Content

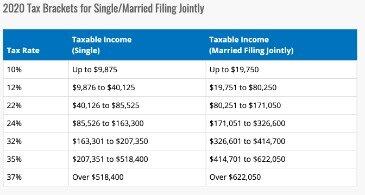

So take out deductions before you start doing the math. Let’s say you’re married filing jointly with $90,000 in taxable income. Roughly the first $20,000 of that income will be taxed in the first bracket. Then the next $60,000 or so will be taxed in the next bracket. Then the next portion will be taxed in thenextbracket. The good news is that whatever bracket you find yourself in, you don’t have to pay that percentage on yourentireincome—just the portion that lands in that range.

So, when you hear you’ve moved up a tax bracket, don’t be scared. It doesn’t mean you’re going to lose more money, it just means the portion of money you’ve earned over your previous tax bracket will be taxed at a higher rate. Get your taxes done right by the best in the business! So, how do you know what rate you’ll be taxed at? This is where tax brackets come in.

Find outhow to calculate your taxable income. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account? What if I receive another tax form after I’ve filed my return? Adjustments are a special kind of deduction that lets you reduce your taxable income even before you start applying the standard deduction or itemizing.

Tax Brackets In India

OBTP# B13696 ©2020 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

Additional state programs extra. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Learn what to do if you’ve received one or more IRS notices, and you’re not sure what the tax problem is or where to start. Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. The maximum amount of qualified adoption expenses you can use to determine your adoption credit increased to $14,300 per child, up from $14,080 in 2020.

Why Do Tax Brackets Change Every Year?

In 2020, Joe earned $9,000 of taxable income. For 2020, the lowest individual income tax rate was 10% for single filers with taxable income of $9,875 or less. Joe fell into the 10% tax bracket, meaning all his taxable income was taxed at 10%. Your bracket shows you the tax rate that you will pay for each portion of your income. For example, if you are a single person, the lowest possible tax rate of 10 percent is applied to the first $9,525 of your income in 2020. The next portion of your income is taxed at the next tax bracket of 12 percent. That continues for each tax bracket up to the top of your taxable income.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. Adjusted gross income is Total Income less some specific allowed deductions. Such as; alimony paid , permitted moving expenses, self-employed retirement program, student loan interest, etc.

The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy.

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees.

How Getting A Raise Affects Your Taxes

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. The law also hits people with high mortgage debt a little harder. The amount of mortgage debt on which the interest is tax-deductible has been reduced from $1 million to $750,000.

You pay 10 percent on the first $9,525, plus 12 percent of the amount over $9,525. If you prefer that we do not use this information, you mayopt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising.

The word “bracket” may immediately call sports to mind. Some people think if they earn more money, they are in a higher tax bracket. They believe they pay more taxes and may actually have less money left over than they would if they had earned less. As a Single filer, you’re now in the 12 percent tax bracket. That doesn’t mean you pay 12 percent on all your income, however. Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps. Tax brackets—and the progressive tax system they create—contrast with a flat tax structure, in which all individuals are taxed at the same rate, regardless of their income levels.

- Basically, that means the more money you make, the more you’re going to be taxed on that income.

- For 2020, there are seven different tax brackets with tax rates of 10, 12, 22, 24, 32, 35, and 37 percent.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- The amount of mortgage debt on which the interest is tax-deductible has been reduced from $1 million to $750,000.

- You will then earn $100,000 a year total.

- But this compensation does not influence the information we publish, or the reviews that you see on this site.

Income Tax Brackets– These are the ranges of income to which a tax rate applies. Currently there are seven ranges or segments. Think getting a big refund is like getting free money? We’ll walk you through getting your federal tax withholding right so there are no unwanted surprises come tax time. Here in the U.S., we have what’s called aprogressivetax system. Basically, that means the more money you make, the more you’re going to be taxed on that income.

E-file fees do not apply to NY state returns. State e-file available for $19.95.

When it comes to your Social Security benefits, you might be curious if yours will be taxed. Let’s take a look at how it plays out. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

There are education tax credits and tax credits for the cost of child care and dependent care, to name a few. Many states also offer tax credits. Your total tax bill would be $14,744. Divide that by your earnings of $70,000 and you get an effective tax rate of 21 percent, which is lower than the 22 percent bracket you’re in. Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their tax rate. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.