Content

However, the caps are lower because the payments are less. New $600 stimulus checks will be arriving in the coming weeks.

Some people, taking it for junk mail,may have mistakenly thrown these letters away. If you’ve misplaced or thrown away your card, the EIP card service has an FAQ on what to do if your card is lost or stolen. You can also call to request a replacement. It’s free, according to a spokesperson for the Treasury Department. To request a new card, press option 2 when prompted. Why visit a government office to get your Social Security business done?

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply.

appeared first on SmartAsset Blog. Buffett has shared these bits of wisdom to protect your money from COVID. Provide your identity protection personal identification number , if applicable, and sign the return under penalties of perjury. A Certified Credit Counselor will be calling you at the number you provided.

We know you may have more questions beyond whether people on Social Security will get both stimulus checks/payments. Visit ourCoronavirus Tax Impactpage for the latest news and facts regarding the latest stimulus bill. As they always do, scammers are preying on Social Security beneficiaries, SSDI beneficiaries, and railroad retirees getting a stimulus check/payment. These scammers come in all forms — pretending to be doctors and government officials for example — to try and take advantage of unsuspecting victims. As the second round of stimulus checks roll out, many Social Security beneficiaries have questions about whether they qualify for the stimulus checks, how they’ll get them, and whether they need to take any action. Thankfully, the IRS has cleared up a lot of the confusion since the March 2020 CARES Act checks, so if you find yourself scratching your head and are looking for answers, we’ve got you covered.

An additional fee applies for online. Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.

Should You Call The Irs To Ask About Your Missing Stimulus Check?

That means if you have to amend your taxes for 2018 or 2019 in order to get your full payment, you might just have to sit tight for now. You can learn more about the stimulus payment here. People who haven’t filed yet for 2019. The IRS will look at the information on their 2018 tax return and they’ll be getting their money too.

OBTP#B13696 ©2017 HRB Tax Group, Inc. While most Americans will receive a coronavirus stimulus check based on their tax returns, the IRS is urging certain groups that do not typically file taxes to do so as soon as they can in order to receive a payment. If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you don’t provide it to them, your payment will be sent to you by check to the address they have on file.

- For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

- May I ask, did the person who claimed you in 2018 file independently for 2019 yet?

- If you’ve already received a check, you’ll unfortunately have to negotiate dividing the payment between the two of you.

- You can also add the paid preparer information if applicable at the bottom of page 2.

- See your Cardholder or Account Agreement for details.

January’s drop compares to a 15.5pc fall in imports from Germany over 2020 but the latest slump in trade was still not as severe as the worst months of the first lockdown. The tumble in German imports at the start of the UK’s life outside the EU was also worsened by many businesses stockpiling in December as Brexit talks went down to the wire. Rod McKenzie, head of policy and public affairs at the Road Haulage Association, said UK-EU trade had improved in recent weeks but cautioned there are “still substantial underlying problems”. He said phytosanitary checks – measures to stop the entry of plant pests and diseases – being enforced from April risk being a “real stress point” as European firms are not prepared. Germany is the UK’s second-largest trading partner after the US but Britain imports more from Europe’s largest economy anywhere else. The UK imported £55bn of goods from Germany in 2020 and exported £32bn to the industrial powerhouse, according to the Office for National Statistics. However, UK-German trade has been in decline in recent years and was worsened by the Covid blow.

To get around this problem, the IRS collected information from the Social Security Administration and the VA so it could send out checks to individuals who receive these benefits but don’t file returns. The agency also set up an online form for non-filers that people could use to provide the necessary details for the IRS to send their stimulus payments. Those who don’t get SSA or VA benefits and who don’t file returns were able to use this form.

Economic Stimulus Payments Are Generally Based On Information From 2018 Or 2019 Tax Returns, But Non

Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account.

Because of this form, it was not necessary for non-filers to submit a tax return to get their stimulus money. However, the deadline for using the form for non-filers has now passed, and the form is closed. As a result, if you did not get your stimulus payment yet, or you didn’t receive the full amount owed, you will have to file a 2020 tax return to claim your payment. The checks will be based on your adjusted gross income as reported on your tax returns. The IRS will first look to use your 2019 return, but for those who haven’t filed yet, the agency will defer to 2018.

