Content

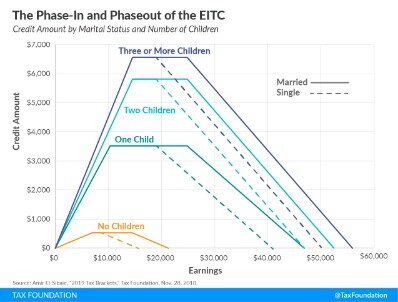

EITC is a refundable tax credit available to eligible workers earning relatively low wages. To those who qualify, EITC represents a substantial amount of money they will receive from the government. The 2018 maximum EITC for a tax filer with one child is $3,461; for two children, $5,716; and for three or more children, $6,431. When you are receiving that much from filing the tax return, paying $200 can be seen as a necessary and acceptable cost. The IRS is responsible for determining taxpayer eligibility for receiving a stimulus and, if a taxpayer is eligible, how and when the stimulus payments will be delivered to them.

Hello, If someone claim their parent, can that parent apply to get a stimulus check? They don’t do taxes because they falls under the taxes of their child’s household.

My son was a dependent on our 2019 tax return as a senior in college. However in May of 2020 he graduated and began working fulltime in June. He is 23 years old and is not a dependent on our 2020 tax return we will file. Does he have any recourse to claim the stimulus checks for 2020?

It’s possible for your earned income to be below the threshold but for your total income, and therefore your AGI, to be above the threshold because of the addition of unemployment compensation. This could make you ineligible for the Earned Income Credit.

Investment Income Can Disqualify You

To claim the Earned Income Tax Credit , you must have what qualifies as earned income and meet certain adjusted gross income and credit limits for the current, previous and upcoming tax years. The amount of your credit may change if you have children, dependents, are disabled or meet other criteria. You may claim the Head of Household filing status if you’re not married and pay more than half the costs of keeping up your home where you live with your qualifying child. If you claim your parent as a dependent, as it pertains to the stimulus payments they do not qualify for an additional payment. The dependent rules for the stimulus are for dependents under age 17.

I’m curious about co-parenting and how the stimulus money is supposed to be divided if the parents alternate each year for claiming the child as their dependent. The parent that claimed the child on 2019 taxes has received both stimulus relief checks and has not split this with the other parent in which they share joint custody with. How will this affect the parent claiming the child in 2020? Also, is the parent that received the stimulus money supposed to split the amount with the other parent. A second wave of direct stimulus payments for millions of Americans – up to $600 for eligible individuals, $1,200 for joint taxpayers, and an additional $600 for each dependent child under 17 – is on the way for millions. This means a family with two children could receive $2,400. The Earned Income Credit is a valuable, refundable tax credit available to low and moderate income taxpayers and families.

- To claim the Earned Income Tax Credit , you must have what qualifies as earned income and meet certain adjusted gross income and credit limits for the current, previous and upcoming tax years.

- Prior to becoming the TurboTax Blog Editor, she was a Technical Writer for the TurboTax Consumer Group and worked on a project to write new FAQs to help customers better understand tax laws.

- Jen will receive $1,645 in EITC and $2,000 in Child Tax Credit.

- You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

The child must have lived with you for more than half of the year. Your foster child, placed with you by an authorized agency or court order. You, your spouse and children, if applicable, all have Social Security numbers. You did not receive more than $3,650 in interest or dividends, or income from rentals, royalties or stock and other asset sales during 2020.

Turbotaxlisa (188 Posts)

If a child can be the qualifying child for more than one person, the IRS has a tie breaker to determine who claims the child. In the event the IRS determines a filer has supplied fraudulent financial information to claim the EITC, it may penalize the filer by disallowing the credit for 10 years. Like everything else associated with the IRS, it doesn’t pay to be dishonest.

According to the IRS, they will issue payments using the most recent information they have on file, likely from your 2019 tax return. If one parent already received a full stimulus payment for their qualifying child under 17 then the other parent most likely would not be able to get another stimulus payment if they claim the same child for 2020. As today is National Earned Income Tax Credit Day, we’re offering some simple tips and useful resources to help taxpayers claim this valuable tax credit. The EITC is a refundable federal tax credit for low to moderate income working individuals and families.

Self-employed individuals, small businesses, small 501 organizations, restaurants, live venues, and EIDL grants will again be eligible. Also, businesses experiencing severe revenue reductions will have the opportunity to apply for a second PPP loan. The bill also extends the Pandemic Unemployment Assistance , which expands unemployment to those who are not usually eligible for regular unemployment insurance benefits. This means that self-employed, freelancers, and side giggers will continue to be eligible for unemployment benefits. Note, adjusted gross income is your gross income like wages, salaries, or interest minus adjustments for eligible deductions like student loan interest or your IRA deduction.

So either way we (the self-employed) miss out on several thousands of $ from the EIC because the AGI remains too high in 2020 vis-à-vis 2019. TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered. The IRS defines “earned income” as the compensation you receive from employment and self-employment. Specifically excluded from this definition is any unemployment compensation you receive from your state. Receiving unemployment benefits doesn’t mean you’re automatically ineligible for the Earned Income Credit, but there are other requirements you’ll also need to satisfy to claim the EIC.

Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Having a child as the dependent on her tax return will increase her chance of receiving EITC. However, receiving EITC and paying for tax preparation don’t have to be linked. If you do the tax return on your own, you will still receive EITC. The Earned Income Tax Credit helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. If you paid more than half the total cost to keep up a home during the tax year you file your taxes, you meet the requirement of paying more than half the cost of keeping up the home.

You can do this by entering “EIC” on line 64a of Form 1040. The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate income. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. EITC reduces the amount of tax you owe and may give you a refund. TurboTax will ask the appropriate questions and determine whether you qualify for the EIC or other credits. You may qualify for the EITC even if you can’t claim children on your tax return.

This update may not immediately be reflected in the IRS Get My Payment tool. If you have an adjusted gross income of up to $75,000 ($150,000 married filing jointly), you could be eligible for the full amount of the recovery rebate. On the “plus” side they did allow for self-employment family leave which helped with a couple of grand and now the “possibility” exists of not taxing 2020 unemployment benefits on the federal level . The Earned Income Credit for 2020 is computed by comparing two amounts in the IRS’s EIC table — an amount based on earned income – which can be from either 2019 or and an amount based on your 2020 AGI.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Jen will receive $1,645 in EITC and $2,000 in Child Tax Credit. After subtracting $1,203 in income tax, she will receive net $2,442 from the IRS. Right away TurboTax tells Jen she would get $2,442 in tax refund. Get instructions onhow to claim the EITCfor past tax years. If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

Losing The Eitc

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If you didn’t receive the correct amount of stimulus payment, you can claim a Recovery Rebate Credit when you file your 2020 taxes. TurboTax will guide you through this to make sure you get every dollar you deserve. If your son didn’t receive the correct amount of stimulus payment and was not claimed as a dependent, he may be able to claim a Recovery Rebate Credit when he files his 2020 taxes. TurboTax will guide him through this to make sure he gets every dollar he deserves.

If your earned income was higher in 2019 than in 2020, you may get a higher EITC credit by using 2019 earned income. Try it both ways in TurboTax and see what works best for you. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit.

In addition to extensive tax experience, Lisa also has a very well-rounded professional background. She has held positions as a public auditor, controller, and operations manager. Prior to becoming the TurboTax Blog Editor, she was a Technical Writer for the TurboTax Consumer Group and worked on a project to write new FAQs to help customers better understand tax laws. She could also be seen helping TurboTax customers with tax questions during Lifeline.

If you don’t receive the additional $600 for your qualifying child you had this year, you can claim the $600 in the form of a recovery rebate credit when you file your 2020 taxes. TurboTax will guide you through claiming the recovery rebate credit when you file. Therefore stimulus payments will likely not include a payment for a child born in 2020. Those people receiving Social Security retirement, disability, Railroad Retirement, VA, or SSI income and are not typically required to file a tax return, will again receive a stimulus payment. As in the first round, the IRS would use the information from your Form SSA-1099, Form RRB-1099, or the Veterans Administration to generate your stimulus payment. You cannot claim the credit if you are married and filing a separate return, file Form 2555 or 2555-EZ, have more than $3,650 of investment income , or if you can be the qualifying child of another person.

TurboTax will guide you through claiming the recovery rebate credit if you are eligible. The Economic Impact Payments are not considered income, and therefore are not taxable. TurboTax will guide you through claiming the recovery rebate credit to make sure you get every dollar you deserve. – You experienced adverse financial consequences due to being quarantined, furloughed, laid off, or work hours reduced, closing or reducing hours of your own business, or lack of child care. TurboTax will ask simple questions to make sure that you receive all the tax benefits you are eligible for. Families struggling to pay rent or with past due rent could be able to get assistance with paying past due rent, future rent payments, as well as utility bills.

If you are eligible to claim a Recovery Rebate Credit when you file your 2020 taxes TurboTax will guide you through this to make sure you get every dollar you deserve. If you received your refund on a Turbo Card, this stimulus payment may also go to the same account. If your bank information is invalid or the bank account has been closed, the bank will reject the deposit and the IRS will mail your payment to the most recent address they have on file.

The applicable maximum AGI increases for up to three qualifying children. However, as long as you worked or were otherwise self-employed during the same year you started receiving unemployment checks, you may still be eligible to claim the Earned Income Credit. How is it possible to get a reund over and above any tax paid in. It doesn’t seem right cosidering the federal government is,for all intensive purposes,broke. An easy way to see if you qualify to claim the EITC is to use our Earned Income Tax online calculator. Have earned income (wages, salaries, self-employment income, etc.) and meet the EITC income limits.

One of the most beneficial and refundable tax credits for families with low or moderate incomes is the Earned Income Tax Credit . For many Americans, it can be difficult to know which tax credits they qualify for and why.

She is considered a qualifying child because she lived with you more than half of the year. You do not have a qualifying child, but you and your spouse are between 25 and 65, not the dependents of anyone else, and you have lived in the United States for more than half of the year. You are not excluding any income you earned in a foreign country on your return. You and your spouse are not considered as a qualifying child of someone else. Once you determine that you qualify for the credit, use the Earned Income Credit table found in the instructions for Form 1040 to look up your income and find out the amount of credit you’re entitled to. If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.