Technology makes us more efficient, saving our clients money and letting us offer higher value services like FP&A modeling, 409A valuation, and treasury advice. Kruze’s team has worked with food startups, supplement providers, subscription fashion and more. And we know that high growth comes with its own problems, especially understanding how inventory and manufacturing impact cash flow and getting a handle on customer acquisition costs. These are the Generally Accepted Accounting Principles that are used to standardize accounting practice across the US.

What is GAAP Financials & Does Your Startup Need Them?

A variety of expenditures can be involved in establishing a business; obtaining equipment or stock, market research, and even staff training can qualify as start-up costs. Startup costs for a new business are categorized as income and listed in a balance sheet’s Equity section. A report called Profit and Loss is created to show a business entity’s net income or loss in that particular accounting period. We set startups up for fundrising success, and know how to work with the top VCs. What IS automated with the automated vendors is price increases. Clients who have switched to us have complained about frequent, often monthly, price increases as their startups’ expenses have grown.

The New Wave of Startup Accounting

Many entrepreneurs overlook or delay the need to establish strong accounting procedures, thinking it can be handled later. However, this mistake can lead to financial disarray, hinder growth, and even invite legal complications. Understanding startups’ budgeting and forecasting services, legal and accounting basics right from the outset can set the stage for a robust financial foundation. We know how to de-risk your startup’s next venture capital round. Our team makes sure you are ready to fly through your next VC’s accounting, HR and tax due diligence.

Included with every tax plan

In addition, other emergencies can require assistance from accounting. For example, human resource situations that involve terminating employees can require calculating severance and running payroll, and your accountant can help during these difficult circumstances. Your accountant monitors your financials and ensures your compliance documents are in place and accurate.

Final Thoughts and Advice on Accounting for Startups

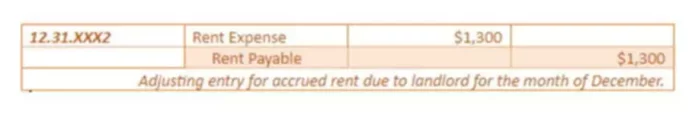

Startups can save money on accounting immediately by taking meticulous care of their records, receipts, and spending. Choosing an accounting program that can help you organize everything in one place is invaluable. In this accounting method, each transaction is assigned to a specific account using journal entries, and the changes in the accounts are recorded using debits and credits. EBITDA is an acronym for Earnings before Interest, Taxes, Depreciation, and Amortization and it is essentially a metric of the best parts of your business’s income statement.

- Your accountant should function as a partner, who supports the success of your startup and helps your company achieve its goals.

- Investing in quality accounting services is an investment in your startup’s future.

- The importance of in-house or outsourced professional accounting was also highlighted.

- It’s also beneficial to keep abreast of any tax incentives or credits available for startups, which could significantly reduce your tax burden.

- We may monetize some of our links through affiliate advertising.

Budgeting for Accounting Services

It will be very important if a major corporation asks to acquire you for hundreds of millions of dollars, or if you are raising outside funding from a professional investor. Finally, diligently recording transactions is a critical aspect of accounting for new business start-up costs. Ensure you record every financial transaction accurately—a revenue sale, an expense, or a tax payment.

What’s also imperative is keeping track of and maintaining these records and forms throughout the year. Whether it’s your first business tax return or you’re a pro, having an organized system for your documents will save you a lot of stress. FreshBooks can help by keeping your accounting systems organized, allowing you and your tax professional to find all the information when you need to file.

It’s essential to think beyond immediate accounting costs and consider how investing in quality accounting services can benefit your startup in the long run. Proper financial management can lead to better cash flow, informed decision-making, and compliance with tax regulations, all vital for growth. Allocating sufficient resources to accounting from the outset can mitigate financial risks and set your business up for sustainable success. Handling your company’s accounting is a very important duty and a full-time responsibility. It is critical for your startup’s financial health and ultimate success. As mentioned before, as a startup founder, you may not have the time or knowledge to handle it properly.

We have standard tools that we prefer and will recommend, but we can also mold to softwares you are using and prefer as well. Most of our clients come to us from a sub par experience with another firm, so we are used to facilitating and managing transitions. Along with your direct Graphite team, every client is also staffed with an onboarding manager who will be the one to manage the transition so you don’t have to. We work with startups of all shapes, sizes and funding levels.

This will save you time and money and get you paid faster. If you are running a SaaS startup, and you sell a 12-month contract to a client for $120,000 in January, on a cash basis you record $120,000 and that’s it. You don’t get any more revenue from that client for the rest of the year. That really doesn’t reflect reality, because you still need to deliver that service for the rest of the year. With accrual accounting, you would recognize $10,000 of that revenue each month.