If the beneficiary didn’t file a 2019 or 2018 tax return, they’ll receive their EIP payments the same way they receive monthly Social Security or SSI payments. This may be through direct deposit to their banking account or Direct Express card, or a mailed paper check. If you received a refund through direct deposit with your latest tax return , the IRS will directly deposit your money into this account, and they won’t need your updated address. If you haven’t filed your 2019 taxes yet, the IRS will receive your updated address through your tax return. The IRS is encouraging people to use these electronic methods for providing this information as they are unable to process other requests for an address change at this time due to the pandemic. The IRS hopes most non-filers will go online and use the “Enter Your Payment Info Here” tool, but it also announced alternative procedures for filing “simplified” tax returns. If you file one of these simple returns by October 15, 2020, you will receive a stimulus check before the end of the year.

How To Get Your Stimulus Check If You Dont File Taxes

It is important to note that taxpayers have until July 15 this year to file their returns, so there is no rush. If you didn’t receive all the stimulus money you were entitled to receive in 2020, you may be eligible to claim the Recovery Rebate Credit when you file your tax returns. This gives you access to the stimulus money that you missed out on last year. Typically, any refund that you receive on your tax return is snatched away to pay down federal and state debts.

A. As it turns out, if your amount was too low, you can claim the Recovery Rebate credit on your 2020 taxes. You’ll receive the correct amount in the form of a tax credit that either lowers your tax bill or gets added to your refund. With the second stimulus check dispersal under way, millions have already received their second stimulus payments.

The Economic Impact Payment is not an SSA benefit and belongs to the beneficiary. Discuss the payment with the beneficiary, and if they request access to the funds, you’re obligated to provide it. Another exception is you have dependent child under the age of 17 who is adopted and has an “Adoption Taxpayer Identification Number” , you will receive the $500 child payment. Economic Impact Payments will either be directly deposited into your bank account or a check or prepaid debit card will be mailed to you. For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money.

That makes sense if your basic needs are already taken care of. This time, however, a spouse who has a Social Security number who files jointly with a spouse who does not will still receive their own $600 check. Their children may also qualify, provided they have Social Security numbers of their own. Payments are also set to be sent to federal beneficiaries, such as those who receive income from Social Security, Supplemental Security Income or the Department of Veterans Affairs, even if they did not file 2019 returns. Second stimulus checks are coming.

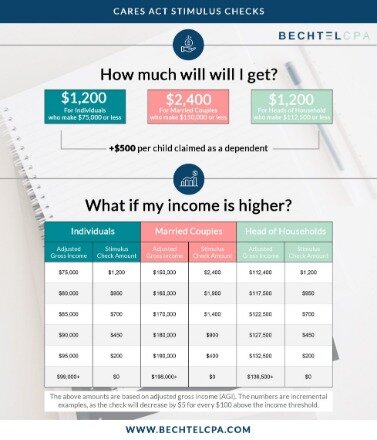

Qualified children under 17 can increase the amount you’re eligible to get by $600 per child for the second stimulus ($500 for the first). Unfortunately, you cannot claim adult dependents to get additional money. If you fall within theAdjusted Gross Income thresholds shown below and have a Social Security number, you are eligible for both stimulus check/payment. Those who do not qualify for payments include non-resident aliens, dependents, and estates/trusts.

For example, let’s say you and your spouse had AGI amounts of $35,000 and $105,000 respectively. As single filers, you’d receive the full stimulus payment because your AGI of $35,000 is below the threshold, but your spouse’s AGI of $105,000 would be over the limit and wouldn’t qualify for a payment. However, if you file jointly for 2020, your combined AGI of $140,000 is below the threshold for joint filers, so you could claim your spouse’s payment as the recovery rebate credit.

Seniors, Veterans And Others Receiving Government Benefits

H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Terms and conditions apply; seeAccurate Calculations Guaranteefor details.

The Economic Impact Payment is a tax credit. That means it shouldn’t be counted as income and shouldn’t affect the beneficiary’s eligibility for income-tested benefits.

See Online and Mobile Banking Agreement for details. Comparison based on paper check mailed from the IRS. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One state program can be downloaded at no additional cost from within the program.

In contrast, the first stimulus checks were based on 2018 or 2019 tax returns. A. You should have received stimulus payments during the original payment periods since you claimed your daughter in 2019.

The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return. If you didn’t file a 2019 return or send the IRS updated information about children dependents by November 21, 2020, you may not get the $600 second stimulus payment per child dependent.