Content

These transfers added to the general budget deficit like general program spending. First, they eliminate dual Social Security taxation, the situation that occurs when a worker from one country works in another country and is required to pay Social Security taxes to both countries on the same earnings. Second, the agreements help fill gaps in benefit protection for workers who have divided their careers between the United States and another country.

If a worker covered by Social Security dies, a surviving spouse can receive survivors’ benefits if a 9-month duration of marriage is met. If a widow waits until Full Retirement Age, they are eligible for 100 percent of their deceased spouse’s PIA. If the death of the worker was accidental the duration of marriage test may be waived.

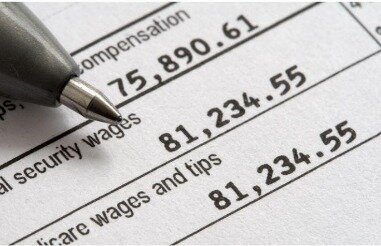

In 2018, the trustees of the Social Security Trust Fund reported that the program will become financially insolvent in the year 2034 unless corrective action is enacted by Congress. In 2020, the Wharton School of the University of Pennsylvania projected that the fund may be empty by 2032. In December 2020, the IRS released the final version of the 2021 Form W-4, Employee’s Withholding Certificate, which employees submit to their HR/payroll departments to adjust their income tax withholding for the year. Notify affected employees that more of their pay will be subject to payroll withholding. Adjust their payroll systems to account for the higher taxable wage base under the Social Security payroll tax.

FICA tax rates are statutorily set and can only be changed through new tax law. If you earn $100,000 dollars per year at your job, $6,200 of it goes to pay Social Security taxes. Only the remaining $93,800 dollars is subject to income tax. So, at least, you’re not being taxed twice on the same money if you are self-employed.

Why Do You Pay Social Security Tax?

In particular, proposals to privatize funding have caused great controversy. A person who is temporarily working outside their country of origin and is covered under a tax treaty between their country and the United States. A nonresident alien who is employed by a foreign employer as a crew member working on a foreign ship or foreign aircraft. Earnings as a council member of a federally recognized Indian tribe. A person at an institution who works for the state of local government that operates the institution. An incarcerated person who works for the state or local government that operates the prison in which the person is incarcerated. A student who is a household employee for a college club, fraternity, or sorority, and is enrolled and regularly attending classes at a university.

The Social Security Act defines the rules for determining marital relationships for SSI recipients. The act requires that if a man and a woman are found to be “holding out”—that is, presenting themselves to the community as husband and wife—they should be considered married for purposes of the SSI program. Consequently, if the claimant is found disabled and found to be “holding out”; this claimant will be entitled to reduced or no SSI benefits.

How To File Social Security Income On Your Federal Taxes

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance program and is administered by the Social Security Administration. The original Social Security Act was signed into law by Franklin D. Roosevelt in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

Self-employed individuals pay the employer and employee portions of Social Security tax, but only on 92.35% of net business earnings. If you, your children or your widow ever receive any kind of Social Security income, these taxes are probably what paid for it. In 2003 economics researchers Hobijn and Lagakos estimated that the social security trust fund would run out of money in 40 years using CPI-W and in 35 years using CPI-E. The current cost of living adjustment is based on the consumer price index for Urban Wage Earners and Clerical Workers (CPI-W).

Some Of Your Earnings Might Be Exempt From This Tax

Although Social Security is sometimes compared to private pensions, the two systems are different in a number of respects. It has been argued that Social Security is an insurance plan as opposed to a retirement plan. Unlike a pension, for example, Social Security pays disability benefits. A private pension fund accumulates the money paid into it, eventually using those reserves to pay pensions to the workers who contributed to the fund; and a private system is not universal. Social Security cannot “prefund” by investing in marketable assets such as equities, because federal law prohibits it from investing in assets other than those backed by the U.S. government. As a result, its investments to date have been limited to special non-negotiable securities issued by the U.S. Treasury, although some argue that debt issued by the Federal National Mortgage Association and other quasi-governmental organizations could meet legal standards.

For reservists and guardsmen performing intermittent duty in 2021, the amount collected may not be the same every pay period. DFAS will collect 2% of net available from each weekly, mid-month and end-of-month pay, and will continue until the deferred taxes have been repaid in full. For active duty military members, the 2020 deferred Social Security taxes will be collected in 24 installments, from your mid-month and end-of-month pay between January 1 and December 30, 2021. Per IRS guidance , the Social Security taxes deferred in 2020 will be collected from pay between January 1 and December 31, 2021. “Are members of religious groups exempt from paying Social Security taxes?” Social Security Administration.

