Content

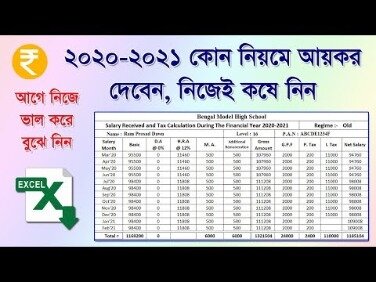

Quickly figure your 2020 tax by entering your filing status and income. Generally, only taxpayers with adjusted gross incomes that exceed the exemption should worry about the AMT. The IRS provides an online AMT Assistant to help figure out whether a taxpayer may be affected by the AMT. Lifetime Learning Credit–Unlike the education tax credit right above it, this one can be used for graduate school, undergraduate expenses, and professional or vocational courses. Can be up to $2,000 for eligible students but is entirely nonrefundable.

The child tax credit starts to phase out once the income reaches $200,000 ($400,000 for joint filers). Due to the complexity of income tax calculations, our Income Tax Calculator only includes input fields for certain tax credits for the sake of simplicity. However, it is possible to enter these manually in the “Other” field. Just be sure to arrive at correct figures for each tax credit using IRS rules.

See How Income, Withholdings, Deductions, And Credits

Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing, or even entirely eliminating taxable income. They do not only apply to personal income tax; for instance, charities and religious organizations are generally exempt from taxation. In some international airports, tax exempt shopping in the form of duty free international shops is available. Other examples include state and local governments not being subject to federal income taxes.

If the credit brings tax liability down to $0, 40% of the remainder (up to $1,000) can be refunded. It is important to make the distinction between nonrefundable and refundable tax credits. Nonrefundable credits can reduce total tax liability to $0, but not beyond $0. Any unused nonrefundable tax credits will expire and cannot be carried over to the next year. On the other hand, refundable tax credit amounts give taxpayers entitlement to the full amount, whether their tax liability drops below $0 or not. If below $0, the difference will be given as a tax refund. Refundable tax credits are less common than nonrefundable tax credits.

Dependents can make you eligible for a variety of tax breaks, such as the Child Tax Credit, Head of Household filing status and other deductions or credits. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Quickly estimate your 2020 tax refund amount with TaxCaster, the convenient tax return calculator that’s always up-to-date on the latest tax laws. This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

See a high-level overview of many different tax deductions that might save you money or even increase your tax refund! Additionally, find ways to save money during the year or save directly on taxes. You do not need in-depth tax knowledge to use our free tax calculator. The tool does not store any information and is not intended to manually file or electronically file (e-file) your tax return with the Internal Revenue Service, or IRS. Taxes are a planning and balancing act. Here are tax calculators and forms for current, previous, and future tax years. To help you make important financial and tax planning decisions, we recommend that you estimate the taxes you might owe or your expected tax refund throughout the tax year.

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. The 2020 Tax Calculator will provide you with estimated tax and tax refund results.

- For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250.

- Child and Dependent Care–About 20% to 35% of allowable expenses up to $3,000 for each child under 13, a disabled spouse or parent, or another dependent care cost can also be used as a tax credit.

- Some people go for the standard deduction mainly because it is the least complicated and saves time.

- You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office.

- Emerald Cash RewardsTMare credited on a monthly basis.

The Internal Revenue Code allows taxpayers to claim exemptions that reduce their taxable income. Both personal and dependent exemptions lower the amount of your taxable income. That ultimately reduces the amount of total tax you owe for the year. Most income is taxable, whether you earn it or are paid as a return on your investment. Also, you generally have to pay tax on income when you sell something for more than your basis . Use of the Calculator is subject to the restrictions found in our TaxActLicense Agreement and our Privacy Policy.

Federal Income Tax Calculator 2020

Medical expenses for cosmetic purposes do not qualify. If premiums are paid with after-tax dollars, deductions are limited only to the expenses that exceed 10% of adjusted gross income, and 7.5% for anyone 65 and older. Note that health savings account contributions are ATL deductions. A personal tax exemption is an amount deductible from adjusted gross income depending on taxpayers and the number of dependents claimed on a tax return. A person claimed as a dependent on one tax return cannot be claimed again on another tax return.

Passive Incomes–Making the distinction between passive and active income is important because taxpayers can claim passive losses. Passive income generally comes from two places, rental properties or businesses that don’t require material participation.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. How much tax you pay on any amount of income depends on multiple factors, including your filing status and any deductions or credits you may qualify for.

Turbotax Online

When you use our tax refund estimator, we’ll ask you questions about these details to let you better calculate your estimated taxes. This is the total amount withheld from your paychecks and applied directly to your federal tax bill over the course of a year based on your W-4 allowances. We’ll ask you about this in our 2020 income tax calculator. How long do you keep my filed tax information on file? Child and Dependent Care–About 20% to 35% of allowable expenses up to $3,000 for each child under 13, a disabled spouse or parent, or another dependent care cost can also be used as a tax credit. Like many other tax credits, this one is also based on income level. Child Tax Credit–It is possible to claim up to $2,000 per child, $1,400 of which is refundable.

You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details. Vanilla Reload is provided by ITC Financial Licenses, Inc.

The state sales tax rate is the rate that is charged on tangible personal property across the state. For example, the state rate in New York is 4% while the state sales tax rate in Tennessee is 7%.

This Tax Withholding Estimator works for most taxpayers. People with more complex tax situations should use the instructions in Publication 505, Tax Withholding and Estimated Tax. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends. If you receive pension income, you can use the results from the estimator to complete a Form W-4P and give it to your payer. The IRS encourages everyone to use the Tax Withholding Estimator to perform a “paycheck checkup.” This will help you make sure you have the right amount of tax withheld from your paycheck.

This calculator will help you estimate your 2020 federal income tax obligation and give you a rough idea of whether you can expect a refund this year. Find tax calculators and other information by tax year below to prepare for current, future, or past tax years. Use these to plan for future tax returns or prepare a past tax return. File a previous year return to reduce or pay off and tax penalties you may have accrued. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site.

Don’t get too excited; this could be a sign that you’re having too much tax withheld from your paycheck and needlessly living on less of your earnings all year. You can use Form W-4 to reduce your withholding easily right now so you don’t have to wait for the government to give you your money back later. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Southern New Hampshire University is a registered trademark in the United State and/or other countries.

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck.

The higher limits mean that more people could qualify for the credit. A number of deductions and credits are available and each has its own eligibility requirement. If you’re a single filer with taxable income of $9,000, your marginal tax rate is the lowest — 10% — because your total taxable income falls within the threshold for the lowest tax bracket.

A mid-year withholding change in 2019 may have a different full-year impact in 2020. So, if you do not file a new Form W-4 for 2020, your withholding might be higher or lower than you intend. Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year. Gather information for other sources of income you may have.

Alternative Minimum Tax (amt)

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated.