not grant anyone remote access to your computer.

If someone tells you to sign a blank tax return or estimates your taxes off the top of their head, it’s best to be skeptical. The first type of phishing scam arrives in the form of an email claiming to be from the Internal Revenue Service . We have also observed phishing emails impersonating TurboTax, a popular tax preparation software, claiming that the recipient’s TurboTax account is locked. In both cases, the goal is to convince them to click on a link, and submit their personal information to unlock their tax return or TurboTax account. Earlier this month, TurboTax was forced to briefly suspend state tax refund filingswhile it investigated the source of the unprecedented fraud spike. To learn more about the run-up to this extraordinary step and other tax fraud trends this year, I talked withIndu Kodukula, chief information security officer at Intuit.

Get More With These Free Tax Calculators And Money

These calls are so common; it’s likely you’ve been targeted at some point. This site is currently unavailable to visitors from the European Economic Area while we work to ensure your data is protected in accordance with applicable EU laws. NortonLifeLock, the NortonLifeLock Logo, the Checkmark Logo, Norton, LifeLock, and the LockMan Logo are trademarks or registered trademarks of NortonLifeLock Inc. or its affiliates in the United States and other countries.