The Bureau of Labor Statistics routinely checks the prices of 211 different categories of consumption items in 38 geographical areas to compute 8,018 item-area indices. Many other indices are computed as weighted averages of these base indices. CPI-W is based on a market basket of goods and services consumed by urban wage earners and clerical workers. The weights for that index are updated in January of every even-numbered year.

The progressive nature of the PIA formula would in effect allow these workers to also get a slightly higher Social Security Benefit percentage on this low average salary. Congress passed in 1983 the Windfall Elimination Provision to minimize Social Security benefits for these recipients. The basic provision is that the first salary bracket, $0–791/month has its normal benefit percentage of 90% reduced to 40–90%—see Social Security for the exact percentage. The reduction is limited to roughly 50% of what you would be eligible for if you had always worked under OASDI taxes. The 90% benefit percentage factor is not reduced if you have 30 or more years of “substantial” earnings. After age 70 there are no more increases as a result of delaying benefits. Social Security uses an “average” survival rate at your full retirement age to prorate the increase in the amount of benefit increase so that the total benefits are roughly the same whenever you retire.

If you want to avoid paying the Social Security tax but still receive benefits when you retire, you should know that the amount you’ve paid into the system determines your benefits to some degree. If you are a nonresident alien, either as a student or an employee of a foreign government, then you won’t have to worry about paying. Furthermore, if you are part of a religious group that opposes the receipt of Social Security benefits, then you won’t have to pay either. The Social Security tax is one reason your take-home pay is less than your income. The tax of 6.2% (on income up to $132,900) is deducted from your pay and appears on your paycheck stub either as FICA or Fed OASDI/EE. Your employer also pays 6.2%, making for a totalSocial Securitytax of 12.4% per employee. Read on to learn what the pay-stub acronyms stand for, whether the self-employed have to pay the tax and if there’s any way to avoid paying it. If you’re concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars.

Video: What Is Social Security Tax?

As of 2018, the projections made by the Social Security Administration estimates that Social Security program as a whole will deplete all reserves by the year 2034. On August 8, 2017, Acting Commissioner Nancy A. Berryhill informed employees that the Office of Disability Adjudication and Review (“ODAR”) would be renamed to Office of Hearings Operations (“OHO”).

- In connection with these and other issues, Robert E. Wright calls Social Security a “quasi” pyramid scheme in his book, Fubarnomics.

- They can be used for any purpose, but Social Security taxes are different.

- Many employees and retirement and disability systems opted to keep out of the Social Security system because of the cost and the limited benefits.

- Once the employee earns $142,800 in 2021, stop withholding and contributing Social Security tax on their wages.

- Landmark U.S. Supreme Court ruling that gave Congress the power to amend and revise the schedule of benefits.

- The sum of the 35 adjusted salaries times its inflation index, AWI divided by 420 gives the 35-year covered Average Indexed Monthly salary, AIME.

A separate set of projections, by the Census Bureau, shows more rapid growth. The Census Bureau projection is that the longer life spans projected for 2075 by the Social Security Administration will be reached in 2050. Other experts, however, think that the past gains in life expectancy cannot be repeated, and add that the adverse effect on the system’s finances may be partly offset if health improvements or reduced retirement benefits induce people to stay in the workforce longer. The government originally stated that the SSN would not be a means of identification, but currently a multitude of U.S. entities use the Social Security number as a personal identifier. These include government agencies such as the Internal Revenue Service, the military as well as private agencies such as banks, colleges and universities, health insurance companies, and employers.

Trust Fund

Police and firefighters who joined at 25 and worked for 30 years could receive 90% (3.0% × 30) of their average salary and full medical coverage at age 55. These retirements have cost of living adjustments applied each year but are limited to a maximum average income of $350,000/year or less. Spousal survivor benefits are available at 100–67% of the primary benefits rate for 8.7% to 6.7% reduction in retirement benefits, respectively. UCRP retirement and disability plan benefits are funded by contributions from both members and the university (typically 5% of salary each) and by the compounded investment earnings of the accumulated totals. These contributions and earnings are held in a trust fund that is invested. The retirement benefits are much more generous than Social Security but are believed to be actuarially sound. Short term federal government investments may be more secure but pay much lower average percentages.

People sometimes relocate from one country to another, either permanently or on a limited-time basis. This presents challenges to businesses, governments, and individuals seeking to ensure future benefits or having to deal with taxation authorities in multiple countries. To that end, the Social Security Administration has signed treaties, often referred to as Totalization Agreements, with other social insurance programs in various foreign countries. The normal retirement age for widow benefits shifts the year-of-birth schedule upward by two years, so that those widows born before 1940 have age 65 as their normal retirement age. Full retirement benefits depend on a retiree’s year of birth. Tax rate is the sum of the OASDI and Medicare rate for employers and workers.