Content

The tax treatment of items of property transferred from you to your spouse or former spouse pursuant to your divorce is shown below. Karen transferred her interest in the home to Don as part of their property settlement when they divorced last year. Don’s basis in the interest received from Karen is her adjusted basis in the home. His total basis in the home is their joint adjusted basis. This rule generally applies to all property received after July 18, 1984, under a divorce or separation instrument in effect after that date. It also applies to all other property received after 1983 for which you and your spouse made a “section 1041 election” to apply this rule. For information about how to make that election, see Temporary Regulations section 1.1041-1T.

If you meet this exception, relief will be considered even though the understated tax or unpaid tax may be attributable in part or in full to your item. The income tax liability from which you seek relief is attributable to an item of your spouse or an unpaid tax resulting from your spouse’s (or former spouse’s) income. If the liability is partially attributable to you, then relief can only be considered for the part of the liability attributable to your spouse . The IRS will consider granting relief regardless of whether the understated tax, deficiency, or unpaid tax is attributable to you if any of the following exceptions apply. Your spouse didn’t transfer property to you for the main purpose of avoiding tax or the payment of tax. Any other income that belongs to your spouse under community property law. You didn’t include an item of community income in gross income on your separate return.

This change also is effective retroactively for federal tax purposes. An amendment to a divorce decree may change the nature of your payments. Amendments aren’t ordinarily retroactive for federal tax purposes. However, a retroactive amendment to a divorce decree correcting a clerical error to reflect the original intent of the court will generally be effective retroactively for federal tax purposes. If no parent can claim the child as a qualifying child, the child is treated as the qualifying child of the person who had the highest AGI for the year. All child support payments actually received from the noncustodial parent under a pre-1985 agreement are considered used for the support of the child.

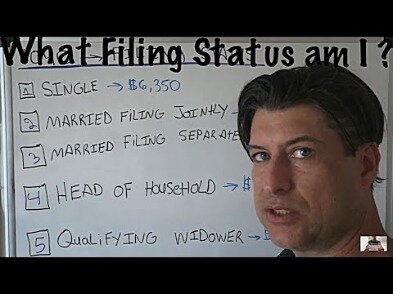

How Do I Choose The Right Tax Filing Status?

In some cases, if you’re legally married you may be able to file as head of household. For the purpose of spouses living apart or living with children, temporary absences such as for school, business trips or medical care don’t count.

Larry and Gina owned their home jointly before their divorce in 1983. That year, Gina received Larry’s interest in the home in settlement of her marital support rights. Gina’s basis in the interest received from Larry is the part of the home’s fair market value proportionate to that interest. Her total basis in the home is that part of the fair market value plus her adjusted basis in her own interest.

A transfer of property under the decree of a divorce court having the power to prescribe a property settlement isn’t subject to gift tax. This exception also applies to a property settlement agreed on before the divorce if it was made part of or approved by the decree. A transfer in settlement of marital support rights isn’t subject to gift tax to the extent the value of the property transferred isn’t more than the value of those rights. This exception doesn’t apply to a transfer in settlement of dower, curtesy, or other marital property rights.

If you were married on the last day of the year, then you cannot file as Single. However, you can file as Married Filing Separately instead of filing a joint return with your spouse.

Tax Rates For Single Filers

Alimony includes premiums you must pay under your divorce or separation instrument for insurance on your life to the extent your spouse owns the policy. You must give the person who paid the alimony your SSN or ITIN. If you don’t, you may have to pay a $50 penalty. Generally, you can deduct alimony you paid, whether or not you itemized deductions on your return. Alimony is deductible by the payer, and the recipient must include it in income. Although this discussion is generally written for the payer of the alimony, the recipient can also use the information to determine whether an amount received is alimony. Under a pre-1985 agreement, the noncustodial parent provides $1,200 for the child’s support.

- In some cases, you may be able to file as single or head of household if you are legally married but separated.

- ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

- Income from your spouse’s (or former spouse’s) separate property (other than income described in , , or ).

- This filing status is often used by single parents supporting their children or people supporting elderly relatives.

- If you file a joint return, your refund will also be considered shared.

- When the marital community ends as a result of divorce or separation, the community assets are divided between the spouses.

Download the official IRS2Go app to your mobile device to check your refund status. You may also be able to access tax law information in your electronic filing software. The Tax Withholding Estimator (IRS.gov/W4app) makes it easier for everyone to pay the correct amount of tax during the year. The tool is a convenient, online way to check and tailor your withholding. It’s more user-friendly for taxpayers, including retirees and self-employed individuals.

If you’re considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses can’t agree to file a joint return, then they’ll generally have to use the married filing separately status. Although filing jointly usually results in a lower tax bill, some married couples may find it to their advantage to file separate returns based on their tax situation. Here’s some information to help you decide if this filing status could work for you.

This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

A payment that is specifically designated as child support or treated as specifically designated as child support under your divorce or separation instrument isn’t alimony. The amount of child support may vary over time. Child support payments aren’t deductible by the payer and aren’t taxable to the payee.

Many Factors Affect How Much Tax You Owe When You File Your Return

In addition, this publication also explains deductions allowed for some of the costs of obtaining a divorce and how to handle tax withholding and estimated tax payments. If you’re married, you may choose to use the married filing separately status in any year. Once you’ve actually filed your return as married filing jointly though, you can’t amend that return to file two separate returns using the married filing separately status.

This means that your combined worldwide incomes are subject to U.S. income tax. If you purchase health insurance coverage through the Health Insurance Marketplace, you may get advance payments of the premium tax credit in 2020. If you do, you should report changes in circumstances to your Marketplace throughout the year. Changes to report include a change in marital status, a name change, and a change in your income or family size. By reporting changes, you will help make sure that you get the proper type and amount of financial assistance. This will also help you avoid getting too much or too little credit in advance.

If your spouse died during the tax year, however, the IRS considers you married for the whole year. You can file jointly that year, even if you don’t have kids in the house. Other than being married, there are no special qualifications for the Married Filing Jointly or MFJ and the Married Filing Separately or MFS filing statuses.

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

Tax Tools & Resources

Starting price for state returns will vary by state filed and complexity. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

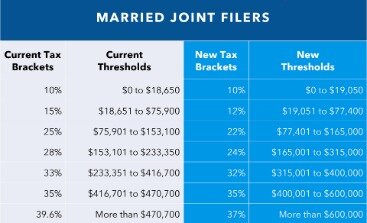

The combination of these two factors yields a marriage bonus of $7,399, or 3.7 percent of their adjusted gross income. A couple with children can still face a marriage penalty because single parents can use the head of household filing status. Consider parents of two children, each parent earning $100,000 . Filing jointly and taking a $24,800 standard deduction, their taxable income is $175,200, for which their 2020 income tax liability is $26,207.

Don’t attach the previously filed tax return, but do include copies of all Forms W-2, Wage and Tax Statement, and W-2G, Certain Gambling Winnings, for both spouses and any Forms 1099 that show income tax withheld. The ITIN is entered wherever an SSN is requested on a tax return. If you’re required to include another person’s SSN on your return and that person doesn’t have and can’t get an SSN, enter that person’s ITIN.