Content

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You do your best to file a correct tax return. You gather all your W-2s, 1099s, receipts and other documents and navigate through all of the information to find the right schedules and forms. Sometimes, however, new information arises after you file your tax return.

Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources. Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links. TaxSlayer has no obligation to monitor the Site. TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose.

Links to external web sites do not constitute an endorsement by TaxSlayer or its website co-branding providers of the sponsors of such sites or the content, products, advertising or other materials presented on such sites. Failure to Comply With Terms and Conditions and Termination. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. Classic All tax situations. The absolute best value for your max refund.

Simply Free For those with a simple tax situation. Includes one free state return.

Ready To Try Turbotax?

Your transcript shows most of the lines from your tax return, including income, deductions, credits, and tax payments. Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, you can ensure the IRS won’t get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return. Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction.

- If you don’t include the payment, the IRS may assess interest and penalties on the unpaid balance.

- Type of federal return filed is based on your personal tax situation and IRS rules.

- Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.

- Our 60,000 tax pros have an average of 10 years’ experience.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc.

Not valid on subsequent payments. Expires January 31, 2021. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity.

To File 2017 Taxes, Please Select A Turbotax Product You Can File Taxes For A Different Year By Selecting The Year Above.

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

Filing An Amendment With Turbotax

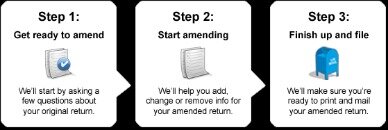

You can also prepare your amended return in TurboTax. To do this, you need to use the version of TurboTax that applies to the tax year you need to amend. For example, if you need to amend your 2019 tax return, you need to use the 2019 version of TurboTax. Gather your original tax return and any new documents needed to prepare your amended return. The IRS will take 12 weeks or longer to process an amended tax return. You’re free to cash your refund check or spend it once you have it.

You are responsible for paying any additional tax owed. Our Simply Free Edition is excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer. Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund. For those who do not qualify the price to file a federal tax return is $17 and the state is $32. The IRS has a simple process in place that allows you to amend your tax return.

Not Sure Where To Start? We’ll Find The Tax Prep Option For You

You can find IRS forms from prior years using TurboTax’s prior-year returns function, or you can search through the IRS website for it. Use separate forms for each tax year. Taxpayers amending tax returns for more than one year will need a separate 1040-X for each tax year. Mail each tax year’s Form 1040-X in separate envelopes.

These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state.

You want to safeguard your tax return, just in case. In the event of an IRS audit, TaxSlayer will help you resolve the matter as quickly as possible. Enter your income and we’ll guide you through the rest of your return to maximize your refund. Price is a huge advantage for TaxSlayer. People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund.

Step 5: Fill Out Form 1040x According To The Instructions

You can recreate the original return using the Forms Mode. Ideally you should go back to who did it and they should amend it for free if it was their error. 3 weeks after you mailed your amendment, you can start tracking its progress at the IRSWhere’s My Amended Return? Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU.