Content

Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). Each state has different criteria for determining your residency status. For example, the state of Maryland considers you a resident in two ways. This article was fact-checked by our editors and Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®.

Some states use this same percentage to prorate deductions, which are then subtracted from the income allocated to that state. The state tax amount is based upon the taxable income figure that results. You’ll have to allocate your unearned income based upon the fraction of the year you lived in that state if it can’t be clearly attributed to one state.

Nine out of 12 months would be 9/12, for example. Unearned income is generally allocated to the state where you were living at the time you received it. For example, the income would be attributed to your new state if you sold stock at a gain just after you moved there. You can allocate your income to each state based on the number of weeks or months you lived there if your income is relatively the same every month. Many states have dedicated forms for taxpayers who were residents for only part of the year, but some use the same forms as full-year residents with special calculations.

Additional training or testing may be required in CA, MD, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

Married Filing Jointly Vs Separated

Determine if you’re a resident of the state for tax purposes. Resources Blog Access up-to-date articles, breaking news, deadline information and in-depth case studies on US expat taxes.

Generally, military personnel are considered residents of their military homes of record. Federal law prohibits other states from taxing the wages of nonresident military members stationed in their state. If you’re not sure if you need to file State Tax Returns as an expat, don’t worry! Our expat-expert CPAs and IRS Enrolled Agents can provide the advice you need.Contact us today for help understanding your state tax requirements. Income earned from working in the state is almost always taxable in the state.

State Residency For Tax Purposes: The 183

In that case, you can pay taxes to the state in which you reside. A few situations may require you to file taxes in more than one state. Common scenarios include the following.

E-file fees do not apply to NY state returns. Before filing taxes as a married couple, there are several things you should look into. Here’s a checklist from H&R Block to make sure you don’t miss anything. Having income over a threshold – In some states, you’ll only need to file if your income is above a certain threshold. This amount will vary state-by-state and can also vary by your filing status. If you purchase a house to live in while you’re in your new state, don’t apply for any special property tax exemption that you would be entitled to if it were your primary residence. If you’re only there temporarily, then your primary residence is still in your old state.

Filing taxes in more than one state sounds intimidating, but it doesn’t have to be. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us.

Because state taxes for expats can be complex, it’s a good idea to consult with an expat tax professional to get the expatriate tax assistance you need for determining your requirements. For more expat tax tips and advice, download our tax guide for Americans working overseas.

Four Reasons You Might Be Filing Taxes In More Than One State

Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details.

In this situation, you will have to pay out of state taxes. Because New York has a 14-day rule when the income tax withholding triggers, the federal legislation with its 30-day trigger would hurt New York greatly, Ziter said. Under the Mobile Workforce legislation, New York State would lose big – in excess of $100 million annually. Some 15 percent of the state’s income tax revenue comes from out-of-state residents. People who travel for business face a multitude of state laws on income tax withholding and liability. Since 2009, military spousesare allowed to claim the same state of legal residence as their partner, and therefore usually file one state tax return. Military members choose a state of legal residence.

- Only available for returns not prepared by H&R Block.

- See Online and Mobile Banking Agreement for details.

- Credit Karma is committed to ensuring digital accessibility for people with disabilities.

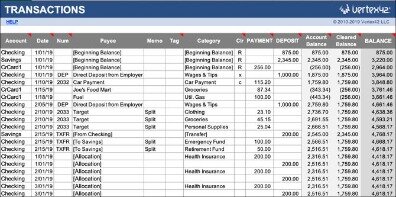

- State tax returns will use the percentage of your income attributed to that state to prorate your tax liability after you’ve determined how much you earned in each location.

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview.

You have to decide whether the time you spent in each state was permanent or temporary. The answer to this question determines which tax forms you need to fill out for each state, and how you calculate your state taxes. Residency is the location of your home where you intend to live when you return from a vacation or temporary business trip. You are a Resident of a state if you intend your main home to be in that state. Military personnel designate their Home of Record as the state where they enlisted.

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Getting a refund – If you’ve had more state income taxes withheld from your paycheck than you owe, you could have a refund coming. However, the state won’t send you the refund automatically.

Do I Have To File Taxes In Two States?

You are not required to file a state income tax return for Wyoming. You are not required to file a state income tax return for Washington State. You are not required to file a state income tax return for Texas.

Changing domiciles while continuing to be actively involved with a closely held company is especially complicated. How to pay taxes if you don’t have the funds. Click on the state map below and learn about how your state handles tax amendments. They can not be e-Filed with most states, however some states use the regular income tax form and need to indicate that this is an amendment. The state tax forms are listed here on eFile.com under each state on the state amendment page. Should you or do you even need to e-File an IRS and/or State Income Tax Extension? If filing an extension is advantageous for you, find out how the IRS and/or your state handle 2020 tax income extensions.

Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

How Can I Tell If My Time In The State Was Permanent Or Temporary?

Prepare ONLY one or more state income tax returns online and mail them to the state. State income tax returns vary from state to state. Some states do not have income taxes at all while some are more automated than others. See this page on states and taxes or navigate below for more information. Prepare your 2020 Federal and State Tax Returns on eFile.com, due April 15, 2021. You do have to claim it and pay taxes on it on your federal and home state tax returns, however.